- myFICO® Forums

- Types of Credit

- Business Credit

- Amex PreQualify?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex PreQualify?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amex PreQualify?

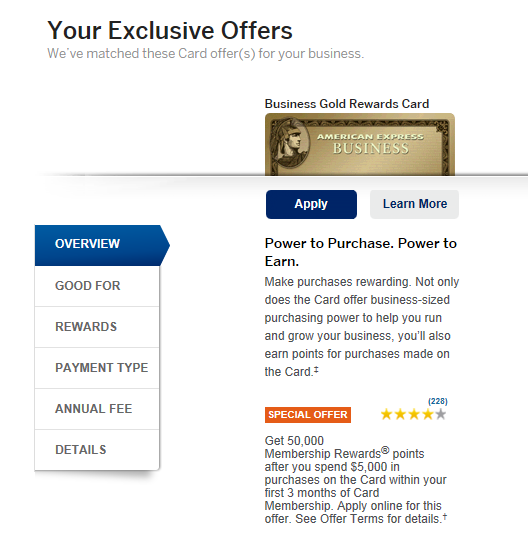

Does this mean my business has been prequalified? I do not see any APR or anything however.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex PreQualify?

After talking to the rep in chat, she stated no APR since it's paid in full every month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex PreQualify?

@Kirmac,

This is a charge card and a balance cannot be carried on the card. You are required to pay in full any amount that is owed at the end of the month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex PreQualify?

The Amex prequalifications are usually spot-on, meaning you could click the link and likely be approved.

There is an offer for higher points, but it also requires a higher spend. One reiew I read made it sound like the extra spend didn't justify the MR points.

Depending on the offer, your annual fee is only waived for the first year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex PreQualify?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex PreQualify?

@klrmac wrote:

I'm undecided if I want to app for it. It would still be PG and a HP on my personal reports. However, this would be my first and only card (charge or not) on my business account in 4 years since I started my LLC.

If you are not sure, don't apply yet. I got an offer for the same card thus 75,000 points with only 2k spend. If you are not in any hurry for the card, wait it out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex PreQualify?

I actually just closed this card. There is no psl,but after having it for two years. I checked to see what amount would be approved and I couldn't buy a big purchase cause in the last six months my spend was down on it and they average the last six months. So if I only spent six thousand in that total time then I would only be approved to spend a thousand on purchases. If I spent 30000 in that time frame then I could spend 5000. I found this out from the csr after it was denied at a store. Nice to look like an idiot at store when you know it has a zero bal every month. Needless to say it wasn't going to happen twice. I don't want to have to worry if the charges will be approved. Never once missed a due date. Not really worth the 175 annual fee either. There points are worth about a half cent. Two points just to get a penny. The only thing they have point for point is gift cards. Everything else take twice the points just to purchase something if that makes sense.