- myFICO® Forums

- Types of Credit

- Auto Loans

- Voluntary Repo / Turn in

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Voluntary Repo / Turn in

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Voluntary Repo / Turn in

Hello community.. it's been about 2 months since I made a post. Need some advice... Long story short, I have a TERRIBLE auto loan at the moment.. 23%, accurs interst daily when past due, payments are $515 per month. I financed $21K almost 2 1/2 years ago and today's payoff is a little over $19K.. this loan is killing me.. we can no longer afford to throw money away for this car. I recently received a bonus at my job and considered dumping that into the car but there are several things that need to repaird/fixed at our house. My consideration is to give the car up and take part of the bonus to purchase an older use car for cash. I understand that I will still be liable for the balance left over once the car sells for pennies on the dollar at some auction. And I know my credit will take a major hit, but my score is low now so I'm too concerned with financing anything in the near future. I guess my main concern is, will the lender be willing to work with me for the remaning balance, and will that balance have any interest attached to it? Or will they try to sue me without working out a payment plan? The lender is Capital One. Any suggestions or previous experiences will be greatly appreciated.

Lender Pull 03/28/2011 EQ:708 TU:698 EXP:709

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Voluntary Repo / Turn in

I don't have all of your numbers, so the simulation is a bit of an estimate, but if you can pay an extra 85 a month, you should save about 3,500 over the remaining life of your loan.

You mentioned a bonus, for every extra 1,000 you pay today, you will save about 2,000 in interest over the remaining life of your loan.

If you would like more accurate numbers, or more specific paying scenarios, you will need to provide:

Initial dollar amount of loan

Initial Monthly terms of loan

exact interest percentage (a flat percentage is rare, so I'm assuming its actually 22.95 or 23.15 or something)

Exact dollar amount remaining

Exact # of months remaining

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Voluntary Repo / Turn in

Hello, thank you for the response. Please see info below:

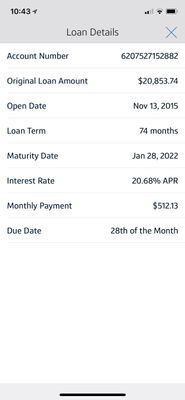

Initial dollar amount of loan:$20,853.74

Initial Monthly terms of loan: 74 months

exact interest percentage (a flat percentage is rare, so I'm assuming its actually 22.95 or 23.15 or something) 20.68%

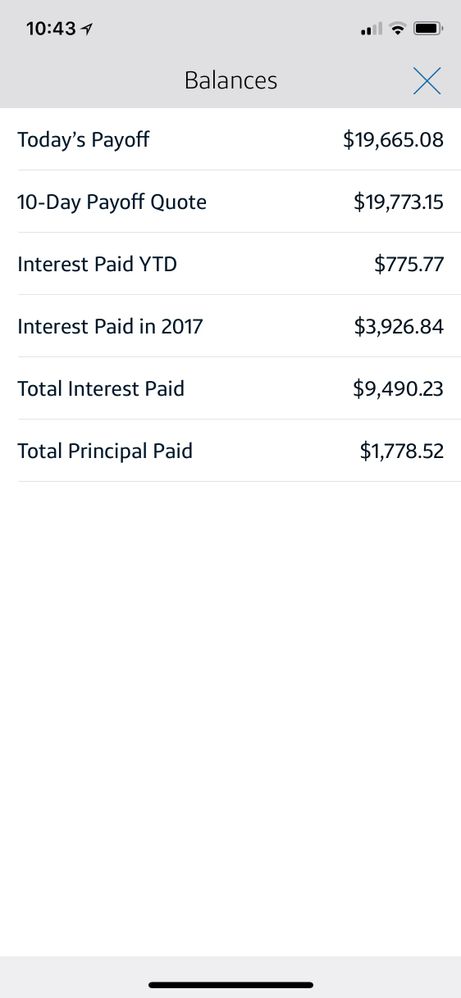

Exact dollar amount remainingPrinciple payoff $19075.22, Today's payoff $19,665.08

Exact # of months remaining 45 months remaining

Lender Pull 03/28/2011 EQ:708 TU:698 EXP:709

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Voluntary Repo / Turn in

I'm having trouble reproducing your loan. were there any additional terms you forgot to mention? like a 600 dollar processing fee? Also with the interest listed, and the original principal balance listed, i can't seem to figure out how you owe 19,000 after 29 payments. Even when massaging the numbers to get other inconsistencies to line up, I'm looking at a number closer to 16,000. Are there any late fees or missed payments you haven't mentioned?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Voluntary Repo / Turn in

Lender Pull 03/28/2011 EQ:708 TU:698 EXP:709

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Voluntary Repo / Turn in

Thanks for providing all of this additional information. I'm afraid though that the more I learn the more questions I end up having. But since its a Cap1 (reputable company) loan, I won't dive to far into your numbers, as I will assume they aren't trying to pull one over on you.

As an overview, It looks like you need to pay about 3,600 just to get your loan back on track. After which paying an additional 100 a month will reduce your loan terms by 10 months, and save you roughly 1700 in interest. Paying an additional 200 dollars will save you about 2700 in interest and cut your loan down to 29 months.

Alternatively, after bringing your loan current; a flat 1,000 paid would save you about 1,100 in interest and take 4 months off of the term. 2000 would be 2,100 and 8 months off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Voluntary Repo / Turn in

You really don't want a repo. I know you mentioned having lousy credit now, but with a repo they will sell your car for next to nothing and you'll be left still owing the balance minus the proceeds from that sale.

I would throw as much money at this as you can, visit the rebuilding forums to see what you can do to get your scores up, and refinance as soon as your scores and LTV allow.

It might not even be a bad idea to sell your house and basically just start fresh.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Voluntary Repo / Turn in

I guess my concern is, I'm not going to have extra money to throw at the loan that I can see for the time being. After speaking with Cap 1, they mentioned that there will not be any interest charged to the deficient balance unless I don't pay and they get a judgment. It seems like a cheaper route to go. I know a repo on the credit report will terrible, but I already have one repo from this car.. I ended up getting it back. To ge to the point, what do you think the terms will be once they come back after the deficient balance?

Lender Pull 03/28/2011 EQ:708 TU:698 EXP:709

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Voluntary Repo / Turn in

@dpagewrote:I guess my concern is, I'm not going to have extra money to throw at the loan that I can see for the time being. After speaking with Cap 1, they mentioned that there will not be any interest charged to the deficient balance unless I don't pay and they get a judgment. It seems like a cheaper route to go. I know a repo on the credit report will terrible, but I already have one repo from this car.. I ended up getting it back. To ge to the point, what do you think the terms will be once they come back after the deficient balance?

dpage, Here's my story as I have been in a similar situation with Capital One before. I was 3 months behind. I kept in contact and made arrangements. I had to pay one note before a certain date. Then they moved one note to the end of my loan. Then the other month was split in half and tacked on to my next two payments that I had to make on time. I caught the loan up. However, the note was still too much for me, I knew I would be behind again and I eventually ended up going bankrupt. Once I filed, I ended up getting another affordable vehicle through the 722 Redemption program.

If you do a voluntary repo, you will get sued. They will get a judgement. But it depends on your state law if they can request wage garnishments, bank account or tax refund levies.

I couldn't phantom the thought of a voluntary repo with a 28k deficency judgement sitting on my credit report. On top of that, I would be garnished for the next four years on a car I was no longer driving. Plus, I would have to pay for another vehicle to replace the one I voluntarily returned. Nope! Don't think so. Wasn't doing that. So bankruptcy was the answer for me.

Do what will provide you relief and soon. Only you know your full situation and you don't have much time before this becomes an involuntary repo.

Current Fico 8 Scores (9/19): EQ: 674 EX: 678 TU: 676

Gardening until 1/2021

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Voluntary Repo / Turn in

Have you ever advertised it in Craigslist and found out what a willing buyer was willing to pay you for it?

Did you get a carmax offer on the car? how about selling it to a DEALERSHIP.

What do you think one is willing to offer you for this car in its present condition?

Find out how much deficient will you be selling this car away.

Have you filed Bankruptcy before? which one? how long ago? if not, that may very well be a better solution.

Is it fair to assume that your CREDIT is not exactly good? what are your scores? have a previous Repo you said?

what else is showing on the report?