- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Credit Card Application Rehab Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Card Application Rehab Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Application Rehab Thread

But I do know exact how you feel. I love "spinning the wheel". Luckily Citi declined my application yesterday. Kinda snapped me back into reality after getting approval after approval. I'll spend some time in "rehab" now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Application Rehab Thread

How many inquiries and apps have you done in the last 6 months? In the past 6 months, I have app’d 11 times; 3 were denied and 8 were approved

How many for the last year? I have app’d 18 times; 14 were approved, 4 were denied.

How many new accounts? 8 new accounts in the past 6 months; 14 in the last year

Had any accounts closed due to risky behavior? None yet—knock on wood.

I definitely have a problem with apping. The first step is to acknowledge you have a problem—step one complete. After going so many years with nothing but denials, it felt so good to finally be approved for something.

But apping just to app is doing me no good—I either get cards I don’t want/will never use, or I get smaller limits than I wanted. It’s best to only apply for the cards I really need/want, and to limit inquiries as much as possible. I am now in the garden for a really long time; I have learned my lesson about excessive apping, but that doesn’t help diminish the urge to app. I think reading everyone else story here will help in that department.

(edited for errors)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Application Rehab Thread

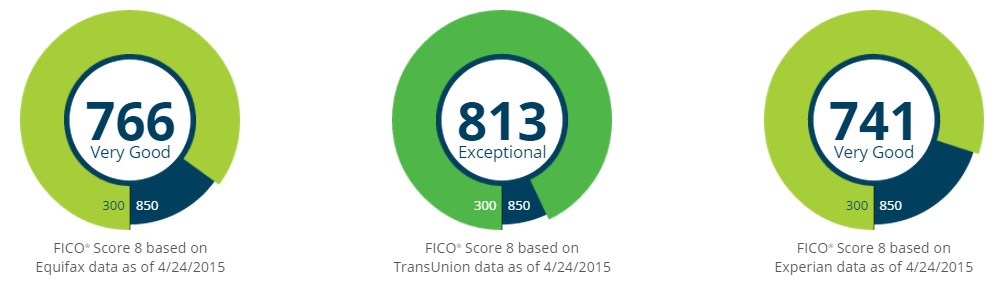

Like others have said, after many years of either denials or just not trying because of poor credit, it was nice to hear yes, yes, yes for a change....until too many INQ finally kicked me back to reality. My scores tumbled a lot and I entered the garden on 4/24. This is my motivation now for staying put. This is what happened to me when I stopped the app nonsense:

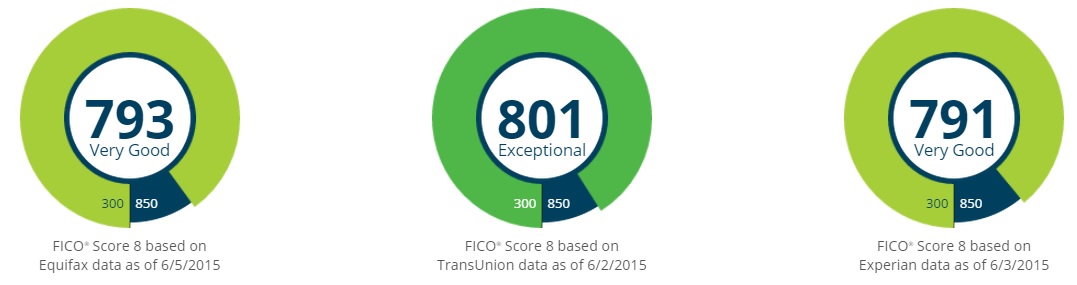

and my latest scores 6 weeks later:

So, good things happen to those who wait. I'm not going to app until the end of the year and hopefully all 3 scores are over 800. I'll pursue the cards I really want by then and close down the deadbeat ones.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Application Rehab Thread

How many inquiries and apps have you done in the last 6 months? I think I've probably done 2 applications (both denied with Barclays in the past 6 months. I may skip Barclays altogether and just stay with Chase, AMEX and Citi.

How many for the last year?

Probably 4 or 5 including the ones I have.

How many new accounts? In the last six months, none.

Had any accounts closed due to risky behavior? None.

My list from my previous post has changed. I'll probably just get CSP to go with Freedom, Double Cash for non-category spending and utilities, and AMEX for Groceries and Department stores. Sam's Club Mastercard and Amazon Prime Store Card are maybes on the list.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Application Rehab Thread

How many inquiries and apps have you done in the last 6 months? Past 6 months: 1. Past Year: 2

How many for the last year? Applied twice, Approved twice

How many new accounts? 2 new accounts in the past year

Had any accounts closed due to risky behavior? Not so far.

I really want the Venture......but I just apped and was approved for the JP Morgan Ritz Carlton. If I app for this, I'll have 7 cards.... and to me that feels like too many.

Someone talk me out of applying!

Chase Freedom Unlimited (6k), CSP (20k), Amex Delta Platinum (13.5k), Amex Marriott Bonvoy (16k), Barclay Apple (12.5k), USBank Flexperks Travel Rewards (12k), Wells Fargo Visa Signature (10k), Citi Double Cash (8k), Amex Gold, Amex Platinum, Amex BBP (15k) Marriott Bonvoy Boundless (15k)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Application Rehab Thread

9 new accounts and about 15 inquiries in the last 6 months. ![]()

I am definitely addicted to the feeling I get when I'm approved, especially after having so many denials in my past. I realized that I don't "need" all this credit, I just like knowing that I am financially worthy enough to have it. I do have everything I feel like I need for now, so I don't plan on apping again for a while.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Application Rehab Thread

How many inquiries and apps have you done in the last 6 months? 16

How many for the last year? 16

How many new accounts? 14 (two denials)

Had any accounts closed due to risky behavior? None.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Application Rehab Thread

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Application Rehab Thread

I did close my Jared card after 18 months because of some fishy questions the company was asking me. I didn't feel comfortable with those questions so I closed the card the same day that I was asked. Children's place used my account due to inactivity. I had the card for twelve months and never used it. Dots credit card was closed because the company went out of business. All of the other cards remain open.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content