- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Throwing in the towel with Chase

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Throwing in the towel with Chase

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Throwing in the towel with Chase

@Anonymous wrote:

@Kathy4NU wrote:I have two cards with Chase. Freedom and Disney. $1,000 & $3,000. Usually always PIF except when I get the special financing from a Disney trip. I have had both cards 2 years.

Called today to see about a CLI with the Freedom. This is my primary card due to the 5% catergories and always 2%. I usually have to pay it off once or twice mid cycle to free up space on it. My scores are in the low 700 except for TU which is 673. A few things have not updated on it TU yet. The guy I talk with at Chase says they need to pull a report. I asked which bureua as that will determine if I go ahead or not. He said EXPERIAN. I gave my ok. He ask how much I want, I tell him a total of $6,000. He immediately tells me I am declined due to too high of revolving balances. Hmmm. I said ok and knew right away I would call the back door to recon. This is what I had to do 2 years ago when I got the card. Hang up and see I have an alert. New Inq from TU!!!! Click and see it is Chase. Grrrr.

Call recon # and told same thing - to high balance on revolving. I explained that 2 of the cards were at 0% interest and the other 2 were in fact paid off. She said she is concerend about the Lowe's. Has $889 balance on $800 cl. I explained that it was at zero and that I ordered something and the sales person ordered wrong and than ordered the right but it put me over the limit but once the wrong came in they immediately credited my account and than I paid off what I really bought as I use the card for the 5% discount you get when buying (this is updated on EX and EQ). She asked permission to pull another report. I said no as the first guy told me he was pulling Experian and really pulled TU. She said they don't have control over what is pulled that the computer automatically does it. I told her no, don't pull again I don't want to rack up a bunch of inq. She said no one really looks at ing and you wouldn't get declined for having too many. I pointed out that when I first got the Freedom I was infact declined due to too many inq and I had to call and explain they were from mortgage shopping. She than said "Yes, they often decline for having too many ing." What??????? Did you just not tell me that ing don't matter. It was like talking in circles with her and the other guy.

Next she suggest I call back within 30 days and they can review again. I asked if this would involve another credit pull and she said "yes, but it wouldn't count as another." I asked how that would be and she said it would be within the same 30 days but they would pull from something other than TU. I politely declined and said I really do not want to rack up any more inq. She than said to wait 30 days as TU updates my file only once every 30 days. I corrected her and said , No TU updates as often as creditor tell them to. She said no, when we submit they just hold onto the data and do all updates just once a month. I informed her that I do have credit monitoring service and I get updates multiple times a week and sometimes within the same day. I gave the example that Chase updates on teh 5th of each month, Discover on the 8th and Lowe's on the 11th. She proceeded to tell me that I was wrong and she was an expert and that TU only updates a person's file once a month after they get all the information from the various creditors as it takes to long to update daily as the data becomes available.

GRRRR. I love my Freedome card but paying it multiple times a month is becoming a pain. What is the next best rewards card? I am done with Chase Freedom and need better go to card for daily spending.

Hmmmmmmmmmmmmmmmmm, is it me or Kathy are you just having the time of your life with your creditors. First it was Capital One (Who you HATE). Now, you HATE Chase. Who's next Citi??? Luck doesn't seem to be on your side or you're just ranting off on every bank that gives you lip service.

Time for a martini or a glass of wine to chillax.

Time to update your signature too - 2012 and 2013 want their numbers back.

The OP was just venting her frustrations, that's all. I believe you're reading too much into it. People change their minds all the time, just depends on the experience - just the nature of the credit beast I suppose. Yet, I don't think the OP has fully called it quits since she just posted a recent approval for the Southwest Airlines CC.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Throwing in the towel with Chase

@FinStar wrote:

@Anonymous wrote:

@Kathy4NU wrote:I have two cards with Chase. Freedom and Disney. $1,000 & $3,000. Usually always PIF except when I get the special financing from a Disney trip. I have had both cards 2 years.

Called today to see about a CLI with the Freedom. This is my primary card due to the 5% catergories and always 2%. I usually have to pay it off once or twice mid cycle to free up space on it. My scores are in the low 700 except for TU which is 673. A few things have not updated on it TU yet. The guy I talk with at Chase says they need to pull a report. I asked which bureua as that will determine if I go ahead or not. He said EXPERIAN. I gave my ok. He ask how much I want, I tell him a total of $6,000. He immediately tells me I am declined due to too high of revolving balances. Hmmm. I said ok and knew right away I would call the back door to recon. This is what I had to do 2 years ago when I got the card. Hang up and see I have an alert. New Inq from TU!!!! Click and see it is Chase. Grrrr.

Call recon # and told same thing - to high balance on revolving. I explained that 2 of the cards were at 0% interest and the other 2 were in fact paid off. She said she is concerend about the Lowe's. Has $889 balance on $800 cl. I explained that it was at zero and that I ordered something and the sales person ordered wrong and than ordered the right but it put me over the limit but once the wrong came in they immediately credited my account and than I paid off what I really bought as I use the card for the 5% discount you get when buying (this is updated on EX and EQ). She asked permission to pull another report. I said no as the first guy told me he was pulling Experian and really pulled TU. She said they don't have control over what is pulled that the computer automatically does it. I told her no, don't pull again I don't want to rack up a bunch of inq. She said no one really looks at ing and you wouldn't get declined for having too many. I pointed out that when I first got the Freedom I was infact declined due to too many inq and I had to call and explain they were from mortgage shopping. She than said "Yes, they often decline for having too many ing." What??????? Did you just not tell me that ing don't matter. It was like talking in circles with her and the other guy.

Next she suggest I call back within 30 days and they can review again. I asked if this would involve another credit pull and she said "yes, but it wouldn't count as another." I asked how that would be and she said it would be within the same 30 days but they would pull from something other than TU. I politely declined and said I really do not want to rack up any more inq. She than said to wait 30 days as TU updates my file only once every 30 days. I corrected her and said , No TU updates as often as creditor tell them to. She said no, when we submit they just hold onto the data and do all updates just once a month. I informed her that I do have credit monitoring service and I get updates multiple times a week and sometimes within the same day. I gave the example that Chase updates on teh 5th of each month, Discover on the 8th and Lowe's on the 11th. She proceeded to tell me that I was wrong and she was an expert and that TU only updates a person's file once a month after they get all the information from the various creditors as it takes to long to update daily as the data becomes available.

GRRRR. I love my Freedome card but paying it multiple times a month is becoming a pain. What is the next best rewards card? I am done with Chase Freedom and need better go to card for daily spending.

Hmmmmmmmmmmmmmmmmm, is it me or Kathy are you just having the time of your life with your creditors. First it was Capital One (Who you HATE). Now, you HATE Chase. Who's next Citi??? Luck doesn't seem to be on your side or you're just ranting off on every bank that gives you lip service.

Time for a martini or a glass of wine to chillax.

Time to update your signature too - 2012 and 2013 want their numbers back.

The OP was just venting her frustrations, that's all. I believe you're reading too much into it. People change their minds all the time, just depends on the experience - just the nature of the credit beast I suppose. Yet, I don't think the OP has fully called it quits since she just posted a recent approval for the Southwest Airlines CC.

Agreed..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Throwing in the towel with Chase

I don't like capital one. Did lots of reading and closed my menards and cap one card I had. Closed then both last night.

I'm on my phone and not sure what my sig says as it doesn't show up. Myfico has my EX 719, EQ 739 and TU at 699. Still waiting on 2 cards to update to zero balance so hoping to break 700 on TU. I don't think they are far of from 2 years ago.

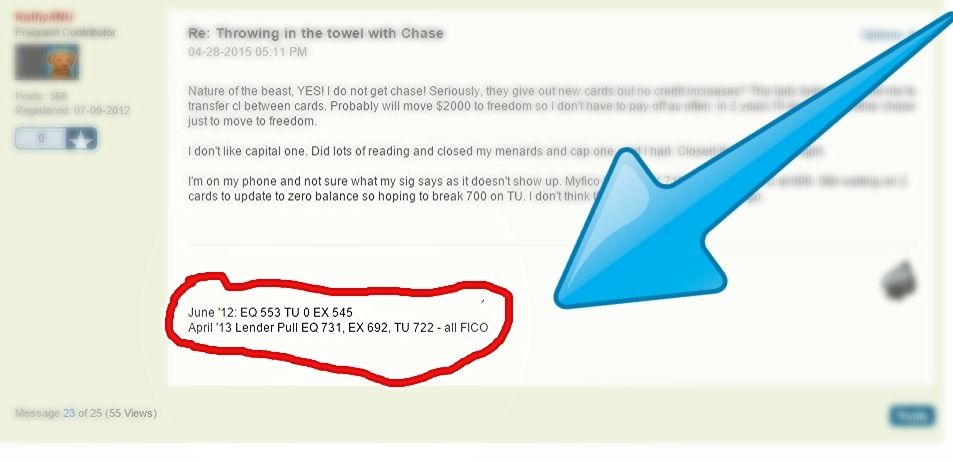

June '12: EQ 553 TU 0 EX 545

April '13 Lender Pull EQ 731, EX 692, TU 722 - all FICO

Closed on home May 22, 2013 at 2:00pm!!!

CU Visa $1000, VS $350, Chase Freedom $1000, Discover IT $2500, Home Depot: $2700, Menards $3000, NFM $3500

What's been deleted: 32 collections, 5 PR, 2 tax liens, defaulted student loans

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Throwing in the towel with Chase

I'm not into martinis but I'm into wine. Bring it on over. I have fresh strawberries and some great dark chocolate to do them into. We can talk and listen to John Tesh.

June '12: EQ 553 TU 0 EX 545

April '13 Lender Pull EQ 731, EX 692, TU 722 - all FICO

Closed on home May 22, 2013 at 2:00pm!!!

CU Visa $1000, VS $350, Chase Freedom $1000, Discover IT $2500, Home Depot: $2700, Menards $3000, NFM $3500

What's been deleted: 32 collections, 5 PR, 2 tax liens, defaulted student loans

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Throwing in the towel with Chase

@Kathy4NU wrote:I have two cards with Chase. Freedom and Disney. $1,000 & $3,000. Usually always PIF except when I get the special financing from a Disney trip. I have had both cards 2 years.

Called today to see about a CLI with the Freedom. This is my primary card due to the 5% catergories and always 2%. I usually have to pay it off once or twice mid cycle to free up space on it. My scores are in the low 700 except for TU which is 673. A few things have not updated on it TU yet. The guy I talk with at Chase says they need to pull a report. I asked which bureua as that will determine if I go ahead or not. He said EXPERIAN. I gave my ok. He ask how much I want, I tell him a total of $6,000. He immediately tells me I am declined due to too high of revolving balances. Hmmm. I said ok and knew right away I would call the back door to recon. This is what I had to do 2 years ago when I got the card. Hang up and see I have an alert. New Inq from TU!!!! Click and see it is Chase. Grrrr.

Call recon # and told same thing - to high balance on revolving. I explained that 2 of the cards were at 0% interest and the other 2 were in fact paid off. She said she is concerend about the Lowe's. Has $889 balance on $800 cl. I explained that it was at zero and that I ordered something and the sales person ordered wrong and than ordered the right but it put me over the limit but once the wrong came in they immediately credited my account and than I paid off what I really bought as I use the card for the 5% discount you get when buying (this is updated on EX and EQ). She asked permission to pull another report. I said no as the first guy told me he was pulling Experian and really pulled TU. She said they don't have control over what is pulled that the computer automatically does it. I told her no, don't pull again I don't want to rack up a bunch of inq. She said no one really looks at ing and you wouldn't get declined for having too many. I pointed out that when I first got the Freedom I was infact declined due to too many inq and I had to call and explain they were from mortgage shopping. She than said "Yes, they often decline for having too many ing." What??????? Did you just not tell me that ing don't matter. It was like talking in circles with her and the other guy.

Next she suggest I call back within 30 days and they can review again. I asked if this would involve another credit pull and she said "yes, but it wouldn't count as another." I asked how that would be and she said it would be within the same 30 days but they would pull from something other than TU. I politely declined and said I really do not want to rack up any more inq. She than said to wait 30 days as TU updates my file only once every 30 days. I corrected her and said , No TU updates as often as creditor tell them to. She said no, when we submit they just hold onto the data and do all updates just once a month. I informed her that I do have credit monitoring service and I get updates multiple times a week and sometimes within the same day. I gave the example that Chase updates on teh 5th of each month, Discover on the 8th and Lowe's on the 11th. She proceeded to tell me that I was wrong and she was an expert and that TU only updates a person's file once a month after they get all the information from the various creditors as it takes to long to update daily as the data becomes available.

GRRRR. I love my Freedome card but paying it multiple times a month is becoming a pain. What is the next best rewards card? I am done with Chase Freedom and need better go to card for daily spending.

Sorry for your Chase experience. I'm in the same boat with you when it comes to Chase. Notta is what they tell me. I'm stuck at $10,000 and that came from consolidating two Chase cards into one.

___________ 12Njoy

FICO - EX 810; EQ 797; TU 804 I'm climbing back to 800+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Throwing in the towel with Chase

@Kathy4NU wrote:

Nature of the beast, YES! I do not get chase! Seriously, they give out new cards but no credit increases? The lady today even told me to transfer cl between cards. Probably will move $2000 to freedom so I don't have to pay off as often. In 2 years I'll apply for another chase just to move to freedom.

I don't like capital one. Did lots of reading and closed my menards and cap one card I had. Closed then both last night.

I'm on my phone and not sure what my sig says as it doesn't show up. Myfico has my EX 719, EQ 739 and TU at 699. Still waiting on 2 cards to update to zero balance so hoping to break 700 on TU. I don't think they are far of from 2 years ago.

Yay! Martinis Wine, let's do it. ![]()

John Tesh. . . ummmmmm NO Thanks! (no offense) ![]()

Btw, let me help you see your signature. . . (not sure why you are not able to see your own signature.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Throwing in the towel with Chase

I can't see anyones scores or other stuff they put in their siggy from my phone. Mine included. But it looks like my scores rebounded from the app spree I did two years ago. I will update them tomorrow when I am on my laptop.

What's wrong with John Tesh? He put me to sleep. Such a soothing voice. Oldies but goodies.

June '12: EQ 553 TU 0 EX 545

April '13 Lender Pull EQ 731, EX 692, TU 722 - all FICO

Closed on home May 22, 2013 at 2:00pm!!!

CU Visa $1000, VS $350, Chase Freedom $1000, Discover IT $2500, Home Depot: $2700, Menards $3000, NFM $3500

What's been deleted: 32 collections, 5 PR, 2 tax liens, defaulted student loans

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Throwing in the towel with Chase

Sorry to hear of your Chase troubles ![]() I too have had several bad experiences with their CSR's. When this happens, I usually just end the call and call back, its hit or miss, but when you get someone who is knowledgeable, they can do wonders

I too have had several bad experiences with their CSR's. When this happens, I usually just end the call and call back, its hit or miss, but when you get someone who is knowledgeable, they can do wonders

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Throwing in the towel with Chase

Good Luck Kathy better times are ahead ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Throwing in the towel with Chase

Sorry for the horrible customer service and misinformation! CHASE SUCKS! HATE THEM!

[Amex PRG No PSL] [Cap 1 QS Visa Sig $50,000] [Barclaycard CashForward WMC $25,000] [Patelco CU MC $20,000] [BofA Cash Rewards Visa Sig $15,000] [Amex BCE $13,000] [Discover It Cashback $13,500] [US Bank Cash + Visa Sig $10,000][US Bank Platinum Visa $8,400] [Penfed Power Cash Rewards Visa Sig $10,000] [USAA Cashback Rewards Plus Amex $15,000] [Citi AAdvantage WMC $5,000] [Macy's Amex $7,500] [JCP $6,500] [Amazon Prime $6,000] [Target $2,000]