- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: First Flat Out Denial in A While

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

First Flat Out Denial in A While

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

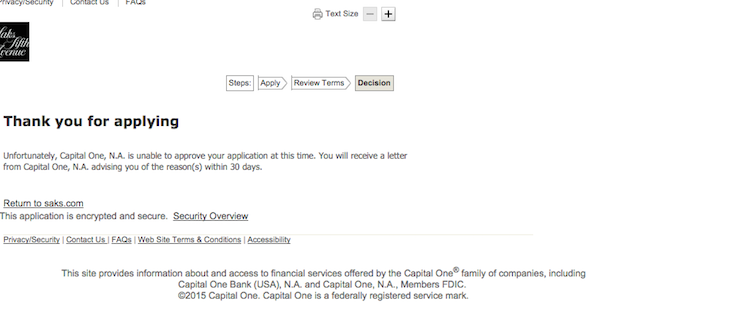

First Flat Out Denial in A While

I am used to the application requires further processing message get back to me in 30 days or receiving a store card instread of synchrony bank visa or mastercard lol.

I applied for Saks Credit Card, I knew I probably shouldn't have because I have too many CapitalOne credit cards and a Neimans Credit Card.

I have 5 capitalone mc/visa cards when I opened Neimans putting me at 6 cards. So I thought it was a grey area thing maybe with capitalone especially with the retail cards. I knew they were going to pull TU, my inquiries are down to 10 (which is LOW for me) and it took about 20 seconds to spit this out to me.

Worth a recon?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First Flat Out Denial in A While

@ddemari wrote:I am used to the application requires further processing message get back to me in 30 days or receiving a store card instread of synchrony bank visa or mastercard lol.

I applied for Saks Credit Card, I knew I probably shouldn't have because I have too many CapitalOne credit cards and a Neimans Credit Card.

I have 5 capitalone mc/visa cards when I opened Neimans putting me at 6 cards. So I thought it was a grey area thing maybe with capitalone especially with the retail cards. I knew they were going to pull TU, my inquiries are down to 10 (which is LOW for me) and it took about 20 seconds to spit this out to me.

Worth a recon?

First of all, depending on your file and history, 10 inquiries could still be quite a lot, so down to 10 may not cut it. If you have a long and thick file, it may not be a big deal.

You could simply be at your exposure limit with Capital One. There's nothing wrong with an attempt at recon although Capital One isn't known for recons really.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First Flat Out Denial in A While

I feel it is an exposure reason, I mean it could be because of new accounts. when I approved for neimans I had 28 inquiries. My TU fico is 728, no derogs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First Flat Out Denial in A While

I have 3 Cap One cards and the Saks card! Wanted to app for Neiman's as that is where I buy my handbags & sunglasses but was afraid to because of Cap One & all I have with them right now. Can I ask how long you had your Neiman's card? I was going to wait a year before attempting it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First Flat Out Denial in A While

Neimans is only 3 months old.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First Flat Out Denial in A While

@ddemari wrote:Neimans is only 3 months old.

Regardless if under the same umbrella, this is their private lable division. And, they pretty much have the same underwriting criteria (a la Capital One of course) as they did back with HSBC. The same applies for NM, Menards and their other private label CCs. Has nothing to do with exposure.

Reconsideration will not work unless it's a verification issue. Of course, you are welcome to try but it will not be fruitful. Not to damper your spirits but you already know this from recent apps not coming to expectations (recent store card vs MC). Creditaddict was unsuccessful in his reconsideration efforts with Saks. Just being realistic.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First Flat Out Denial in A While

@FinStar wrote:

@ddemari wrote:Neimans is only 3 months old.

Regardless if under the same umbrella, this is their private lable division. And, they pretty much have the same underwriting criteria (a la Capital One of course) as they did back with HSBC. The same applies for NM, Menards and their other private label CCs. Has nothing to do with exposure.

Reconsideration will not work unless it's a verification issue. Of course, you are welcome to try but it will not be fruitful. Not to damper your spirits but you already know this from recent apps not coming to expectations (recent store card vs MC). Creditaddict was unsuccessful in his reconsideration efforts with Saks. Just being realistic.

I remember that ordeal through the posts he made on it. Jesus, if I had the money to regularly shop at Saks, I still wouldn't apply for that CC with all of the runaround CA got.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First Flat Out Denial in A While

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First Flat Out Denial in A While

@ddemari wrote:

Interesting, i thought it had to do with having over 5 capitalone cards but i didnt see that on the fine print so ya it was a we dont u denial. Thanks for the info!

No, not really as far as the total count. I have NM, Saks (WEMC & Store), Menards, Venture WEMC, QS VS, QS WMC (I used to have a couple more but they're closed now), Yet, it's never been the relative number of CCs IME.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First Flat Out Denial in A While

I would wait another 3 months or even 6 and try again. With so many banks financing the store cards, they should matter less than a major card. We know how long the list goes for Comenity/Sychrony. I think it's too soon. I won't give up on Neiman's. That's on the top of my retail list!