- myFICO® Forums

- Types of Credit

- Auto Loans

- Auto Loan Approvals!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Auto Loan Approvals!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

BUREAU PULLED: Experian

CREDIT SCORE: 800+

CUSTOMER STATE OF RESIDENCE: California

NEW/USED: New

YEAR OF VEHICLE: 2016

MILEAGE: 21

RETAIL/LEASE: Retail

AMOUNT OF LOAN: 40000

TERM CONTRACTED: 60 months

APR/LEASE RATE: 2.24

MONTHLY PAYMENT: 705.32

Sock Drawered -

Equifax Bankcard 8 - 830 - 4/21 | Experian Score 8 - 812 - 5/26 | TransUnion Score 8 - 810 - 5/1

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

We went to try to get an auto loan in Jan of this year and realized our credit scores and files needed lots of work due to identity theft on my fiancé by a family member. Anyway that is what prompted us to repair and walk away from the dealers who would only offer us them crazy sub prime 25 % interest loans .

So in about two mths we will be ready to go try again , our old car is barely making it and we desperately need a new one. If he has never had an auto loan bf how will the Auto enhanced fico scores effect this . I had several car loans but this was years ago and they have all fallen off of my reports. And I only uses cashed for everything for many many years until this year so basically it's like I'm a first time buyer too right ?

I would appreciate any and all advice , we planned to try with our CUs first, we don't want to deal with the dealerships at all this time if possible . They messed us up pretty bad last time with inquiries, 20 in total for them trying to get us financed . Thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

APPROVING BANK: VW Credit

BUREAU PULLED: Transunion (Equifax as well cause my previous auto loan from CU only reported there)

CREDIT SCORE: 653

CUSTOMER STATE OF RESIDENCE: Florida

NEW/USED: New

YEAR OF VEHICLE: 2016

MAKE: Volkswagen

MODEL: Passat S

MILEAGE: 27

RETAIL/LEASE: Retail

AMOUNT OF LOAN: 25031

TERM CONTRACTED: 72

APR/LEASE RATE: 2.65%

MONTHLY PAYMENT: 379

ANNUAL INCOME: 35000

DEBT TO INCOME RATIO: 27%

MISCELLANEOUS COMMENTARY: Spoke to mulitple dealers, but settled on one that had my color combo that i wanted (black). I was armed with my Fico score and when negotiating with dealers told them i would not buy their vehicle unless i was B-Tier or above on interest rate. Drove 2 1/2 hrs down there to meet my sales person id been emailing for a few days and he was a great guy. They gave me full NADA for my trade (i rolled 4k in negative equity, but 1700 is from an extended warranty on my trade in that will be refunded and go straight to the principal) told my sales person to axe the dealer fee as well, they left the fee as a line item since they charge customers it has to be on every contract (regulatory thing, you do it on one loan it has to be on every loan) but cut 799 from the vehicle selling price. Originally qualified a C tier, but got my B-tier per my negotiations so im happy at the end of the day!

From what i read on here helped me a lot knowing the tiers and their scoring system helped me nail down the interest rate i wanted, so thank you MyFico and everyone who contributes here, and maybe I can pass along a little knowledge to anyone who gets a VW!

In case anyone wants to know tiers, these are some tiers (sorry i dont know everything, but this came from the finance manager), things like money down and car payment history are mitigating factors that can either get you bumped up or down. If youre close with credit you can make it a stipulation that the car stays on the lot if you cant get the rate you want like i did ![]()

700+ A Tier (advertised lowest rate)

660-699 B Tier (advertised rate + 1.25%)

659-??? C Tier (advertised rate + 3.75%)

???-??? D Tier (advertised rate + 8.75%)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Loan Approvals!

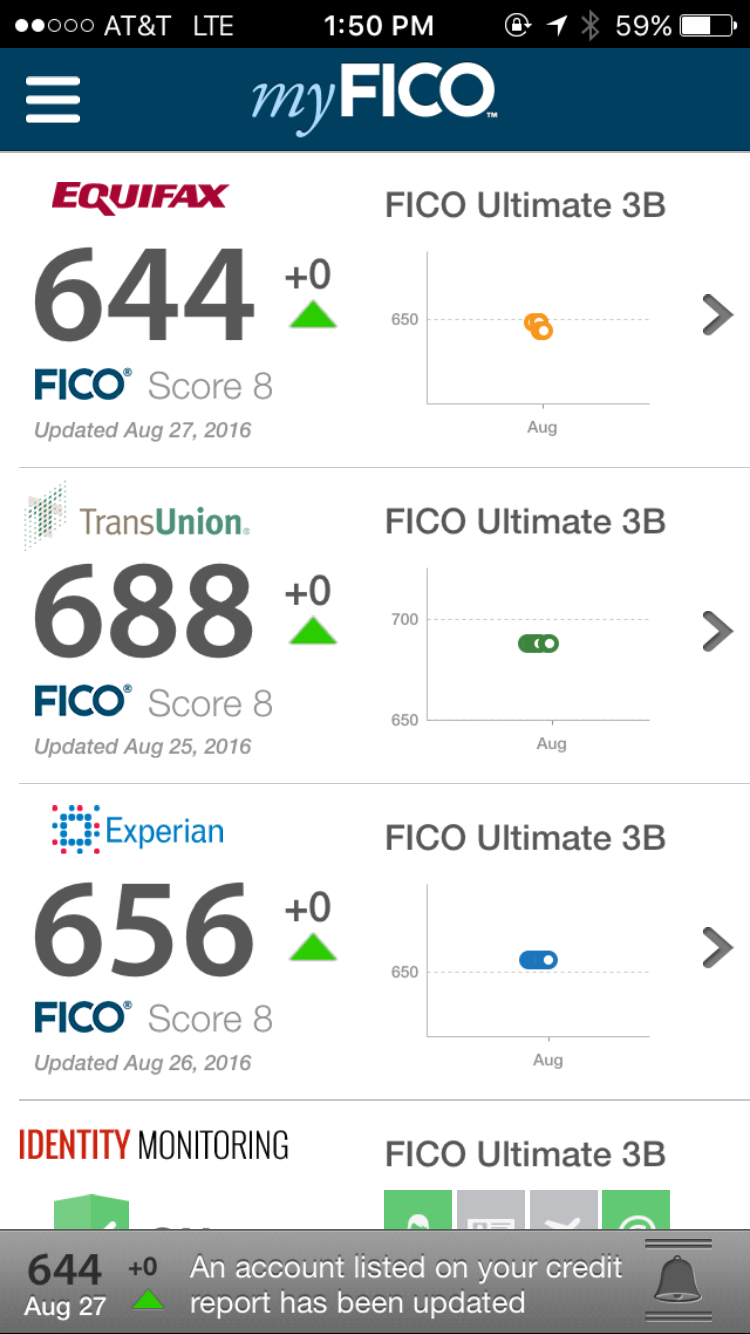

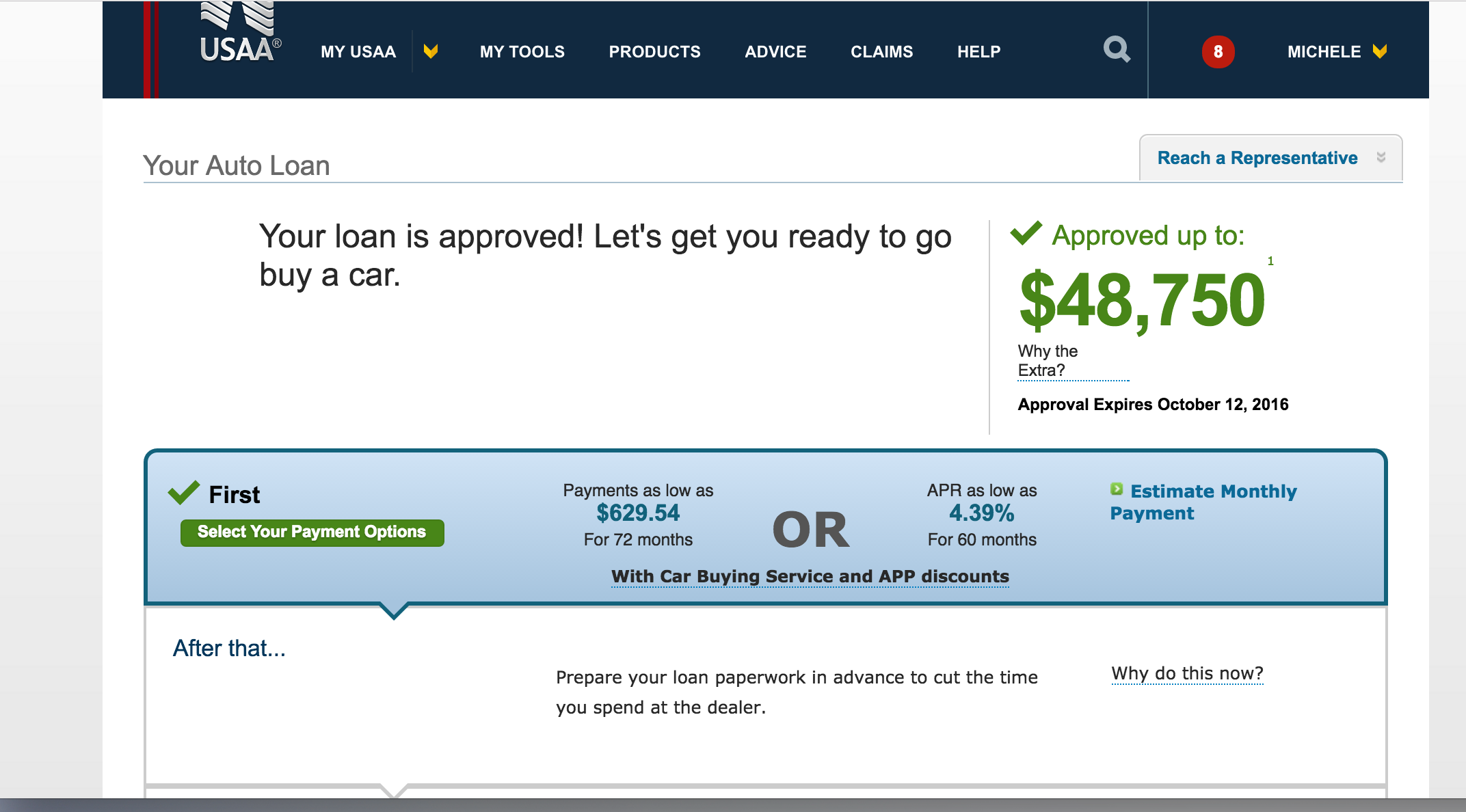

Here are my Fico scores. My income is $53,000/yr and utl is at 9%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content