- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Discover you're killin me

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Discover you're killin me

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Discover you're killin me

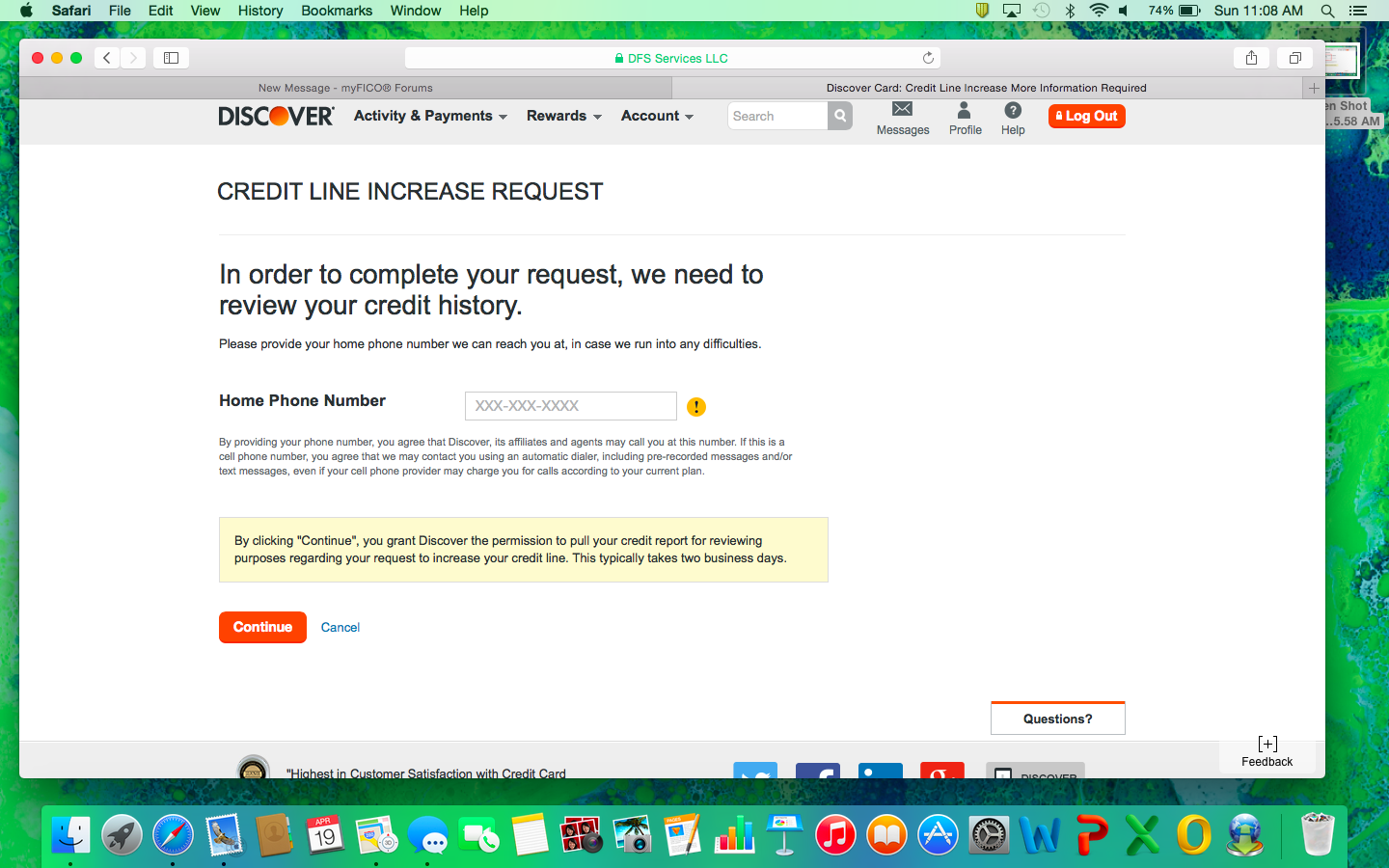

Just tried for Discover CLI again and this came up...I don't know if it is worth the HP! What do you guys think? My limit is only $500 which is annoying and I use this card all the time.

Cap 1 Williams Sonoma Visa $3.5k limit, Walmart MC $2k limit, American Express Platinum $2K limit, Venmo Visa $900 limit, Credit One Amex $700 limit, Credit One Visa $400 limit, Kohls $300 limit, Target RedCard $300 limit, Living Spaces $1k limit, Amazon $400 limit, Jcrew $450 limit, US Bank $300 limit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover you're killin me

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover you're killin me

I've only had it since December but I was hoping now that the 4th statement cut that I would get some sort of increase

Cap 1 Williams Sonoma Visa $3.5k limit, Walmart MC $2k limit, American Express Platinum $2K limit, Venmo Visa $900 limit, Credit One Amex $700 limit, Credit One Visa $400 limit, Kohls $300 limit, Target RedCard $300 limit, Living Spaces $1k limit, Amazon $400 limit, Jcrew $450 limit, US Bank $300 limit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover you're killin me

Sorry to see that happen to you, especially considering the amount of soft-pull love they have been giving to others lately. How long have you had the card? If it hasn't been open very long, you might need a bit more history on it before you'll be eligible for a CLI.

I think if you're willing to take a HP, you might be better off calling them and speaking to a credit analyst. I would be afraid of only getting say a $500 increase for a HP via the online system. Best of luck in whatever you decide to do.

My Wallet: Amex Gold NPSL; Amex Optima Platinum $25K; Amex BCE $12K; Apple Card $20K; BofA Travel Rewards Visa Sig $67.6K; Cap1 Quicksilver Visa Sig $10K; CSP $28.2K; Chase Freedom $13K; Chase Freedom Unlimited $21.4K; Citi Costco Visa $19.3K; Citi Double Cash $13.5K; Citi Simplicity Visa $23.3K; Discover IT $50K; Fidelity Visa $25K; NFCU Flagship Visa Sig $40K; NFCU More Rewards Amex $30K; PenFed Plat Rewards Visa Sig $50K; Sears MC $10.1K; US Bank Altitude Go Visa Sig $20K; US Bank Cash+ Visa Sig $26K; Wells Fargo Rewards Visa Sig $14K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover you're killin me

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover you're killin me

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover you're killin me

Ditto. I only started getting SP CLIs after 18 months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover you're killin me

get the scores up before wasting more INQ.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover you're killin me

I get the same thing and I have had mine since April 2014 at $500. For the longest I didn't get anything. Then it "opened" up and I would get declined. Now it states it wants to pull a report.

I guess that's progress LOLOL

I won't take a HP though, in fear of the $500 increase. I willjust use it as I can. Luckily I got the Freedom recently with $2000 so that can cover the category this time ![]()

So I feel you OP ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover you're killin me

After trying the luv button every few days, I finally got this message as well.

Current FICOS: Mid 640s-50s on all reports, Ch 7 BK D/C Aug 2019

Starting scores: EX - 534, EQ - 574, TU - 516 | Total TLs: $91k approx | Total Utilization: 17%, getting this back down