- myFICO® Forums

- Bouncing Back from Credit Problems

- Bankruptcy

- HOW TO: From BK7 discharge to 700 in 24 months or ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

HOW TO: From BK7 discharge to 700 in 24 months or less!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW TO: From BK7 discharge to 700 in 24 months or less!

@Anonymous wrote:You can dispute the judgments on your cr's because they should be reporting as "0 balance, included in bankruptcy". You can also try to ask the court to set aside the judgment since technically the debt is no longer valid but my courts were jerks and refused to comply. It's called a motion to set aside judgment.

Great!! Thank you!! I will try this.

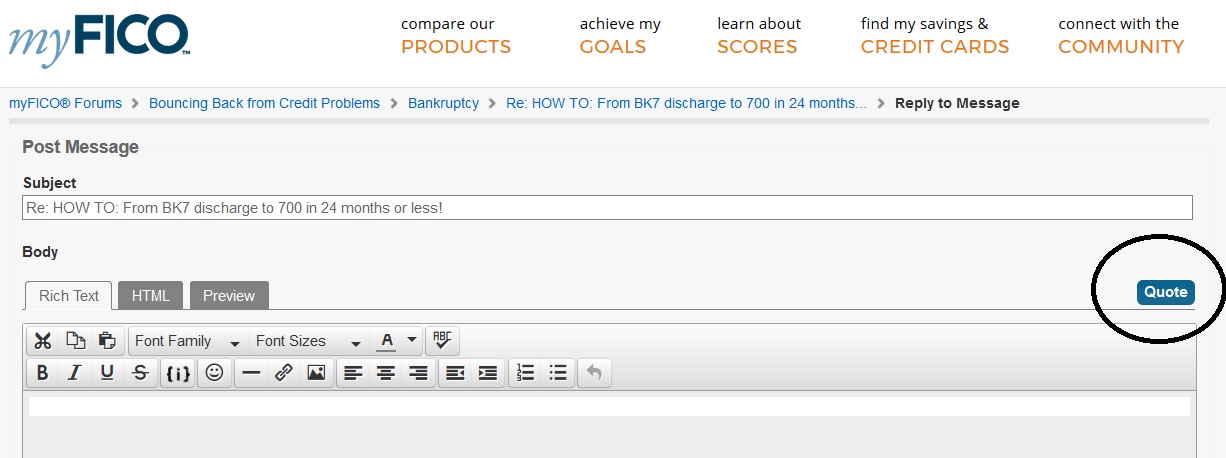

(by the way, I guess I don't know how to quote...or delete a post here

)

You can't delete a post. And the quote button is in a strange place, took me awhile to figure it out. It's in the upper right of the box where you type in your text:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW TO: From BK7 discharge to 700 in 24 months or less!

@texasguppie wrote:

Lost employment along with a six-figure income 9/2013.

As a man in his mid-50's regaining that level of income was impossible to find again so I plugged along the best I could by paying the minimums with a drastically reduced income.

The hole just got bigger.

I filed BK7 on 3/31/17.

My 341 hearing is 5/9/17 and I'm a nervous wreck but according to my Attorney I have no reason to be.

I'm keeping my home "as contracted" (I'm not past due with my Chase mortgage) and on the advice of my counsel I'm not reaffirming.

Once discharged I plan on following the advice found here to get back to a 700+ CS.

I'm blessed to have stumbled across this forum and look forward to posting my progress.

Keep me in your good thoughts!

My good thoughts headed your way. ![]() Yes, pretty much impossible to start over with a high paying position later in life, they'd rather hire a young person at half price.

Yes, pretty much impossible to start over with a high paying position later in life, they'd rather hire a young person at half price.

Your attorney is right, nothing to your 341. I assume your case is a no assets, meaning no property or money will be taken from you to reapy anything? If so, no creditor will bother to show up, you should be in & out in 5-10 minutes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW TO: From BK7 discharge to 700 in 24 months or less!

I apologize if this question was already asked somewhere in this thread, but I wanted to ask, what if CreditOne was one I already had and included in my Chapter 7? (burned) Should I still try them first?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW TO: From BK7 discharge to 700 in 24 months or less!

I don't have a vehicle other than my Harley and it's value is under the threshold.

I love my home and I'm happy to be able to keep it. I am however unhappy that the two payments I've made to Chase since filing aren't reflected on any of the three CRA's.

I assume the only way to get my payments reported is to refi at some point?

I've read this entire thread from #1 to #172 and have found encouragement.

I no longer feel sub-human or like a deadbeat.

I've also learned that living a more modest and planned financial life is completely within my control.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW TO: From BK7 discharge to 700 in 24 months or less!

@Anonymous wrote:I apologize if this question was already asked somewhere in this thread, but I wanted to ask, what if CreditOne was one I already had and included in my Chapter 7? (burned) Should I still try them first?

Welcome to the forums!

The answer is no, absolutely not - they'll turn you down flat and waste a credit pull besides. You could try going straight to Capital One if they're not part of your BK. Other less savory options are out there as well...but hopefully it doesn't come to that...

Check out this thread to get some other ideas

Good Luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW TO: From BK7 discharge to 700 in 24 months or less!

@texasguppie wrote:

Correct; it is a no asset BK7.

I don't have a vehicle other than my Harley and it's value is under the threshold.

I love my home and I'm happy to be able to keep it. I am however unhappy that the two payments I've made to Chase since filing aren't reflected on any of the three CRA's.

I assume the only way to get my payments reported is to refi at some point?

I've read this entire thread from #1 to #172 and have found encouragement.

I no longer feel sub-human or like a deadbeat.

I've also learned that living a more modest and planned financial life is completely within my control.

You're right about Chase - once you include a creditor, they're typically not going to continue reporting unless you reaffirm...and since that would ber a bad idea in your case, well...youy might have to get creative about ways to show some payment hostory for a while ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW TO: From BK7 discharge to 700 in 24 months or less!

I'm able to pay my mortgage. The discharge of other debt makes it much easier so I'm not in fear of falling behind and facing a potential foreclosure.

I have equity in my home but not an absorbent amount so there is no true advantage for Chase to WANT it back at this point in the loan (8 years into a 30 year FHA loan.)

Perhaps some of you can enlighten me as to options post discharge.

My 341 Is May 9th, 2017.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW TO: From BK7 discharge to 700 in 24 months or less!

@texasguppie wrote:

I'm quite confident why reaffirming might not be a good idea but I'm also not certain of all of the potential pitfalls and benefits of reaffirmation.

I'm able to pay my mortgage. The discharge of other debt makes it much easier so I'm not in fear of falling behind and facing a potential foreclosure.

I have equity in my home but not an absorbent amount so there is no true advantage for Chase to WANT it back at this point in the loan (8 years into a 30 year FHA loan.)

Perhaps some of you can enlighten me as to options post discharge.

My 341 Is May 9th, 2017.

The short version is that if you reaffirm a mortgage (or any loan) you are liable for the entire current balance of the loan. If you do not reaffirm and you become late on payments all they can do is foreclose, if they sell the house for less than the amount you owe, it's their loss, they can't come after you for any "deficiency" - the mortgage balance less the net selling price.

If your mortgage is 8 years into a 30 year loan then you bought in 2009, and probably got a good price in the midst of massive foreclosures after the 2008 financial crisis. But, when they foreclose they sell the home at auction, which usually brings the lowest possible selling price because auction sales are cash only, and the bank pads the mortgage balance with late & penalty fees plus foreclosure costs. If you do not reaffirm they will not report your continued on time payments because in BK the debt is discharged, all your on time payments do is prevent them from being able to foreclose. However they do continue to amortize the 'loan' - apply your payments for interest and against the principal.

In my 2010 BK7 I wanted to reaffirm my mortgage - I had equity, could afford the payments, I enjoyed the home and planned to stay. But my attorney argued strongly against it, so I took his advice. I was never late prior to filing, never late during BK, and 7+ years later still have never been late. But no one but the bank and I know that. But I've been able to rebuild my credit just fine without the mortgage reporting.

On thing you should ask your attorney: Does your state prohibit deficiency judgements in foreclosures for a principal residence? Some states do, and in those states not reaffirming a mortgage gives you no additional protection. My state of AZ has a law preventing deficiency judgements for a primary residence, but is limited to residences on 1 acre or less. My home is a rural property on 10 acres, so my attorney was correct in advising against reaffirming.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW TO: From BK7 discharge to 700 in 24 months or less!

I too live in AZ so we are in the same "protected boat!"

I'm looking forward to putting my 341 hearing behind me, awaiting discharge and moving on with rebuilding.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW TO: From BK7 discharge to 700 in 24 months or less!

I currently have 2 autoloans , 1 we plan to keep and the other with too high a note. We can carpool for 4 months tops and really need a second vehicle.