- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Question on a 'silent' decline

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Question on a 'silent' decline

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on a 'silent' decline

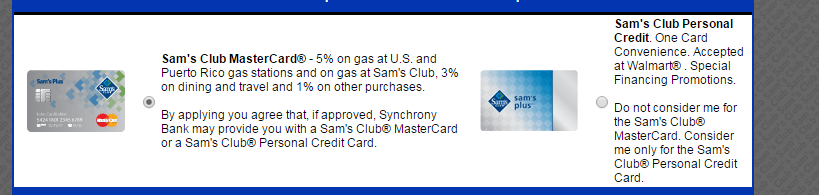

Last year in November I applied for the Sams MasterCard, the one with 5% back on gas and whatnot, now after filling out the online application and reading through the terms for any sneaky things I was informed I was approved and an email said i would receive the card in 7-10 business days. After waiting and not receiving the card I call and find out that instead of getting the card I applied for, they gave me the Sams personal credit which is only good at sams. I did not agree to that card nor could I get some sort of resolution with synchrony through BBB complaint(1).

Since my complaint was closed by the BBB they have since changed the online application, heres an archive that contains the old and new versions with personal info redacted. http://ss13.pomf.se/BBB/Sams.7z

Why can they do this, and if they can't what recourse might I have?

1: Rep with synchrony kept saying the mail in application had an opt out checkbox for the personal card if you don't get the actual MC, could not get them to understand that I applied online and the online application does not have any verbage or mention of the sams personal credit being given instead of the MC if you do not qualify, only that you can choose between the two to apply.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question on a 'silent' decline

This is the new Application as you mentioned.

As for the old application i looked and read the fine print towards the bottom and its not very specific but this might be their defense? If you notice on both applications it says the same wording, just one has fine print and the new application is more readable.

As for what recourse you might have. Not totally sure besides contacting the CFPB, but why would you prefer to just be denied credit overall vs having a personal line and the possibility of it being upped to the MC? But as mentioned it does have the same wording just in differnt places.

Cap1 QS - 2k (4/21)

Mission Lane - 4k (11/21)

Venmo - 900 (11/21)

SavorOne - 2500 (12/21)

VentureOne - 2000 (7/22)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question on a 'silent' decline

Main reason for applying for that card to begin with was 5% back on gas when gas was $4/gallon last year, the $500 personal credit line good at sams/walmart wasn't of much use to me except as another account to increase AAoA at the cost of a hardpull. edit: Also from the way that fine print is worded on the last 'i agree' checkbox on the old application would, to a normal person, insinuate that 'the sams club mastercard or sams club personal credit card' refers to which card was chosen at the beginning of the application.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question on a 'silent' decline

many lenders actually do this. synchrony is famous for giving you another card if not approved for the one you really wanted. Also citi does this at least with best buy. they consider you for the mastercard but if not you may get the store card. thats why in the case of Sams club. they will let you know. I will never apply again for a card like that. just in case. even my walmart card. i thought i was getting the walmart Discover last year it was store card. but now that i understand things. i thought my score was higher than what it actually was. at the time last year. my Tu was 628. but the store card has grown to 5k. so i will keep it. lots of perks. i don't even want the mastercard at this point.