- myFICO® Forums

- Bouncing Back from Credit Problems

- Bankruptcy

- Looks like its time to sue FMC...Input please.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Looks like its time to sue FMC...Input please.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Looks like its time to sue FMC...Input please.

Im going to call an FCRA attorney today. I have been battling with FMC for months to get this corrected on my Eq, and EX reports. Luckily its not on my TU at all. But heres the story.

Bought this vehicle in 09 new. Had to file BK7 in 2010 because of a realestate investment from 06 that was going bad. So we reaffirmed this vehicle no problem. Well in 2012 we had job loss and couldnt afford it anymore. So we decided to vol repo it. No drama. The car was always paid ontime up to 6/2012. FMC wouldnt take it back until it went 120 days late, so we stopped paying and let it sit. It goes in sept 2012 and by dec we get the overage letter. Couldnt pay it, so we let it go. Well two years later they decided to sue us for the overage.

So we strung them along until we were able to do BK13. Got out of the law suit and a bunch of other business expenses that we had the opportunity to get rid of with this BK. So fast forward to a few months ago. Im looking at our credit reports to see what i can start working on, and I see FMC on there now. It wasnt there at the beginning of the BK, but now it is in a bad way.

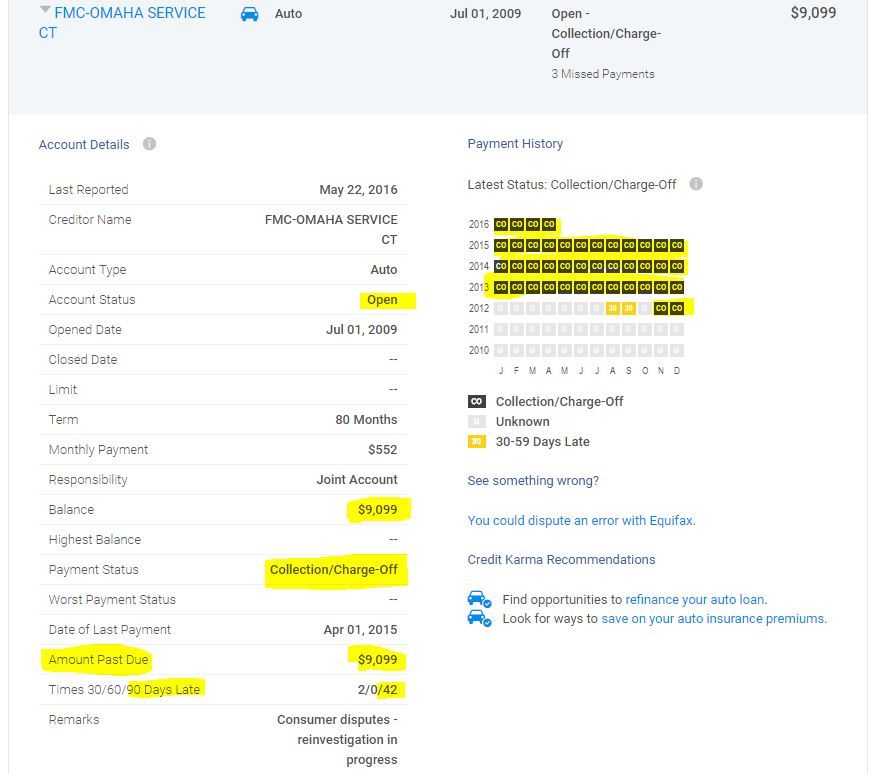

Firstly its showing OPEN (wrong). Secondly its showing Charge OFF(wrong- should be IIB) Thirdly its showing a balance (wrong). And lastly and the WORST, its showing 90 days late for 42 straight months(VERY WRONG). Basically its still reporting and all those COs are counting as 90 day lates on my eq and ex. This is awful. So I disputed on both CRs, three times, and all three times its coming back with the same info. I called FMC and they transfer me from Collections to recovery and to bk departments and back. They wont help, and my BK lawyer wont help with the credit stuff.

Should I call a FCRA lawyer and sue? We moved a few months ago, and had to pay several deposits for utilities because of this account. I have nothing else bad showing but the BK. Scores for both eq and ex are in the low 600's. See the screen cap and lets here some opinions.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Looks like its time to sue FMC...Input please.

Oh and lets not forget that its showing NONE of my ontime payments from 09/09 - when it was returned in 2012...

And then theres this........ Sounds like a trend not just a mistake.

Quote from the complaint. Sounds fimilar.

"

The worst of it is that they are reporting charge offs on my credit report for 37 months. They claim because it was turned over to a law firm. I never missed a payment up to the voluntary surrender. I have challenged my credit report and called them.

How can they rip me for $6500 on a $2000 debt, then add a judgement to my credit report (which I paid) then add 37 months of charge offs. It did not take 37 months for them to receive payment in full including the time I received notification from the law firm and my payment. The car was auctioned within a month, I paid the law firm within six months."

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Looks like its time to sue FMC...Input please.

Nobody??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Looks like its time to sue FMC...Input please.

I'm no lawyer but I would contact an attorney, especially if you have documented the path you took to resolve it correctly.

It should belisted as IIB, showign a zero balance and not 90 days late durign the CH7/13 time period. If it was late before you filed, that will stay, but not after the date you filed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Looks like its time to sue FMC...Input please.

Your next step would be to file a complaint with the CFPB. When you file the complaint, attach all of your bankruptcy information, copies of the original disputes or their dispute numbers and a copy of your report, and circle the incorrect information and put notes that refer back to your bk dates. Complaints will get attention of the bureaus. Ask in your complaint that they correct the record or delete the account in it's entirity. They have 30 days to respond back to the CFPB. This will get their attention.

I had to file complaints on a few accounts and it worked where the dispute process failed. Good luck!