- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Penfed Approvals Please Post Your Data For Oth...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Pentagon Federal Credit Union Data Share

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pentagon Federal Credit Union Data Share

@Anonymous wrote:Although this isn't the Auto Loan forum...however, being it's a Penfed thread with the Penfed guru behind the wheel...May I ask if auto loans are easier or harder to get then credit cards with Penfed? One of the main reasons I joined was there attractive auto rates. I have 2 loans with DCU at 5.49%. I would like to move 1 to Penfed. Now that I have finally gotten approved for the Promise, is this a good time to try to refinance? They quoted my EQ score at 646 on my Promise app. Any chance I could get a better rate? Thanks!

I don't believe you would get a better rate at Penfed than you have with DCU until you reach 680-700. However, if you are still under your 90 day time frame, no harm in trying. Just my honest opinion.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pentagon Federal Credit Union Data Share

Well, PF made a booboo and my Plat Rewards was at 16.24% and I called and told then that when they approved me it was at 10.24 then they CLI me to 45k and then the rate went up to the 16.24. So after 10 min on the phone they adjusted it back to 10.24. The initial reasoning was it was pre approved at 10.24 but when they did the CLI the rate went up instead of staying the same. Either way, they honor everything that they say, even though they dont record the phone calls. They said John, since you have our max CL there is no reason that you shouldnt have our lowest APR!!!! Love these guys/gals. Had to be PC lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pentagon Federal Credit Union Data Share

@Anonymous wrote:Well, PF made a booboo and my Plat Rewards was at 16.24% and I called and told then that when they approved me it was at 10.24 then they CLI me to 45k and then the rate went up to the 16.24. So after 10 min on the phone they adjusted it back to 10.24. The initial reasoning was it was pre approved at 10.24 but when they did the CLI the rate went up instead of staying the same. Either way, they honor everything that they say, even though they dont record the phone calls. They said John, since you have our max CL there is no reason that you shouldnt have our lowest APR!!!! Love these guys/gals. Had to be PC lol.

Haha that is fantastic!! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pentagon Federal Credit Union Data Share

I figured I'd add my data share to this forum even though I started a thread.

I got approved for membership last night and then immediately applied for the Rewards CC. I got approved for $5k.

This morning I called to recon the CL and was increased to $12k.

Btw The risk paper they sent me with my score listed my EQ at 662.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Approvals Please Post Your Data For Others

This info is from the time of my app in August 2014.

Product approved and Limit: Platinum Rewards Visa Signature $20K

EQ 08 Fico: 810

Penfed Nextgen: 822

Instant or Review: Instant

POI: None

AAOA: 10 yrs

Derogs?: 1 30-day late from Feb 2010, and 3 30-day lates from early 2008

Util: 2%

Total EQ Inquiries: 1

Last 12 months: 1

Last 6 months: 1

New Accounts in last 12 months: 3

Last 6 months: 2

Received my first quarterly pre-approval offers in April 2015, but they were only for auto/boat/RV loans. In January 2016, I received quarterly pre-approval offers that included credit card products. There has been lots of speculation on these forums that if you join dirty, you won't receive the quarterly offers. While my EQ report probably wasn't filthy, it wasn't spotless either.

My Wallet: Amex Gold NPSL; Amex Optima Platinum $25K; Amex BCE $12K; Apple Card $20K; BofA Travel Rewards Visa Sig $67.6K; Cap1 Quicksilver Visa Sig $10K; CSP $28.2K; Chase Freedom $13K; Chase Freedom Unlimited $21.4K; Citi Costco Visa $19.3K; Citi Double Cash $13.5K; Citi Simplicity Visa $23.3K; Discover IT $50K; Fidelity Visa $25K; NFCU Flagship Visa Sig $40K; NFCU More Rewards Amex $30K; PenFed Plat Rewards Visa Sig $50K; Sears MC $10.1K; US Bank Altitude Go Visa Sig $20K; US Bank Cash+ Visa Sig $26K; Wells Fargo Rewards Visa Sig $14K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Approvals Please Post Your Data For Others

@CribDuchess wrote:This info is from the time of my app in August 2014.

Product approved and Limit: Platinum Rewards Visa Signature $20K

EQ 08 Fico: 810

Penfed Nextgen: 822Instant or Review: Instant

POI: None

AAOA: 10 yrs

Derogs?: 1 30-day late from Feb 2010, and 3 30-day lates from early 2008Util: 2%

Total EQ Inquiries: 1

Last 12 months: 1

Last 6 months: 1

New Accounts in last 12 months: 3

Last 6 months: 2

Received my first quarterly pre-approval offers in April 2015, but they were only for auto/boat/RV loans. In January 2016, I received quarterly pre-approval offers that included credit card products. There has been lots of speculation on these forums that if you join dirty, you won't receive the quarterly offers. While my EQ report probably wasn't filthy, it wasn't spotless either.

Thank you sooooo much for posting this!! It's urban myth that if you join with baddies you never get any pre-approvals. It may have once been true. But, it certainly no longer is!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Approvals Please Post Your Data For Others

@baller4life wrote:

@CribDuchess wrote:This info is from the time of my app in August 2014.

Product approved and Limit: Platinum Rewards Visa Signature $20K

EQ 08 Fico: 810

Penfed Nextgen: 822Instant or Review: Instant

POI: None

AAOA: 10 yrs

Derogs?: 1 30-day late from Feb 2010, and 3 30-day lates from early 2008Util: 2%

Total EQ Inquiries: 1

Last 12 months: 1

Last 6 months: 1

New Accounts in last 12 months: 3

Last 6 months: 2

Received my first quarterly pre-approval offers in April 2015, but they were only for auto/boat/RV loans. In January 2016, I received quarterly pre-approval offers that included credit card products. There has been lots of speculation on these forums that if you join dirty, you won't receive the quarterly offers. While my EQ report probably wasn't filthy, it wasn't spotless either.

Thank you sooooo much for posting this!! It's urban myth that if you join with baddies you never get any pre-approvals. It may have once been true. But, it certainly no longer is!!!

Happy to help prove an urban myth wrong! ![]() Believe me, I was tempted to app many times prior to Aug 2014, but I was too scared to do it since I had some 30-day lates. PenFed was my holy grail! I finally just went for it, and everything turned out great! But yes, PenFed does seem to have loosened up quite a bit!

Believe me, I was tempted to app many times prior to Aug 2014, but I was too scared to do it since I had some 30-day lates. PenFed was my holy grail! I finally just went for it, and everything turned out great! But yes, PenFed does seem to have loosened up quite a bit!

Thank you for creating this great PenFed data share thread, Ms. Baller!! ![]()

My Wallet: Amex Gold NPSL; Amex Optima Platinum $25K; Amex BCE $12K; Apple Card $20K; BofA Travel Rewards Visa Sig $67.6K; Cap1 Quicksilver Visa Sig $10K; CSP $28.2K; Chase Freedom $13K; Chase Freedom Unlimited $21.4K; Citi Costco Visa $19.3K; Citi Double Cash $13.5K; Citi Simplicity Visa $23.3K; Discover IT $50K; Fidelity Visa $25K; NFCU Flagship Visa Sig $40K; NFCU More Rewards Amex $30K; PenFed Plat Rewards Visa Sig $50K; Sears MC $10.1K; US Bank Altitude Go Visa Sig $20K; US Bank Cash+ Visa Sig $26K; Wells Fargo Rewards Visa Sig $14K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pentagon Federal Credit Union Data Share

You are very welcome Crib! ![]() Everyone please let us know if you receive pre-approvals even though you joined with baddies.

Everyone please let us know if you receive pre-approvals even though you joined with baddies.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Approvals Please Post Your Data For Others

@CribDuchess wrote:This info is from the time of my app in August 2014.

Product approved and Limit: Platinum Rewards Visa Signature $20K

EQ 08 Fico: 810

Penfed Nextgen: 822Instant or Review: Instant

POI: None

AAOA: 10 yrs

Derogs?: 1 30-day late from Feb 2010, and 3 30-day lates from early 2008Util: 2%

Total EQ Inquiries: 1

Last 12 months: 1

Last 6 months: 1

New Accounts in last 12 months: 3

Last 6 months: 2

Received my first quarterly pre-approval offers in April 2015, but they were only for auto/boat/RV loans. In January 2016, I received quarterly pre-approval offers that included credit card products. There has been lots of speculation on these forums that if you join dirty, you won't receive the quarterly offers. While my EQ report probably wasn't filthy, it wasn't spotless either.

Maybe I'm missing something here, but you had scores over 800 with baddies in your file?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed Approvals Please Post Your Data For Others

@Anonymous wrote:

@CribDuchess wrote:This info is from the time of my app in August 2014.

Product approved and Limit: Platinum Rewards Visa Signature $20K

EQ 08 Fico: 810

Penfed Nextgen: 822Instant or Review: Instant

POI: None

AAOA: 10 yrs

Derogs?: 1 30-day late from Feb 2010, and 3 30-day lates from early 2008Util: 2%

Total EQ Inquiries: 1

Last 12 months: 1

Last 6 months: 1

New Accounts in last 12 months: 3

Last 6 months: 2

Received my first quarterly pre-approval offers in April 2015, but they were only for auto/boat/RV loans. In January 2016, I received quarterly pre-approval offers that included credit card products. There has been lots of speculation on these forums that if you join dirty, you won't receive the quarterly offers. While my EQ report probably wasn't filthy, it wasn't spotless either.

Maybe I'm missing something here, but you had scores over 800 with baddies in your file?

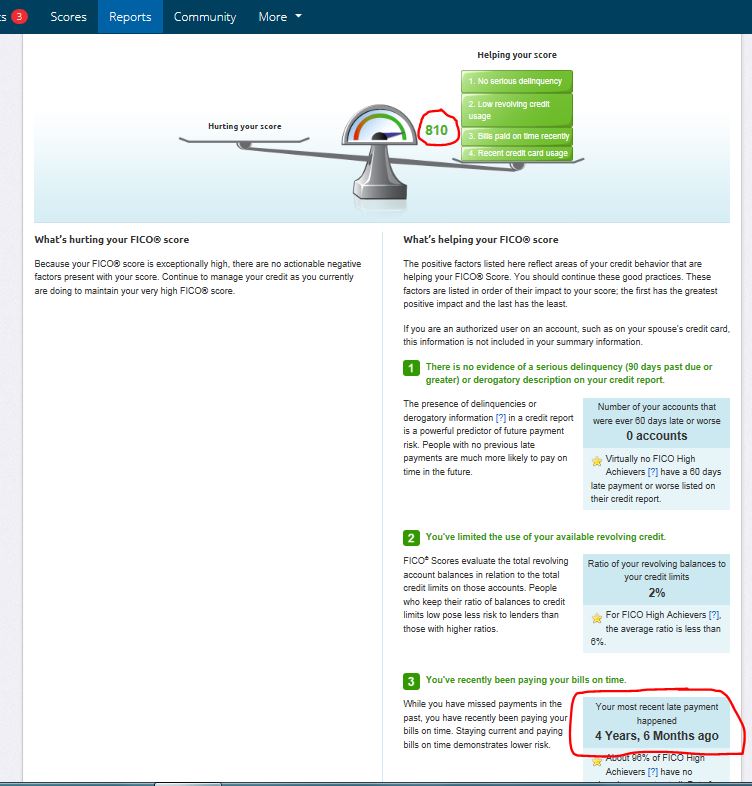

Hi CAPTOOL,

Yes, that is correct. In fact, currently I'm at 817 on EQ and 825 on EX, and both still have one 30-day late reporting from Feb 2010. For whatever reason, that 30-day late isn't showing on TU any more, so my TU score is at 842 right now.

With the additional 3 30-day lates from early 2008 still reporting, my EQ was still over 800. As I posted, it was 810 in August 2014. Here's a screenshot of my EQ report from August 2, 2014.

My Wallet: Amex Gold NPSL; Amex Optima Platinum $25K; Amex BCE $12K; Apple Card $20K; BofA Travel Rewards Visa Sig $67.6K; Cap1 Quicksilver Visa Sig $10K; CSP $28.2K; Chase Freedom $13K; Chase Freedom Unlimited $21.4K; Citi Costco Visa $19.3K; Citi Double Cash $13.5K; Citi Simplicity Visa $23.3K; Discover IT $50K; Fidelity Visa $25K; NFCU Flagship Visa Sig $40K; NFCU More Rewards Amex $30K; PenFed Plat Rewards Visa Sig $50K; Sears MC $10.1K; US Bank Altitude Go Visa Sig $20K; US Bank Cash+ Visa Sig $26K; Wells Fargo Rewards Visa Sig $14K