- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Want to pull trigger on AMEX SPG, Advice

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Want to pull trigger on AMEX SPG, Advice

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Want to pull trigger on AMEX SPG, Advice

@Anonymous wrote:

you two care way too much. i just get hammered the night before, don't shower or brush my teeth, eat a breakfast taco to mask the breath and get on out there! lol

Translation help: "I just really prefer being single!"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Want to pull trigger on AMEX SPG, Advice

@Anonymous wrote:Stranger things have happened. An analogy, apply for credit like you get ready for a first date. Make your self representable. Best face forward with whatever your working with!

Nice analogy!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Want to pull trigger on AMEX SPG, Advice

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Want to pull trigger on AMEX SPG, Advice

@Anonymous wrote:

meh i am in a relationship lol so meeting new girls isn't something i am worried about.

Is it keeping them for awhile????? hahaha j/k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Want to pull trigger on AMEX SPG, Advice

I only am thinking of applying because, if you seen my earlier post, I was approved for the AMEX BCED card exactly a year ago, with a 672 FICO and 3 baddies on my report. Now my EX report is pretty clean, Midland collection gone, Portfolio collection gone, HSBC charge off acct removed since then, over a year of on time "late-free" payments from all my cards, and an auto loan and current fico is 721.

My total credit to debt ratio for accounts is: Credit card balance $10,491 ÷ Your total credit card limit $59,600 =Your credit card utilization 18%

Those are the reasons why I am crossing my fingers / thinking of apping for the SPG. But I DOOO see how having a balance on my only AMEX could hurt me. But stranger things have happened? LOL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Want to pull trigger on AMEX SPG, Advice

@Outdoorstech1 wrote:I only am thinking of applying because, if you seen my earlier post, I was approved for the AMEX BCED card exactly a year ago, with a 672 FICO and 3 baddies on my report. Now my EX report is pretty clean, Midland collection gone, Portfolio collection gone, HSBC charge off acct removed since then, over a year of on time "late-free" payments from all my cards, and an auto loan and current fico is 721.

My total credit to debt ratio for accounts is: Credit card balance $10,491 ÷ Your total credit card limit $59,600 =Your credit card utilization 18%

Those are the reasons why I am crossing my fingers / thinking of apping for the SPG. But I DOOO see how having a balance on my only AMEX could hurt me. But stranger things have happened? LOL

Totally understand Outdoorstech...I actually think you have gotten good guidance in this thread.

#1. Your overall utilization should be fine (lower is always better), but your individual Amex card may make them a little hesitant.

#2. You have a solid payment history with them, but they do prefer to see balances paid down pretty quick.

#3. Your Experian Score is climbing and clearing some old baddies...that is definitely a positive.

What it comes down to is the individual card utilization. It might be a deal breaker or it might not. Only the Grand Amex Algorithm can say for sure.

Still, unlike other grantors, Amex has a tendency not to do a Hard Pull on denials for existing members. This is a huge benefit when considering an app just like this!

If you apply, I wish you the best of luck with an approval and an outstanding line of credit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Want to pull trigger on AMEX SPG, Advice

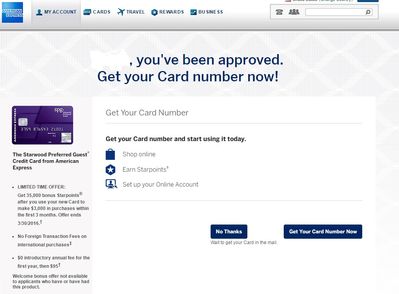

I was instantly approved. I gave in and submitted my app. $1,000 limit, I'll take it. Should receive card in 7-10 days.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Want to pull trigger on AMEX SPG, Advice

@SouthJamaica wrote:

@Outdoorstech1 wrote:I received my first Amex, BCED card Last March, with a $5k limit and was approved with a 672 FICO. I recently asked for a CLI on the card but was denied because apparently I asked once before within the past 90 day's and was denied because my balance on the card was $4,400 out of my $5k limit. IAs of today my balance is $3,800, and always paying every two weeks.

I really want to bite on the 35,000 bonus points on the SPG card before this month is over. Is that a tougher card to acquire?

I heard they usualy always pull Experian and my Experian MYFICO is currently at 721 and since last march I've have two collections come off my reports, and one baddie pay off. So I am wondering if I would be approved or not. I did try AMEX pre approval link but it could not put me with a card at this time. Is it possibly due to the high balance on my current AMEX card, will that affect me getting approved for the SPG card?

Any tips, insite, advice? Thanks guys!

You're not going to be approved, so don't do it.

HA!!

ok i am better now

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Want to pull trigger on AMEX SPG, Advice

LOL

I was nervous but I said screw it, itf it'll be a SP from AMEX if I'm not approved, so be it. But I was! -Insert HAPPY DANCE!!!- ![]()

![]()

This is my SECOND AMEX since rebuilding starting in the Summer of 2014. I started with a 615 ish score along with three horrible collections, four charge off's, two seperate accounts with 7+ latepayments, and a satisfied Judgement, which will still be on my report until 2019. Thanks to all the MYFICO members to help me rebuild and get these cards and the knowledge I've gaind is tremendous. I wish I knew what I know now when I was 18.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Want to pull trigger on AMEX SPG, Advice

@Outdoorstech1 wrote:LOL

I was nervous but I said screw it, itf it'll be a SP from AMEX if I'm not approved, so be it. But I was! -Insert HAPPY DANCE!!!-

This is my SECOND AMEX since rebuilding starting in the Summer of 2014. I started with a 615 ish score along with three horrible collections, four charge off's, two seperate accounts with 7+ latepayments, and a satisfied Judgement, which will still be on my report until 2019. Thanks to all the MYFICO members to help me rebuild and get these cards and the knowledge I've gaind is tremendous. I wish I knew what I know now when I was 18.

Congrats!! Here's your happy dance: