- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Navy Federal Thread for CLI and Additional Car...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Navy Federal Thread for CLI and Additional Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

Thanks! I appreciate the quick reply!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

First time poster and thought I'd add my experience.

My Chapter 7 was discharged in October 2015. I applied for and got an NFCU Cash Rewards card with a 1K limit and 11.4% APR on 3/22/17. Even though the limit was low I was pretty happy b/c I never had an APR that low even before my BK. At the time of approval I already had a CapOne Quicksilver with a 9K limit and a Barclay Rewards MasterCard with a $1500 limit.

3 statements have cut and I'm over 90 days, so I decided to go for the CLI today instead of waiting for the AR, because based on when and how my recent statements have reported, my utilization was actually better at the end of April/begining of May than it will be in the next week . All my cards are still under 9% but still. Anyway, when I go on the website it says there is a condition on my account that prevents me from getting a CLI! What? I have been using this thing like crazy to get the bonus and paying it off several times a month.

I call and the rep says he doesn't see any problems with the account and he can do the increase request for me over the phone. I tell him I heard that if it's an instant approval on the website it's a soft pull and if it goes to review it's a hard pull. He says the same applies if he does it over the phone. He agrees to send a message to the loan department immediately to cancel the request if it's not an instant approval and even sets up the message in advance so it's ready to go right away if I'm not instantly approved. I tell him to pull the trigger. Instantly approved for a new limit of 15K! It's already showing in my account online and I have received no alerts about any hard pulls.

Gotta love NFCU!

I should add

687 Equifax (FICO 9 from NFCU site)

661 Experian (FICO from Discover Credit ScoreCard Site)

634 Transunion (FICO from Barclay site)

I guess I could go for that second card, but I don't want to push my luck.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

Gotta love navy they give out credit like candy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

CreditLuv waited patiently in the garden for 6 months and one day before he went on a major CLI request spree that he is only half done with (the other half is tomorrow).

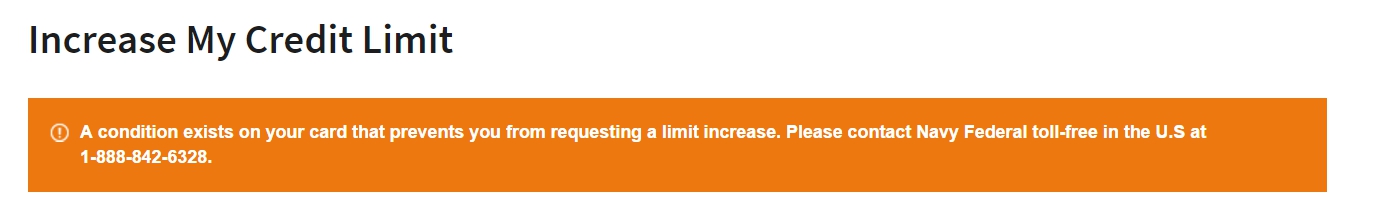

It started scarily. ![]()

When I went to ask for my first ever NFCU CLI online I thought I would see like everyone had said a "max" button to hit.

Instead, when I hit the submit button through the prompts I got this scary looking denial message of DOOM that popped up.

A condition? I was like what condition?

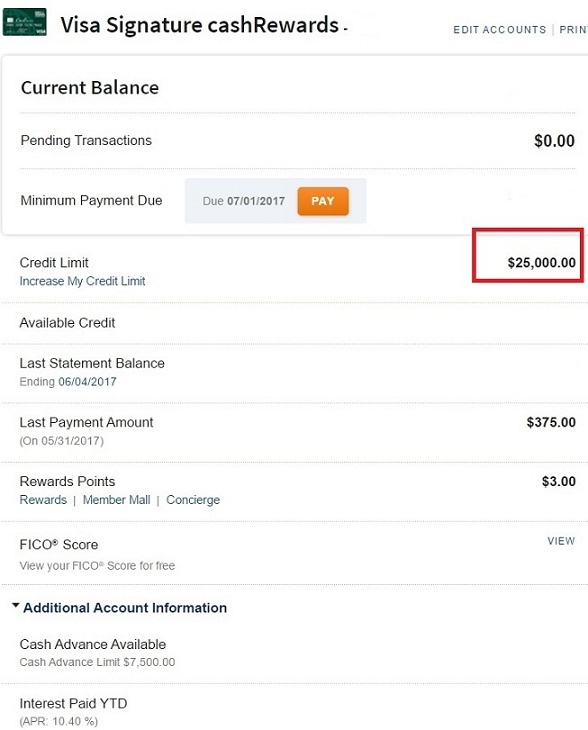

I then called 1-888-842-6328 at like 2:30 am in the morning and I got a CSR on the line. I told him I was trying to get a CLI on my Flagship Visa credit card and I got this weird message on my screen. After blah blah talk he asked me how much I wanted above the current $5K limit that I already had and I, of course, said the "max." He said the max was $25,000 (we know it's $50K for all NFCU cards except the Flagship that is $80K max limits) but I bit my tongue and said yes $25,000, please.

He said he had to go talk to the underwriter and put me on hold for like 5 minutes or so.

He came back and after what he told me I officially nailed the NFCU "Triple Lindy" (see 'the movie Back To School' with Rodney Dangerously).

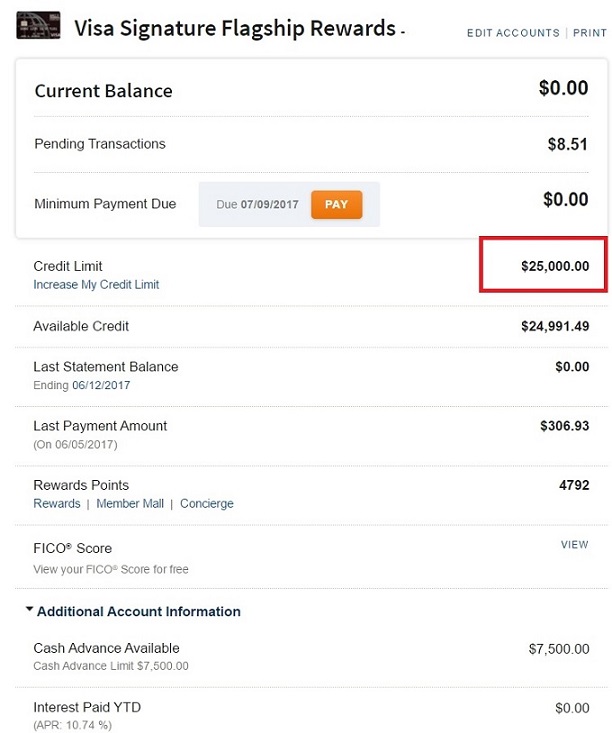

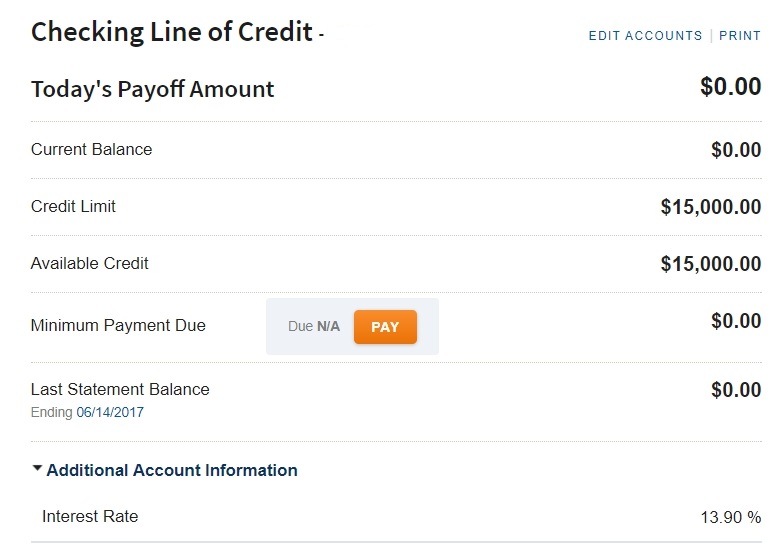

$25,000 cc #1 + $25,000 cc #2 + $15,000 CLOC. ![]()

"You want details" (in my best Ben Affleck Boiler Room speech voice)

None of my alerts have shown me yet what credit bureau the hard pull will come from. It's supposed to be Equifax and my EQ FICO 08 was 761-765 (6/3 pulled 761 but I had some positive credit things happens in the last three weeks so I might've gone up a few points).

Only one CC or PLOC that I have was showing a balance of any kind. I always let one and only one revolving tradeline show a balance before an app or CLI request spree.

I had the Flagship credit card for only 6 months and one day before asking for this CLI.

I hit my one-year NFCU membership anniversary the day before I asked for the CLI (did this on purpose - time and usage matter to NFCU).

I had four total EQ inquiries reporting and only three of them were less than one year old.

My last EQ inquiry was six months and one day ago from this CLI request.

All other details of my credit are in my signature.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

Awesome CreditLuv!...And congrats...your approvals are such a joy to see because I know the planning and patience you have put in to this.( hence the great rates you are approved with) Great job!

Current FICO08 Scores SEP 2023 (TU 834) (EQ 831 (EXP 831)

“The credit is no longer bruised, it has endured the test of time” (formally know as bruisedcredit)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

@Misses_November wrote:

Does anyone know when Navy Federal report to the credit bureaus? Do they report monthly, every other month? And if so what day? Thank you

Navy Federal reports monthly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Thread for CLI and Additional Cards

The AR should be happening any day now! I'm up for my 90 day CLI as of 6/23 so I'm impatiently waiting on this AR before I request the CLI. I was instantly approved on 3/24 with a $14,300 SL. I've been using the crap out of this thing to and paying in full. Hit my $3k spend in 90 days for $200 in about 1.5 months. I still haven't received the bonus either actually lol. I think I'll call in the next week or so after I go for the CLI. Don't forget to post up when you see the AR hit!