- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: pls help i am disapprove for any cc I apply

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

help chase disaproval

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: pls help i am disapprove for any cc I apply

i have no necessity of money in desperatations i make money to live my family and mine own life perfectly adequate;i regret not clarificating my situation when i request for assistance' so the meaning of poor fianancials i refer to was debt to assist my brother to support an small business, when he went in passing and myself was left with the multiple very large debt and am just a working class emigrant not moneied enough to pay these very large business debt. i never had the credit cards to use myself in the usa because i never need it when i can live on my own means and i never know business and personal credits can be the same for one person indivadally now am trying to buy one house and the mortgige financier tells me i need credit card of mine to personal use for a history and from there i was applied for hundred card none will accept ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: pls help i am disapprove for any cc I apply

@Anonymous wrote:i have no necessity of money in desperatations i make money to live my family and mine own life perfectly adequate;i regret not clarificating my situation when i request for assistance' so the meaning of poor fianancials i refer to was debt to assist my brother to support an small business, when he went in passing and myself was left with the multiple very large debt and am just a working class emigrant not moneied enough to pay these very large business debt. i never had the credit cards to use myself in the usa because i never need it when i can live on my own means and i never know business and personal credits can be the same for one person indivadally now am trying to buy one house and the mortgige financier tells me i need credit card of mine to personal use for a history and from there i was applied for hundred card none will accept

Here's a tip for the future; once you get denied for credit, do not submit any more applications until after you receive the reasons for the denials. Every inquiry you take is gonna hurt a bit for up to two years. How many applications have you submitted so far?

If I recall correctly, there's a card out that does not require any credit pull whatsover. I think it may be Credit One. Can anyone confirm?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: pls help i am disapprove for any cc I apply

@Anonymous wrote:i have no necessity of money in desperatations i make money to live my family and mine own life perfectly adequate;i regret not clarificating my situation when i request for assistance' so the meaning of poor fianancials i refer to was debt to assist my brother to support an small business, when he went in passing and myself was left with the multiple very large debt and am just a working class emigrant not moneied enough to pay these very large business debt. i never had the credit cards to use myself in the usa because i never need it when i can live on my own means and i never know business and personal credits can be the same for one person indivadally now am trying to buy one house and the mortgige financier tells me i need credit card of mine to personal use for a history and from there i was applied for hundred card none will accept

imi, I think you need to stop applying for cards that require hard pulls. They aren't helping you and no company is going to approve you with your score as low as it is currently. If I am to understand you correctly the reason your credit score is so low is because you got credit in your name for your brothers buisness. I believe you're saying that your bother passed away( I'm truly sorry for your loss) and you are no longer able to pay those buisness debts that were incurred with a personal gaurentee. So here's my question, can you pay off the debts? if you can't, you might want to look at talking to someone about bankrupcy. No mortgage company is going to give you a mortgage to buy a house with debts still owed.

If those bad debts from the buisness are paid off you can read up on the shopping drawer trick and or credit unions that will not do hard pulls on your credit report, but either way you'll need to build up your credit for a while before you will be mortgage ready but it is possible.

For those of you complaining about font = shouts if OP was hard of hearing would you be angry if he shouted? Would you refuse to help if he or she somehow offended you in other ways because she wasn't cappable of understanding ? OP obviously didn't know that some how bold blue fonts were offensive to you. Btw, it is not offensive to me. I happen to like it.Shame on you for missing the oportunity to help someone in need which is what this forum is supposed to be about.

Mods I'm sorry if this gets me in trouble, but I had to say it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: help chase disaproval

1. Stop applying, each time you apply is another hit to your credit report.

2. Work on the bad things on your credit report, research how credit works. Learn it. You can get your free credit report from annualcreditreport.com or something like that.

3. No one is going to approve an unsecured card with scores so low. Something is hurting your score, it could be collections, missed payments, high debt...etc. try to work on removing those. The rebuilding credit forum is great for that advice.

4. Possibly get a secured credit card where you put a deposit down. There are great lenders out there. Avoid creditone and first premier. I suggest for secured: Wells Fargo, Discover, Citi, and last resort Capital one. Last resort because it doesn't unsecure with them.

5. After some time your scores will improve. It will take a while to have scores and report ready for a mortgage.

Cap1 QS - 2k (4/21)

Mission Lane - 4k (11/21)

Venmo - 900 (11/21)

SavorOne - 2500 (12/21)

VentureOne - 2000 (7/22)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: pls help i am disapprove for any cc I apply

For those of you complaining about font = shouts if OP was hard of hearing would you be angry if he shouted? Would you refuse to help if he or she somehow offended you in other ways because she wasn't cappable of understanding ? OP obviously didn't know that some how bold blue fonts were offensive to you.

It wasn't the OP using the large blue font.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: help chase disaproval

@Anonymous wrote:

why you play I am serious want credit from the chase bank.

I may have had too many beers but I am laughing so freaking hard right now hahahahaha oh my soul.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: pls help i am disapprove for any cc I apply

@ddemari wrote:

Op you need to get a secured credit card. We all have to start somewhere, you need to start at the bottom and work your way up. Luckily 24 months of positive payment/ credit activity can do wonders to a tarnished past. Consider a secured card and stop applying for everything lol.

+1,

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: pls help i am disapprove for any cc I apply

@Anonymous wrote:

@NRB525 wrote:

@Anonymous wrote:

@NRB525 wrote:

@Anonymous wrote:

little backstory i move here from Israel some years ago never need credit barrow but am lately in poor finances due on family happenings,

i go to start for apply on many different banks chase citi capatal one even premiere first bank and all are disapprovel come back with low score on letter from 390 to 465 any suggestives?You can look into joining the State Department Federal Credit Union, SDFCU. They allow you to create a membership with an affiliation, you pay a small fee to the affiliate to become a member of that organization, and then you can join SDFCU.

Once you are a member of SDFCU, you can open a Savings account.

SDFCU also has a Secured Credit Card that has no credit check involved at all. There is no review of your credit file. What you do is, you deposit at least $250 into your SDFCU savings account, then as part of the Secured Credit Card application, you agree to use that $250 (or more, I think you can have something like $2,000) in your savings account as the security for the card. SDFCU then has you electronically sign various forms, agreeing to using the savings as security, applying for the card, etc.

This approval process should be able to complete, as long as you have some sort of US tax identification, such social security number.

Once you get the secured credit card, it works at merchants just like any other credit card, up to the security limit you have. I think you can add to your savings account, to increase the limit later, if you want to. The card reports on your credit report as a credit card, helping to build payment history.

You should also get a copy of your credit report, to see what might be causing your scores to be so low.

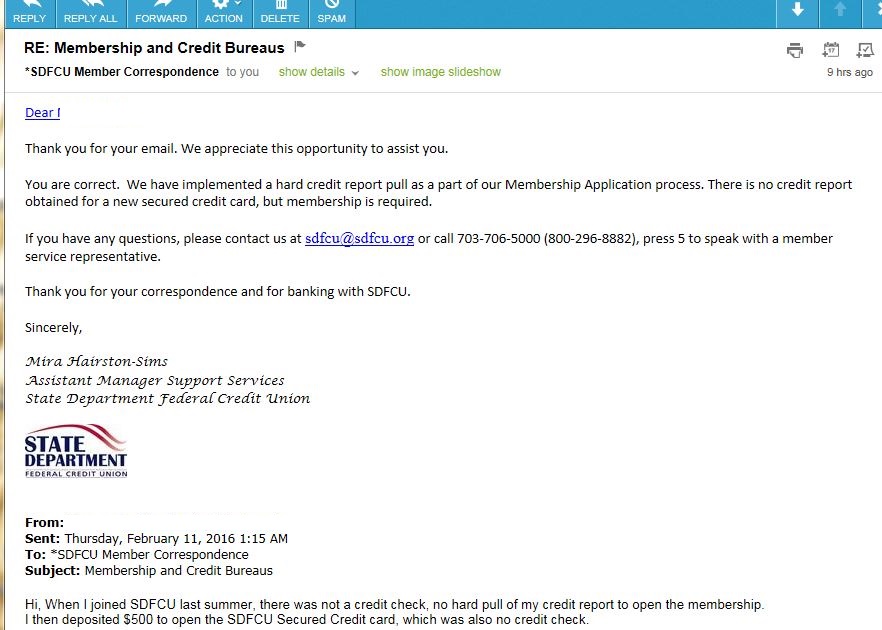

Reports on this forum indicate SDFCU now hard pulls for the secured card, and maybe for membership, also.

I would be quite interested to see specific evidence of this, given that my direct experience in getting that SDFCU Secured card was no HP, and that their website still clearly states no credit check.

Been quite a few people reporting that they now use an HP for membership whick afaik is required to apply for the secured card.

Ok, yes, it has changed. I sent an email question and got confirmation that the membership now incurs a HP.

Hopefully that HP is not a gate, only an identity verification step.

The Secured CC still is no credit check.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765