- myFICO® Forums

- Types of Credit

- Auto Loans

- Re: Refinancing Auto loan or take personal loan?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Refinancing Auto loan or take personal loan?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinancing Auto loan or take personal loan?

Hi,

I'm still pretty new to the whole system and could use some advise. So I have a small car loan (<$4000) with insanely high APR (25%) because when I got it I had zero credit history. Of course I would love to bring the APR down and I've been consdering to refinance the car. Alternatively, I considered to take out a personal loan because I have some other costs coming up.

I'm not sure if I will even get a refining car loan, because of the low loan value (<$5000) and the high mileage of the car (>130k).

On the other hand, I'm not compeltely sure if the personal loan would be a much better deal. I've asked my bank person (ASB) and of course he couldn't tell me the APR without a hard pull, but they do offer personal loans for 48 months.

About two or three weeks ago I got a letter for a preapproved Fast Cash Loan from ASB, but the APR was really high (19%). I was hoping that when I take out a personal loan I could get between 10 and 15... now I'm really reluctant to even try the personal loan because I want to avoid the hard pull on my record.

According to creditkarma, I'm slightly obver 700 (TU) and in the 690s (Equifax)

I would really prefer to take a personal loan for several reasons (the car would be ours and we could use the additional money), but not for a 19% APR.

Any advise on what to do is really appreciated ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinancing Auto loan or take personal loan?

Hi! Welcome to the forum, you should find out what your FICO credit scores are. The ones provided by Credit karma are known as FAKO scores, and no lenders use them. You can get your fico score on credit check total for $1. As to the personal loan vs. refi predicament I would suggest looking at Navy Federal Credit Union. They are accepting of new credit history and are generous. Anyone can join them now. There is a thread on how to do this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinancing Auto loan or take personal loan?

Thank you for your feedback.

I'm aware that the score from credit karma is only an estimate. I only wanted to provide a ballpark to show that I don't have bad credit.

I just checked out the Navy Federal Credit Union (though I'm not sure I'm even eligible as a non-citizen), their rates for personal loans really aren't that great, eitehr (11-18%).

I was hoping to use my bank's personal loan since it is indeed convenient to have someone to talk to in person. However, I'm open to other lenders, but I don't just want to go with 'any'...I'm a little sceptic in this regard.

Eventually, I'm just really hoping I can get a personal loan with a reasonable APR. Or, if it's just not possible with my short credit history (slightly over 1 year) and fair to good credit scores, I may have to reconsider the refinancing part... just not sure if it's an option given the circumstances and not sure which lender to use (right now the car loan is with First Hawaiian Bank)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinancing Auto loan or take personal loan?

@Anonymous wrote:Thank you for your feedback.

I'm aware that the score from credit karma is only an estimate. I only wanted to provide a ballpark to show that I don't have bad credit.

I just checked out the Navy Federal Credit Union (though I'm not sure I'm even eligible as a non-citizen), their rates for personal loans really aren't that great, eitehr (11-18%).

I was hoping to use my bank's personal loan since it is indeed convenient to have someone to talk to in person. However, I'm open to other lenders, but I don't just want to go with 'any'...I'm a little sceptic in this regard.

Eventually, I'm just really hoping I can get a personal loan with a reasonable APR. Or, if it's just not possible with my short credit history (slightly over 1 year) and fair to good credit scores, I may have to reconsider the refinancing part... just not sure if it's an option given the circumstances and not sure which lender to use (right now the car loan is with First Hawaiian Bank)

^^^Statement in red: no, the credit karma score is in NO WAY an estimate. The scoring formula for CK is totally different from the FICO algorithm. We don't know if you have bad credit or not based on a CK score. These algorithms do not correlate in any way.

Check out the subforum here called Understanding FICO scoring. Read that before you make any financial decisions.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinancing Auto loan or take personal loan?

Ok, I just checked my credit card, which does provide a FICO score, and it was 685 pulled from Experian at the beginning of October.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinancing Auto loan or take personal loan?

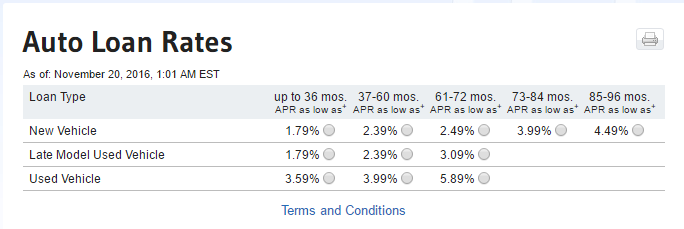

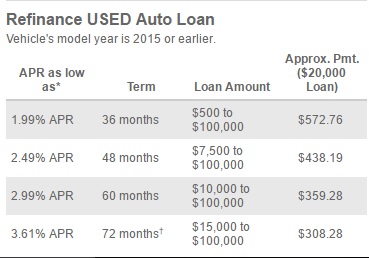

sure you looked at the right bank as i see them much less

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinancing Auto loan or take personal loan?

Did you read? ![]() I'm interested in personal loans rather than auto loans, but there was no subforum (or I missed it).

I'm interested in personal loans rather than auto loans, but there was no subforum (or I missed it).

My initial auto loan has such a high APR because I took it when I had zero credit history combined with a rather low income.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinancing Auto loan or take personal loan?

Oh guess I just caught the first part sorry

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinancing Auto loan or take personal loan?

Everyone on the forum is just trying to help out no need to respond like that. Unless you have terrific credit you are not going to find a personal loan with a great interest rate, have you thought about applying for a 0% balance transfer card you can transfer the balance or a portion of the balance from your car loan and pay more aggressively on it. There are a few options out there, the other thing with NFCU is you can use the full credit limit of a credit card like a personal loan. I would check out the Go Rewards card they are doing 6 months no interest and no balance transfer fee and the APR would still be less than you are currently paying even after the 6 months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinancing Auto loan or take personal loan?

Call PenFed and see if they will refi the auto with that miles/year. Let them know what you are trying to do and that your scores are "good" (when you check your EQ). If they say they do, join and refi for probably 5 or 6 %. PenFed is pretty awesome and are very helpful. Anyone can join.

as low as $500 for 36 months.