- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: chase freedom visa denied

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

chase freedom visa denied

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: chase freedom visa denied

How old is your credit history? Any baddies? Bankruptcy??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: chase freedom visa denied

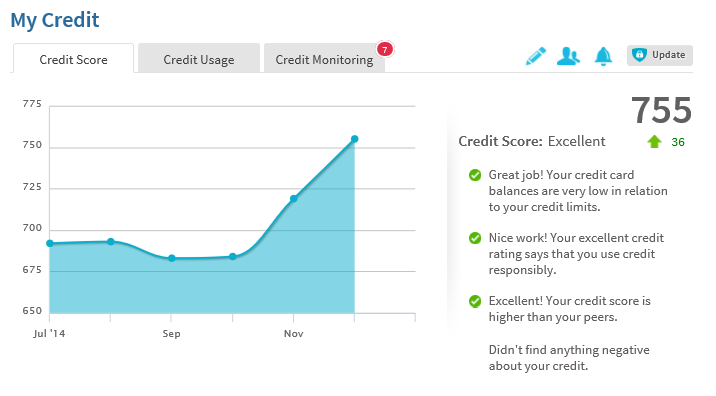

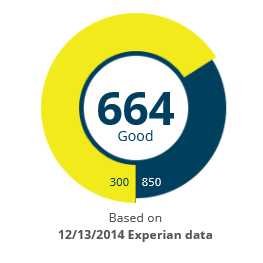

proof in black and white. I just pulled sesame and fico EX scores... here ya go!!! :]

I love this 755 EX score... ready for another AMEX. weeeeeeeeeeeeeeeeee

But unfortinately my FICO EX score is 91 points less. :[

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: chase freedom visa denied

@Anonymous wrote:

You can also get your reports for free once a year.

How old is your credit history? Any baddies? Bankruptcy??

No scores though, lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: chase freedom visa denied

Credit Sesame has me at 747 On Ex so it's actually pretty close. Now Credit Karma on the other hand has my TU score 90 points lower than it is. You can't rely on any of them. The monthly MyFico score watch is the way to go for us credit nuts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: chase freedom visa denied

Spot on. Chase pulled TU and EX for me last month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: chase freedom visa denied

You need to get some more TL's. Try Walmart etc... and do not apply at Chase again until you are pre approved at their site. Good Luck

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: chase freedom visa denied

Best option for your atleast my thoughts, just open checking and saving (both) if you have cash put in there some, wait for 2-3 days then check online pre-approve chase site, you should have a freedom card offer waiting or something. Sometimes it works sometimes it doesnt. This method worked for my partner but i cant say for others tho. Just my two cent!

Good luck ! that $200 offer for $500 spending is hard to pass lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: chase freedom visa denied

fredgyc wrote: My credit card score is like 730 and I only have one account open and one credit card by Bofa. I signed up for chase sapphire preferred and I was obviously denied (stupid move). Then waited 2 months and applied again for chase freedom visa and I was denied due to low credit history and only having one account open. I called the backdoor number 2x and still got denied. What should I do? I really want this card. Plzz help thank you!!!

If you called the back door number, you likely spoke to a Credit Analyst. These are the people who look at your file and actually make a decision. What did they say was the reason for you being denied?

When Chase denied me for a CLI, I spoke with an Analyst. We talked about my derogatory accounts and what the reasons were for denying me. She pointed out that I had a couple of new open accounts, not much other history with credit cards, and said that "Chase likes to see how you do with new credit before giving you more." She suggested I try again when these accounts had been open for six months or a year.

It sounded reasonable to me. So I waited until the six month mark and tried again. It worked; I got a sweet CLI! I used that advice as I continued to repair; resisting app sprees, and upgrading accounts rather than replacing them. It has worked in my favor; from 530 to over 800, from 300 in credit to fifty grand, in a few short years.

In my experience if the backdoor number tells you "no," listen to why you were denied, and wait to try again until you have fixed that issue, and learn from it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: chase freedom visa denied

Regarding scores; Chase already said no, so your actual score is moot. The recon reps care more about your history than the number anyway. You might get a denial letter in the mail showing your score that they used. If you are on a rebuild path, it makes sense to subscribe to a scoring service that shows all 3 so you can see your progress. If you have a score specific goal, like a loan that you know requires a certain score, definitely go with the FICO scores.

Aside from that, the most important thing is to show a history of using credit responsibly. That means pay on time, all the time. Get rid of any derogatory accounts, and manage utilization on your existing credit.