- myFICO® Forums

- Types of Credit

- Auto Loans

- MB E-300 buy vs lease

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

MB E-300 buy vs lease

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MB E-300 buy vs lease

I'm eyeing a 2018 MB E-300. This will be my first true luxury car purchase -- currently in Passat, Jetta prior to that (both financed) and prior to that a BMW convertible but I paid cash for that.

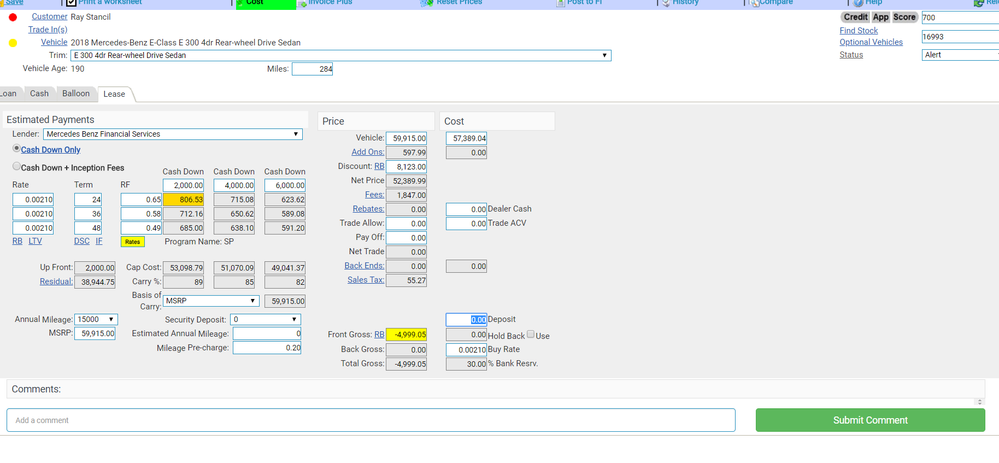

I've negotiated 14% off of sticker price and it's the end of the month so I know they really want me to come in to sign the deal. My question is this -- buy vs lease?

I've never leased before so I don't know what questions I should be asking. What should I ask them about the lease details? I do like the lease payments much better than the finance payments, though my credit is very good -- mid to high 700's with 100K annual income and 4% debt to income.

BOA offers 2.84% for 72 months. MB offered to match for financing, both with options of zero down, which I don't think is bad idea since there is a 14% off MSRP offer on the table.

Any input/advice would be greatly appreciated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MB E-300 buy vs lease

Buy vs Lease is a question only you can answer. Do you drive alot? If so, leasing isn't for you as you are giving an amount of miles you can drive per year. Since you are new to leasing, I suggest you go to www.leaseguide.com for a quick crash course. Also, the zero down is often just a catch phrase and will like pay some money out of pocket. With leasing, you also have to factor in bank acquisition fees, dmv fees etc.. So weigh your options very carefully.

Have you thought about a lease take over? That option is usually cheaper than starting a fresh lease. What are the payments going to be if you were to buy or lease?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MB E-300 buy vs lease

Thank you for your reply and for the very informative link. I do have a 2nd car so I don't anticipate that mileage would be a problem, but I did have them quote me for 15k just to be safe. The money factor here seems to be high (I get 5.04%) when I multiply the stated rate x 2400.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MB E-300 buy vs lease

Leasing versus buying is something that I've taken into account when purchasing my luxury vechiles. I spent a considerable amount on my latest car, and ended up leasing it. I didn't want to be on the hook for thousands of dollars of depreciation or damage if something happened to it that wasn't covered by an insurance policy, like the hard top being destroyed on my last vehicle.

A lease made sense to my wallet, because if anything happens to the vehicle, it's not my problem. Considering that the E class just ended up on a list of fastest-depreciating vehicles I would have a hard time justifying purchasing instead of leasing without a lot of money down.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MB E-300 buy vs lease

@DeeBee78wrote:

A lease made sense to my wallet, because if anything happens to the vehicle, it's not my problem.

I thought at turn-in people were responsible for any damage outside of normal wear/tear.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MB E-300 buy vs lease

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MB E-300 buy vs lease

@Schwartzinatorwrote:

@Kreewrote:

@DeeBee78I thought at turn-in people were responsible for any damage outside of normal wear/tear.

I read that as the inevitable repairs that may start creeping up after the 3 year mark when the vehicle was turned in that they wouldn't need to worry about.

True, but I'm also talking about if the car is wrecked, like my last one was. Leases carry GAP coverage, so you won't get stuck with paying the difference between your car's value and how much you owe.

If you put $0 down on an E Class (like OP is talking about), and something happens to it that totals it out, you could be looking at a significant difference between the payoff and the value.