- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Question/s for the more seasoned Amex cardholders ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Question/s for the more seasoned Amex cardholders ***Update***

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question/s for the more seasoned Amex cardholders ***Update***

... The replies, comments and advices from y’all, Thank you!

A little DP ; (Might not be relevant but just to be thorough)

My DW has a Delta Gold she got last 06/2016 with a borderline $1K SL. Her EX8 back then was 657 per Amex. It now sits at $4K via a combination of auto CLI and counter manual CLI. Her current EX8 is now at 686 with aggregate util of 26% and has been for the last 4 months or so. Her last manual CLI was in May 29, 2017 so Nov 26 would be the 181st day in which she qualifies for a 3X CLI request. Her average usage on the card is about $3-$4K a month making 2-3 payments to PIF. She hasn’t paid a penny in interest since getting the card which probably somewhat annoys Amex that’s why they offered her and we accepted a temporary APR of 6.99 until October 2018.

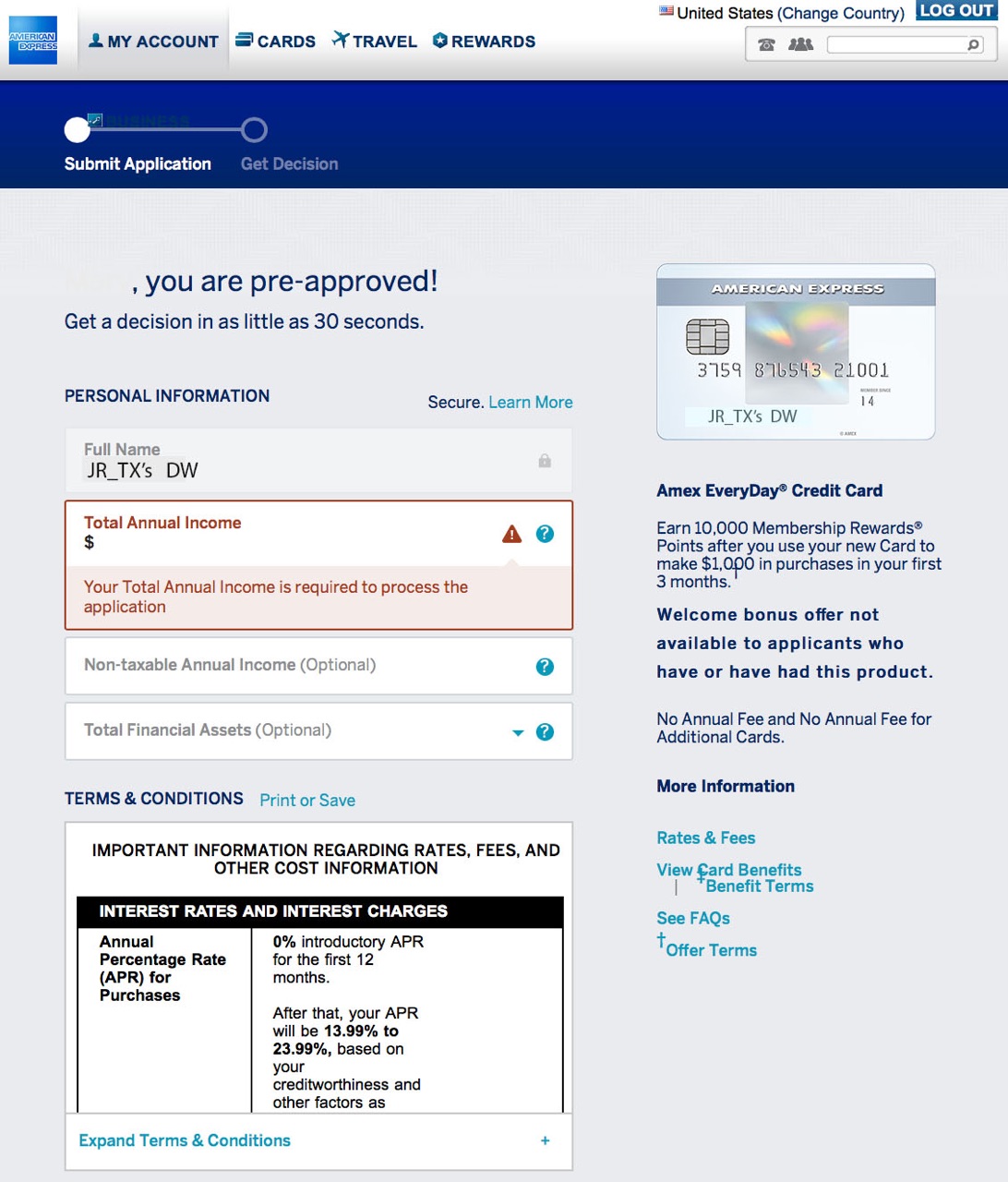

She’s showing “Pre-approved” on all the cards when logged in and hitting apply just before putting in the income and assets.

The question ;

For a better and higher SL outcome , would it be advisable to wait til Nov 26 (181st day for CLI) to apply for a second card (BCE)? Or The SL for the 2nd card has nothing to do with the 1st card’s CL as far as their internal credit allocation goes and relies solely on her current profile and relationship with Amex? In short, should we wait til Nov 26 before applying for the BCE or just apply now or anytime from now?

P.S. Not expecting her credit profile to make a significant gain in the next 3-5 months.

Sorry for the long post and Thanks again in advance!

*** Update ***

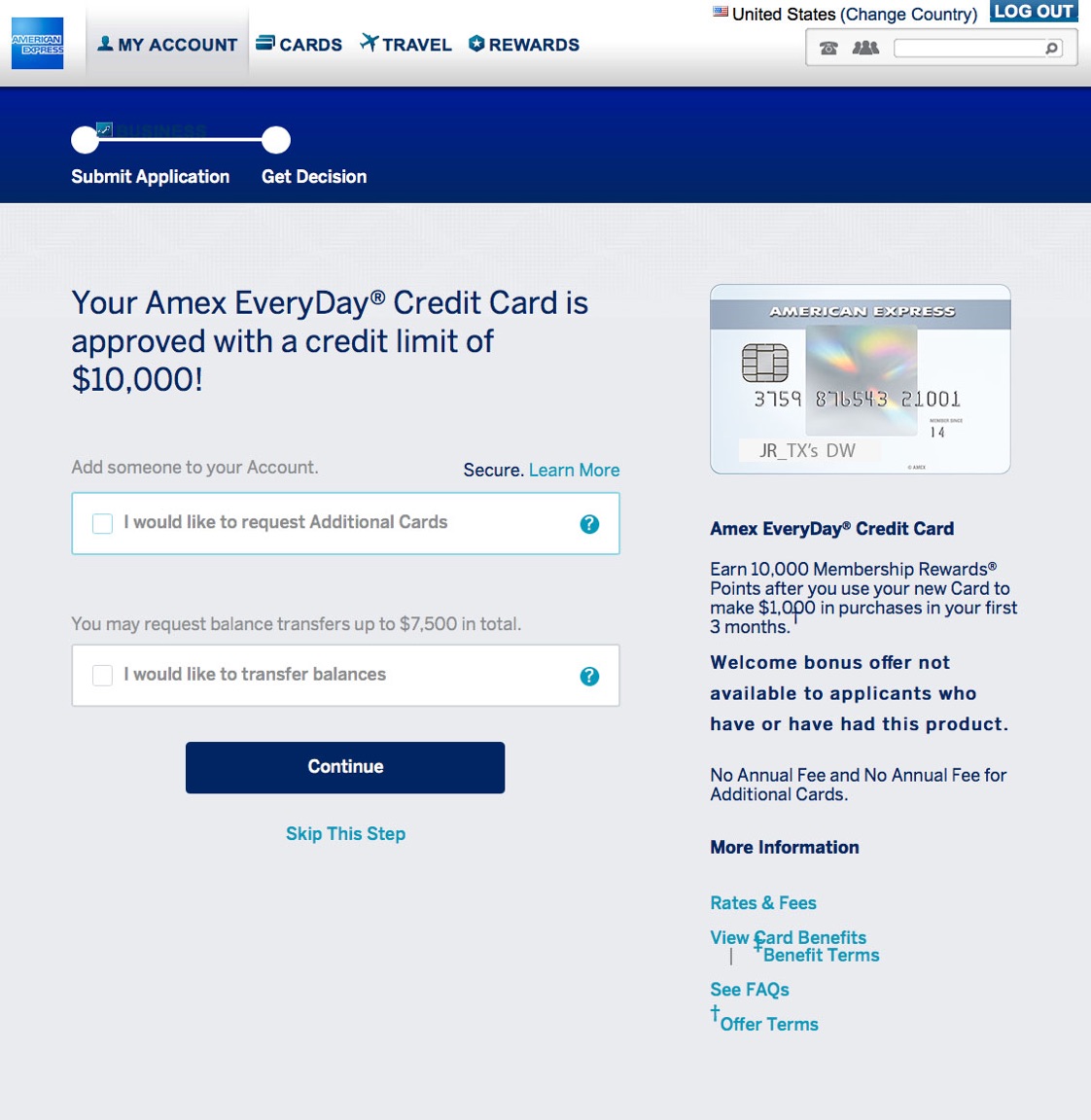

Included screenshots of the before and after to help the community with data points.

With The Good advices and recommendations of my fellow myFICOers KiB, simplynoir, MrDisco and AJC...

went ahead and app’d but decided to go with the ED for the MR points instead of the BCE Cash back.

Approved with SL of $10K! Not too bad!

Thanks for the push guys!!

Now if I can just get off that blacklist so I can have my own. Oh well ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question/s for the more seasoned Amex cardholders

I doubt waiting would have any impact other than adding a little more good history behind the app.

My highest starting limits from any issuer came from Amex, long before my next CLI window.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question/s for the more seasoned Amex cardholders

@MrDisco99 wrote:I doubt waiting would have any impact other than adding a little more good history behind the app.

My highest starting limits from any issuer came from Amex, long before my next CLI window.

+1 At this point for being a new cardholder your DW has a long enough history with AMEX to determine their internal limit for her. If her score is not gonna show much change anytime soon she can go ahead and app; if you don't mind waiting a little longer to be sure a month couldn't hurt before doing so but I don't see the benefit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question/s for the more seasoned Amex cardholders

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question/s for the more seasoned Amex cardholders

I'd just go for it. The Amex cap on an account isn't necessarily the same as their cap on a card at any given time. DW got a CLI from $12k to $32k on her ED in late July (countered from $36k asking), then they just gave her a $23,700 starting line on the Delta Gold. Nothing of note changed on her reports in those approximately 9 weeks so even though they countered on one CLI request, they started her 2nd card off well past the $4k difference in those amounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question/s for the more seasoned Amex cardholders

@K-in-Boston wrote:I'd just go for it. The Amex cap on an account isn't necessarily the same as their cap on a card at any given time. DW got a CLI from $12k to $32k on her ED in late July (countered from $36k asking), then they just gave her a $23,700 starting line on the Delta Gold. Nothing of note changed on her reports in those approximately 9 weeks so even though they countered on one CLI request, they started her 2nd card off well past the $4k difference in those amounts.

Can I just say how absolutely weird that is that AMEX does that. So many DPs that don't matter when you think about it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question/s for the more seasoned Amex cardholders

The ways of Amex are not for us to know. After being an AU on 3 of my accounts for 13 or 14 years that saw at least half a mil of spend and payments, they gave her a training wheels limit of $2k on her first app. Now 17 months later with maybe 3 (large-ish) charges they've extended her over $55k and nothing really changed. Yet with my history and massive SPG spend, they countered my request for $48k in July and gave me a pretty small SL (considering my average CL is around $16k) on my Delta last week. Sometimes their underwriting doesn't make a lot of sense; but their products, stability and service go a long way in keeping me satisfied.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question/s for the more seasoned Amex cardholders

It's that kind of weirdness that's making me probably overthink what to do with my CLI request. Dunno if I should just say eff it and request it on the SPG and go with comes with it since I wanna maximize possible return or just play it safe with BCE; if you could transfer credit lines business -> personal I'd just do that but you can't. And I agree I know that there are horror stories for every lender out there but they've treated me pretty great for awhile and with their cards being good so far I'm more than happy to give them the swipes they want.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question/s for the more seasoned Amex cardholders

The business to personal transfer I find odd that they don’t allow because you CAN do it the other direction.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question/s for the more seasoned Amex cardholders

@K-in-Boston wrote:The business to personal transfer I find odd that they don’t allow because you CAN do it the other direction.

This. So. Much.