- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: CHASE AA DISASTER!!!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CHASE AA DISASTER!!! Updated 1/4/16 Results

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE AA DISASTER!!!

How about everybody chill out a bit. Keep on topic.

your friendly neighborhood mod,

Shogun

July 2013 score: EQ FICO 819, TU08 778, EX "806 lender pull 07/26/2013

Goal Score: All Scores 760+, Newest goal 800+

Take the myFICO Fitness Challenge

Current scores after adding $81K in CLs and 2 new cars since July 2013

EQ:809 TU 777 EX 790 Now it's just garden time!

June 2017 update: All scores over 820, just pure gardening now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE AA DISASTER!!!

summation: Different strokes for different folks. One size doesn't fit all. I think OP was sharing information that may or may not help others. It's up to the reader(s) what they get out of it. Thanks for sharing OP.

___________ 12Njoy

FICO - EX 810; EQ 797; TU 804 I'm climbing back to 800+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE AA DISASTER!!!

@12njoy wrote:summation: Different strokes for different folks. One size doesn't fit all. I think OP was sharing information that may or may not help others. It's up to the reader(s) what they get out of it. Thanks for sharing OP.

Agreed. Plus, OP's wife is the one with AA (though he is worried about family cards). Methinks if DW had gone through proper channels, this thread would be moot. But, it was a reaction, and sometimes, humans just react. Still waiting on the update from LOE.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE AA DISASTER!!!

Imperfectfuture,

Yes, if the DW had not been so stubborn and had escalated this issue to the EO, we probably would not be discussing at all. On the other hand, when LOE gets here we can maybe take something from that.

sealight,

very good data points, I lean towards your thoery a bit more. I think the DW scared them with the 4 new accounts in 8 month period. This does not hold true if you read jcef1995 & Aahz post (very great data points).

I personally think it was a great combination of things.

1.) 4 new accounts (2 being large ones)

2.) rare usage and then all of a sudden using 60% utilization on Freedom (even though it was pif)

3.) sent the sm to a csr that was having a very bad day (i really belive this is possible)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE AA DISASTER!!!

What an ordeal for your wife. She seems more calm and matter of fact about it.."ok, just close all of my acts then". ,Honestly, I would have reacted the same way, and told them to stick it.

Sorry for all your troubles, and hope it gets worked out on way or another, but looks like it already has.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE AA DISASTER!!!

Ok, let me see if I can catch up the situation with the OP's DW:

Two Chase cards, Freedom and Amazon, opened a year to 18 months ago. (others not quite relevant to my outline)

Chase Freedom card, used primarily if not exclusively for Category spend. A 70,000 point balance (did I get that right? It was a big number, right?) before we got into the Q4 2015 or December 2015 spend period. Chase Freedom category in Q4 is... Amazon. 5% during the first part of Q4, then a reset to a new $1,500 spend max, for 10% on Amazon during December. Very rich rewards.

Chase Amazon card. SD during all of Q4 because, well, the rewards are better on Freedom so why bother?

In the space of how much time, DW realizes there are A Lot of purchases to make on Amazon, pushes the limit on the Freedom card to get those 10 UR points (can't say I blame her). The charges post. DW pays that amount days later.

Then in a matter of days, DW reaches out to Chase to try to transfer CL from the Amazon card to the Freedom card. This triggers an internal review as part of the CL transfer. This doesn't have to be sinister, it seems like it would just be a normal part of the bank practice to computer review the accounts that have any request against them, you know, just in case. Risk Mitigation would be the reason.

The computer algorithm came up with some reason to CLD the Freedom card, basically did not transfer the Amazon limit but did do the Amazon card closure as requested.

There were a number of reports at the end of 2014 of "random" Chase card closures and CLD, which seemed to align with a general press release by Chase that they were reducing their "loan risk exposure". It is possible (not certain, only possible) that this card fell into one of Chase's "let's reduce risk" categories at the end of 2015. Triggering the computer review by the CL Transfer request may have raised the odds of going through the "let's reduce risk" filter.

I suspect the flurry of purchases, request to combine limits, and some goal within the Chase Borg combined to result in the $2k limit on the Freedom.

DW saying "close the cards", unfortunately, has resulted in No Rewards For You. That's a lot of UR points to give up on the principle that "the bank dissrespected me." It's why it's important to think through apps, and consider fully whether to close a card.

Sorry to hear about the situation, OP, I wish it were a better outcome. Chase did a CLD on my Freedom card from $3,500 to now $1,500 in a couple of steps. Even at $1,500 I find it a valuable card, but each person has to make their own choices.

Good luck to DW!

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE AA DISASTER!!!

@Bowzer wrote:Imperfectfuture,

Yes, if the DW had not been so stubborn and had escalated this issue to the EO, we probably would not be discussing at all. On the other hand, when LOE gets here we can maybe take something from that.

sealight,

very good data points, I lean towards your thoery a bit more. I think the DW scared them with the 4 new accounts in 8 month period. This does not hold true if you read jcef1995 & Aahz post (very great data points).

I personally think it was a great combination of things.

1.) 4 new accounts (2 being large ones)

2.) rare usage and then all of a sudden using 60% utilization on Freedom (even though it was pif)

3.) sent the sm to a csr that was having a very bad day (i really belive this is possible)

I believe number two was really the key. I've seen far more reports of AA occuring after a recent spike in spending than after an app spree.

If I recall correctly income is roughly double total credit lines. But usage (across all cards?) was relatively low and then BOOM! Shoud this have happened any month other than December I'd be positive it was the increased spending that triggered it. But it's hard to believe neither the computers nor the UWs expect a big spending increase in December.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE AA DISASTER!!!

Excellent Recap NRB525, Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE AA DISASTER!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE AA DISASTER!!!

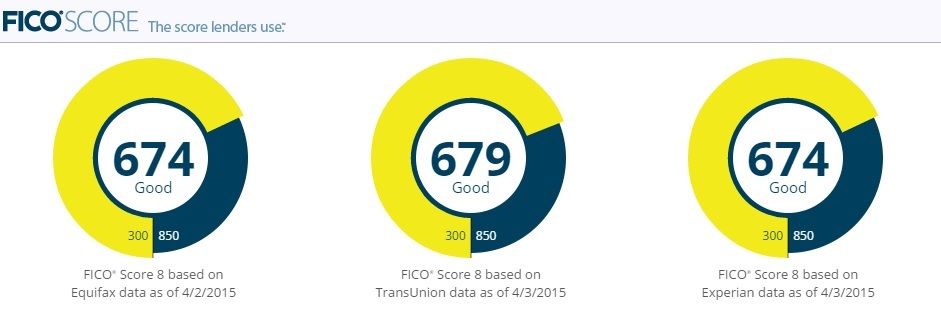

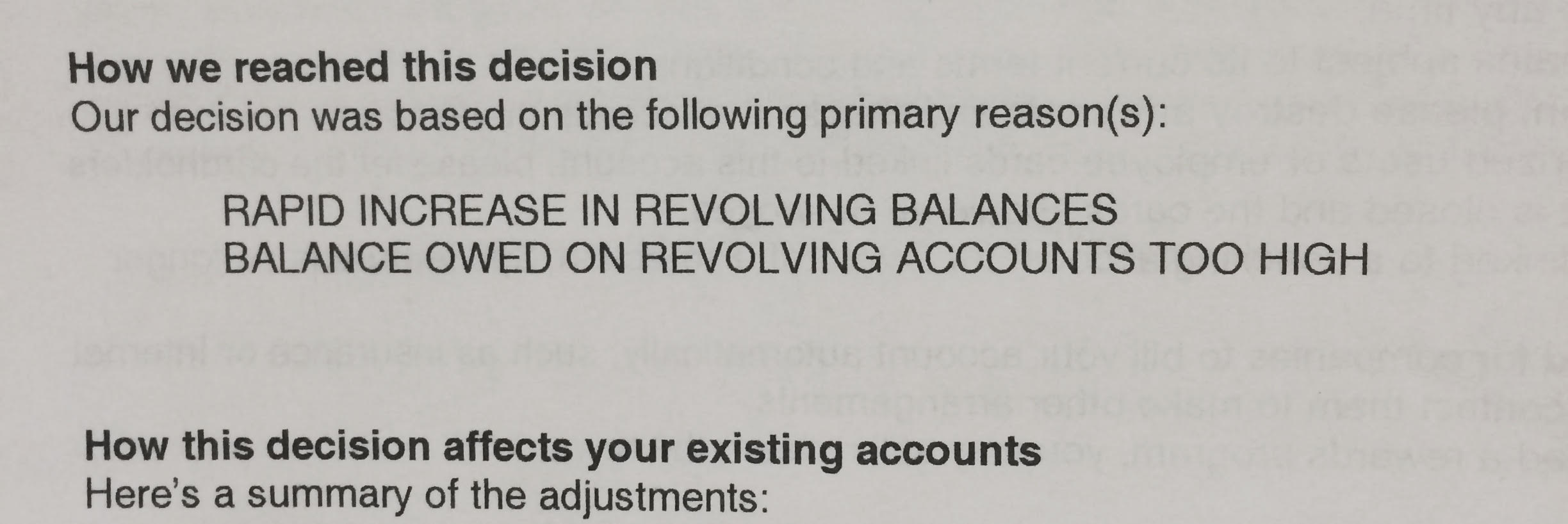

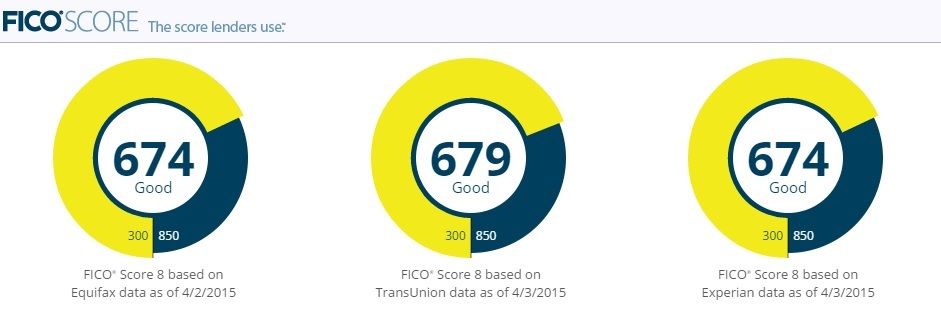

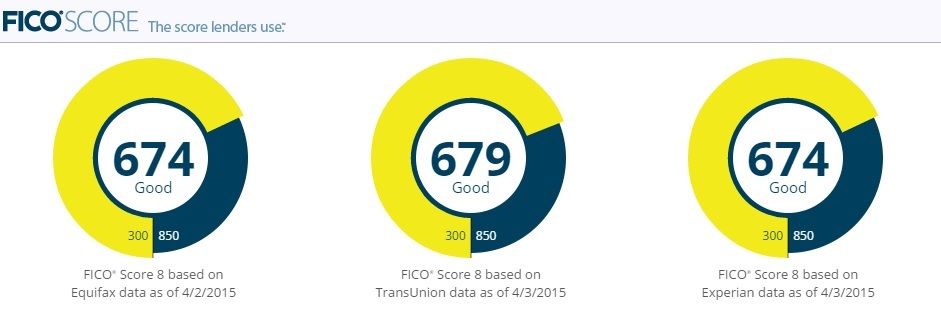

Well, received results today and posted below.

1st reason is fair enough and understandable after the DW used 60% of available balance after not showing this kind of usage in the past. I could see where this would have spooked them a bit, on the contrary they also were pif immedialtley after amount posted to account.

2nd reason is totally incorrect and absurd that they would even indicate this as being a factor. The DW only carries a balance on one card month to month to max out fico's and this is always at 1% utitlity and always pif when statement is cut. This is confusing and somewhat fustruting, I could see if they meant that the installment loans that were recently accuired were high balance but this strickly stated revolving.