- myFICO® Forums

- Types of Credit

- Auto Loans

- Re: PenFed Preliminary Preapproval

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

PenFed Preliminary Preapproval

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PenFed Preliminary Preapproval

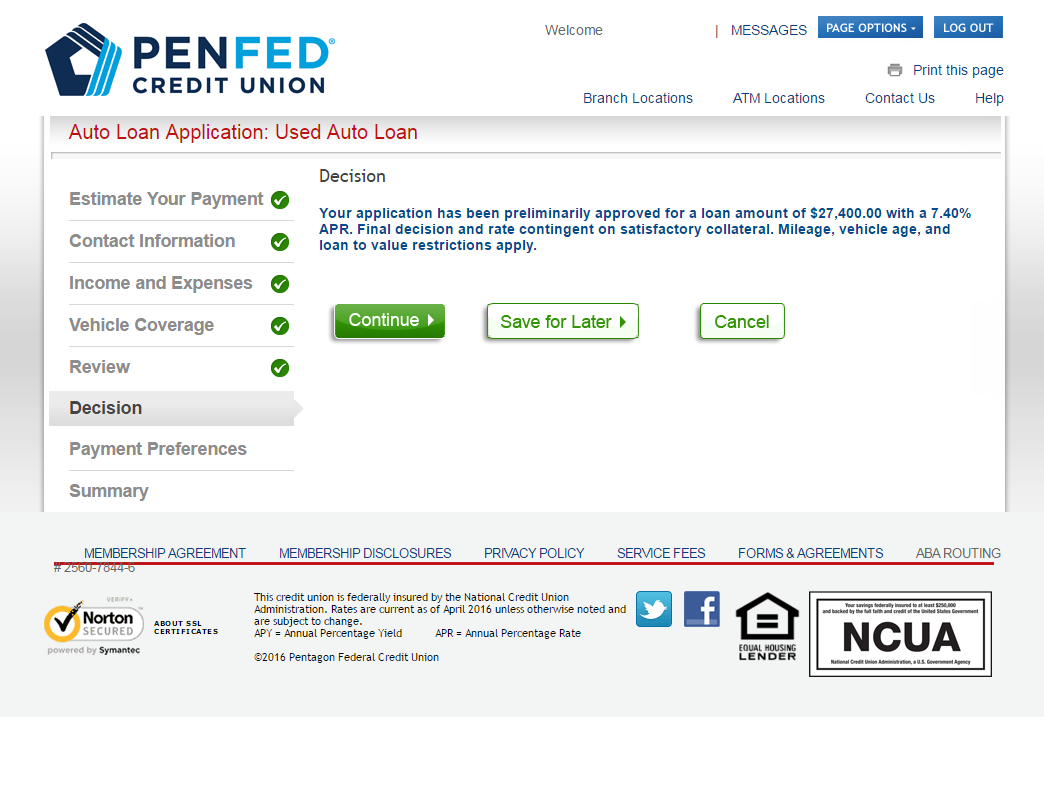

Approved for a PenFed Cash Rewards last week so knowing I had a fresh pull with them wanted to test the waters and see what I might get on an auto loan. Been thinking of swapping out my 2007 Envoy Denali for something newer and a bit bigger. Not in need of getting this right away just thinking it over. Bought a 2014 Vette last month outright but it's not a daily driver. Newer truck or SUV would be. Got a preliminary preapproval from them for 274k which would more than cover getting into a newer truck especially with trading the Envoy in. Rate is very so so to me though. My NextGen with them is at 667. Anyone have any thoughts on any one else? I've got a solid relationship with NFCU and even though my EQ took a dip I'm still at 690 or so for my FICO Score 5. TU is clean and settled in at 754 currently with 12 INQ's in the past year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Preliminary Preapproval

I thought they were one rate, you either qualified or didn't. What make/model did you put in?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Preliminary Preapproval

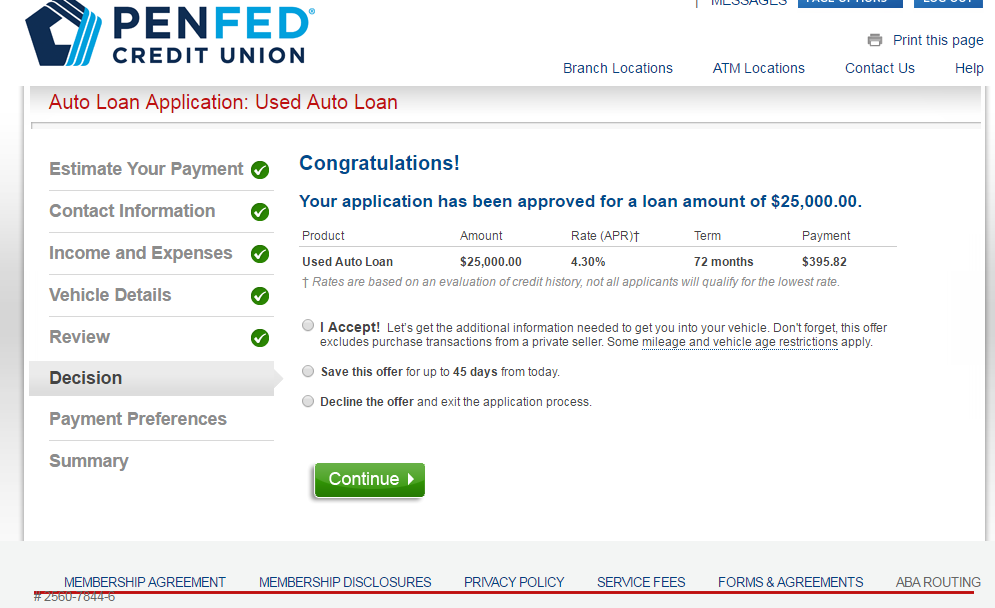

Rate can vary with them but you know the first go round and didn't say I had a vehicle selected and was just looking at the amount. Ran it through again and this time entered vehicle details and actually looking at a slightly lower amount as I'm leaning more towards one I found that at 32.9k. They came back with an approval at 4.30%. This is suddenly a lot more tempting to maybe go pick this thing up. Loaded 2014 Sierra SLT with only 11k on it. Still curious what Apple FCU might do for me on this with my TU in the 750's.

Would love to replace my Envoy with this

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Preliminary Preapproval

OP have you tried the ol Cap1 prequal?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Preliminary Preapproval

@Anonymous wrote:

I thought they were one rate too, but I was preapproved for 4.3% for 72 mos. My score from my adverse action letter was 646 (adverse action as in I did a generic app with no car info for 50k and was only approved for 40k) I was firstly surprised that I was approved at all, then surprised at the interest rate. Guess it's not a flat rate anymore.

OP have you tried the ol Cap1 prequal?

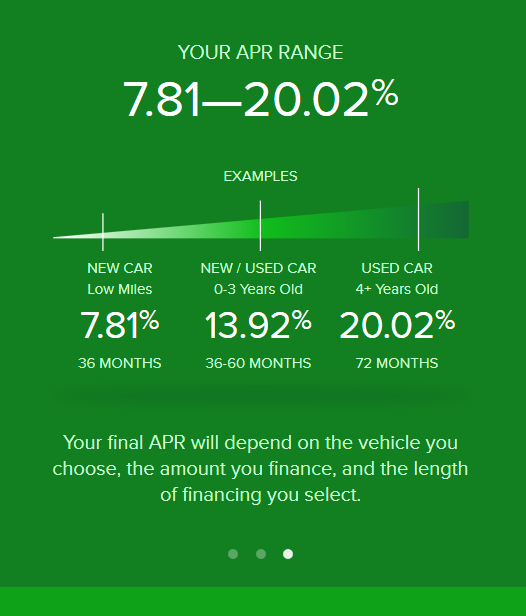

646 NextGen score is not bad with them and 4.3% is just outside their best rates for that long of a term on 72 months. Not bad at all. I put an app in with Apple FCU since they are local to me and they will use the TU pull from last week. I'll see what they come back with. Looked at Cap1 and this is what they came back with. No way. Looks like it would be in the 13% range. That's 2% higher than what I have on my current loan and I got that when I was under 600. Not a chance in hell I'd go for that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Preliminary Preapproval

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Preliminary Preapproval

I also have a penfed account I had a loan auto loan with them 2 years ago I was late a couple of times do to lost job but the funny thing is they never reported it to the 3 credit bureaus but they have my late records internally. My next gen score right now is 638 but I know in august it will boost but I'm still scared to ask for 50k auto loan being that their internal division knows my lateness even tho they never reported it. What should I do

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Preliminary Preapproval

@bsal wrote:

and why didn't you USE NFCU since you establish a good relationship 690 fico 5 is a really good score

I also have a penfed account I had a loan auto loan with them 2 years ago I was late a couple of times do to lost job but the funny thing is they never reported it to the 3 credit bureaus but they have my late records internally. My next gen score right now is 638 but I know in august it will boost but I'm still scared to ask for 50k auto loan being that their internal division knows my lateness even tho they never reported it. What should I do

I tested the waters with PenFed because I just got approved on 4/4 for a Platinum Cash Rewards Visa with them. With the fresh HP with them figured I'd see what they offered without having to take another hit. For NFCU I'd have to take another INQ for an app just to see what they offered. And yes the 690 is the EQ Fico 5 commonly called the mortgage lending score. It's actually down 25 points thanks to TU handling my EE request for my last baddie as a validation request and the OC updating a CO that hadn't had a new report date in 5 years. Fortunately in 4 months I should be able to get EE on EQ and EX as well and have it gone for good.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Preliminary Preapproval

I'm glad your rate dropped when you put in an actual vehicle. That rate seemed really high considering your high scores!! Nice truck, btw!