- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Pre-Qualifys vs Approval

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Pre-Qualifys vs Approval

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pre-Qualifys vs Approval

So I've ben playing around with Pre-Approvals seeing what is out there. Every card I check gives me a large range of APRs but ONE.

American Express is the only card that is giving me a solid interest rate.

I read a while back that when you are given a solid interest rate on your offers, it is a good sign that they will approve you.

Question is, what are the chances of AMEX approving me? How much of my credit report does AMEX see when they pre-qual you?

Starting Score: May 23, 2016 EQ 537 TU 518 EX 548

Recent Scores: EQ 839 TU 824 EX 821

Goal Score: 840

Current Vantage 3.0: 808

Mortgage Scores August 18 2017: EQ5 684 TU4 692 EX2 690

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-Qualifys vs Approval

If they've given you an offer with a solid APR, then they've soft pulled your EX. I'm not certain what they actually see when they soft pull and you are not a customer with them. Your EX score looks good. Any derogatories? Utilization? Inquiries in the last two years? Missed payments? AMEX will dig deeper into those at time of app, and then continue to soft pull you intermittently after you've been approved.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-Qualifys vs Approval

AMEX Platinum Card

AMEX PRG Card

AMEX Green Card

AMEX Delta Platinum

AMEX Delta Gold

AMEX Everyday

AMEX Blue Cash Everyday

Assuming no recent baddies or high utilization on another card or cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-Qualifys vs Approval

Last month, with many EX inquiries and a 710 FICO EX8 score and absolutely zero prequalified offers from Amex, I cold apped for BCP and got approved instantly with $2000 SL.

Note that my FICO8s were in the 550s in 2017 so I am in total rebuild mode with many new accounts and an AAoA of 12ish months.

After I was approved, I was preapproved for almost every Amex card after about 2 weeks of creating my login.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-Qualifys vs Approval

You qualify for AMEX Platinum now. Are you waiting for 100k SUB?

Platinum would look good on you this Christmas! 😀

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-Qualifys vs Approval

@RicHowe wrote:

@Anonymous

You qualify for AMEX Platinum now. Are you waiting for 100k SUB?

Platinum would look good on you this Christmas! 😀

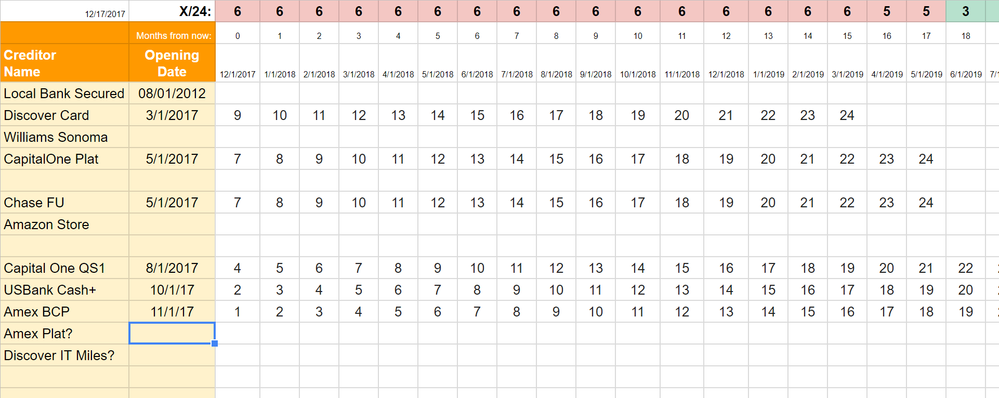

It's on my list (I have a spreadsheet for planning credit cards in the future and the spreadsheet tells me WHEN to app for a card!). I am waiting for:

- 100K SUB -- if it happens, I will snag it right away, disregarding the rest of this list

- Chase 5/24 problems -- I am at 6/24 right now, ugh. I won't be OFF 5/24 until 6/1/2019 and really want the CSR (CSP will do before that if preapproved). If I app for any card now, it will keep my 6/24 to 6/1/2019. That's a hella long time to wait.

- Maximize timing of perks -- I don't want the Platinum in December since I will lose out on 100% of the annual perks. I'd rather get it closer to March because that will let me maximize perks AND my spend on airfare (I book $5000 in airfare every March on average).

The Platinum is definitely in my future, but the math tells me to wait. I have a feeling Chase may give me a CSP preapproval in 2018 and that would do a lot of good for my rewards plan (CSR would slay CSP though) so I am holding out and gardening until then. Unless the 100K SUB shows up for some reason, then that return will offset CSP (but not CSR!).

I'm different than most folks though -- I put 70% of my income in savings/investments and of the remaining 30% left, about 70% of my remaining income goes to travel expenses. Only 10% of my income goes to cost of living, housing, etc. So travel is #1 spend for me, and CSR/Platinum both would work just fine but CSR is remarkably better in overall value to me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-Qualifys vs Approval

Your story sounds alot like mine. Back in 2016 I was in the low 500s. My credit report was a circus of baddies and the candy store even denied me for a loan on a gum ball thats how quick people were pulling the trigger to decline my credit requests.

Jumping to today, you see my scores. 2 weeks ago, I closed on a Home Equity loan and the only CC I have is a Surge and the UTL is 7% on that right now. I feel its time to get a major credit card and give it a try again, seeing I am much more fluent with credit now.

My only baddies is a capital one charge off- Febuary 2015 was the CO date. This was PAID IN FULL 3/2017.

My Surge Card has 3 30 day lates, from 20 months ago was the most recent (20, 21, 23). This was because their autopay never autopaid my payment and at that time I realy had not much fight in me to get it off.

Studet loan is current, current on car lease, and previous car loans

10 inquiries on Experian. 1 expires 12-21 for Messerli and Kramer (They did a HP for a collection account), 6 were from 2016 when I was trying the first time for home equity and never got approved, 1 from May on a home equity with Wells Faro and they denied me because it was not 2 years since my CO was PAID. (I know doesn;t make sence), ad 2 back in August from the home equity I closed on. It was 2 because it was double pulledby error by Equifax Mortgage. So realy any day now would be 120 days from that date.

And yes, AMEX BCE pulled Experian for the softpull.

Now we have my baddies spilled out, and other info so now back to my first post, what are my chances?

@Anonymous wrote:Last month, with many EX inquiries and a 710 FICO EX8 score and absolutely zero prequalified offers from Amex, I cold apped for BCP and got approved instantly with $2000 SL.

Note that my FICO8s were in the 550s in 2017 so I am in total rebuild mode with many new accounts and an AAoA of 12ish months.

After I was approved, I was preapproved for almost every Amex card after about 2 weeks of creating my login.

Starting Score: May 23, 2016 EQ 537 TU 518 EX 548

Recent Scores: EQ 839 TU 824 EX 821

Goal Score: 840

Current Vantage 3.0: 808

Mortgage Scores August 18 2017: EQ5 684 TU4 692 EX2 690

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-Qualifys vs Approval

The recent CO is concerning but I also have seen data points of Amex approvals with COs -- it's a recent thing since Amex started offering "credit steps" starting limits to some folks. Remember, Amex lost a LOT of customers after breaking up with Costco, and they've lowered their minimum approval requirements to give some folks a new chance at Amex.

I'd say if their site says you're approved, I'd think it's pretty solid. It may make sense to wait for that CO to be 3 years old, but that's up to you. If it was me, I'd be slamming Capital One with tons of goodwill letters to remove that CO since you paid it and "I had no idea it would hurt my credit history for so many years in the future" and give them reasons why you learned a harsh lesson and hope they find it in their cold dark lead hearts to remove the tradeline, etc, etc.

I'd also goodwill Surge for removing those lates -- slam them with letters every months.

Still, I think you're probably a good candidate for a "credit steps" amex card at the very least. And all it is is an EX inquiry, which ages off score-wise in a year. No big deal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-Qualifys vs Approval

Well what makes this CO a little more unique that it CO is paid- and its almost 3 years.

I tried a few times with Cap1 of removing it.

Explain the "Credit Steps" card. They are giving me a BCE card offer along with 2 others.

I slammed SURGE more then once. Its at the point now is its hitting the 2 year mark- but once I get a major card I'll proll hire an attorney to fix it, seeing it was their computer error that caused the problem.

Starting Score: May 23, 2016 EQ 537 TU 518 EX 548

Recent Scores: EQ 839 TU 824 EX 821

Goal Score: 840

Current Vantage 3.0: 808

Mortgage Scores August 18 2017: EQ5 684 TU4 692 EX2 690

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-Qualifys vs Approval

Well I said **bleep** it and give it a try.

I filled out the application, submited it and then I seen a question about additional cards (Good sign). I skipped that step, and it came back APPROVED! 2,000 SL. I need to mark my calander now, and get a CLI! And I got the bonous of $150.00 too after I spend $1000

Sad to say, I have not been approved for this high of a SL unsecured in 16 years....

Usually in the past it camed back delicined faster then I could say pleaze..

15 months 0% and 18.24 APR, I beleive it was 18.99 last night.

Starting Score: May 23, 2016 EQ 537 TU 518 EX 548

Recent Scores: EQ 839 TU 824 EX 821

Goal Score: 840

Current Vantage 3.0: 808

Mortgage Scores August 18 2017: EQ5 684 TU4 692 EX2 690