- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Re: Capital One CLI Is This Normal?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Capital One CLI Is This Normal?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI Is This Normal?

@baller4life wrote:

HOLY MOTHER OF....... If Cap One gave me that kinda of limit I might consider friending them again.CONGRATULATIONS!!!

Think that is something?

Imagine if OP gets another and has 2 of them ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI Is This Normal?

Holy crap! I'm headed off to hit the CLI button!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI Is This Normal?

Okay, it isn't a glitch. I got my usual denial. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI Is This Normal?

dam!!!! lol I'll try for the increase when I get mine. hopefully my $20k will jump to $60k also ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI Is This Normal?

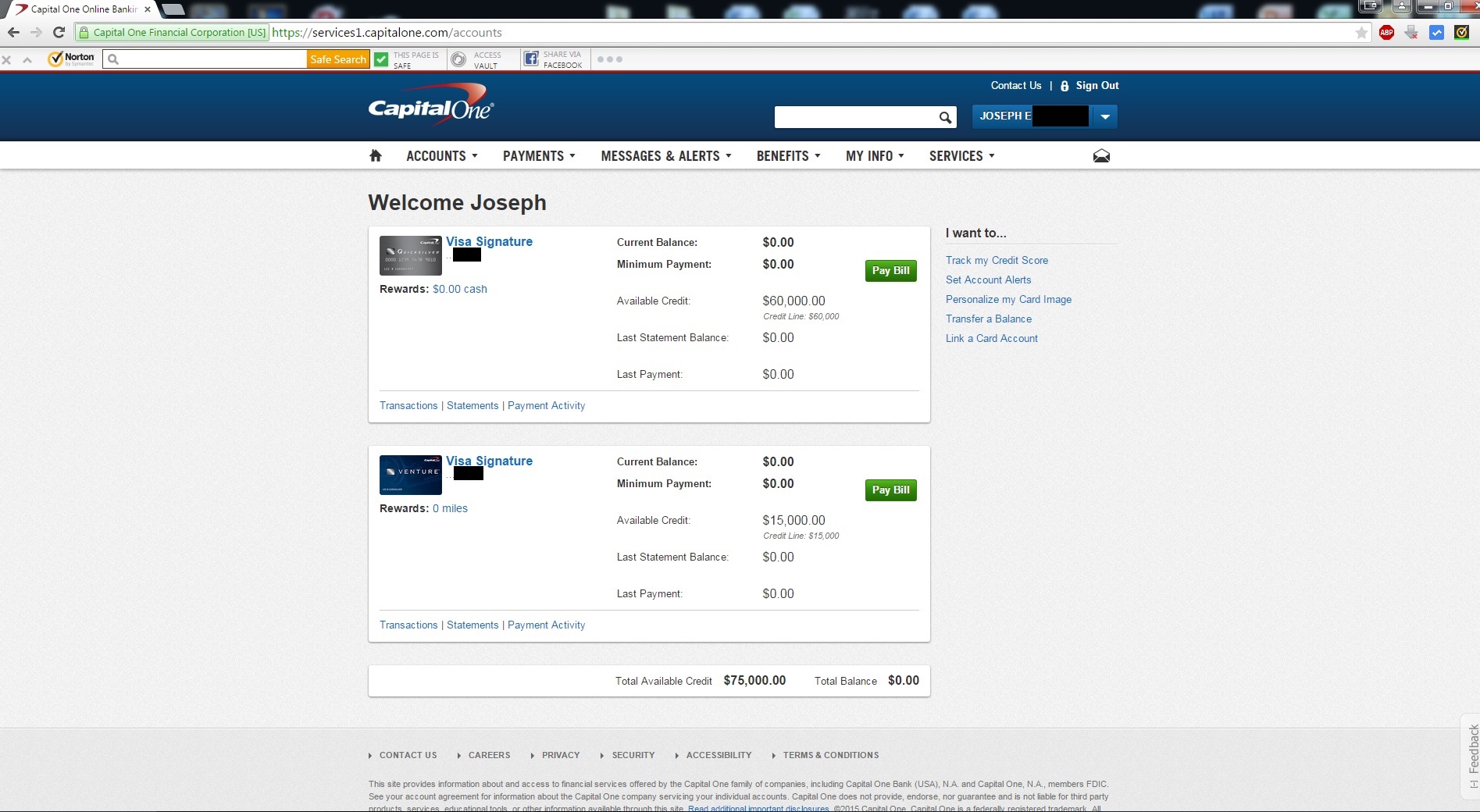

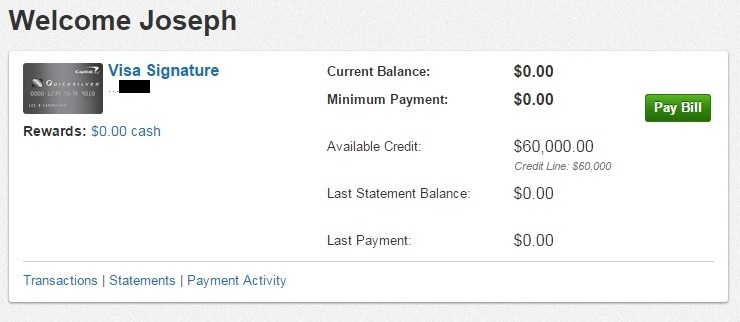

@Mutterz wrote:I posted on here a few days ago when I was approved for a Capital One Quick Silver Signature S20,000 Limit and Venture Signature $15,000 Limit about five minutes apart.

Found the original link: http://ficoforums.myfico.com/t5/Credit-Card-Approvals/Two-Capital-One-Card-Approvals-One-Day/m-p/402...

Anyways I was setting up things like text alerts and email alerts. Making sure my phone number was right and all that. Then I see the request credit increase. Knowing it’s a new account I thought I should probably not do this but filled out the info anyways for the Quicksilver card. I was asking what my income was and how much I would be charging a month. It was blank so I figured they did not have my income on file so I filled it all out then clicked the continue button thinking it would then ask me to confirm after having the info on file. It then said we will review your request or something like that. That was around 10am this morning. I just logged into my account just 10-20 minutes ago and this is what I see on my Quick Silver card.

It looks like it has increased the Quick Silver limit from $20,000 to $60,000?!?! I have no idea if it was automatically increased or if they did a manual review after the request. But my main question is how did this happen? I have never heard of a limit like this let alone with my others just being the secured cards I started with at 18. Could it possibly be a mistake?

Wow thats amazing,,,, congrats on you BIG FAT $60k ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI Is This Normal?

@Mutterz wrote:I posted on here a few days ago when I was approved for a Capital One Quick Silver Signature S20,000 Limit and Venture Signature $15,000 Limit about five minutes apart.

Found the original link: http://ficoforums.myfico.com/t5/Credit-Card-Approvals/Two-Capital-One-Card-Approvals-One-Day/m-p/402...

Anyways I was setting up things like text alerts and email alerts. Making sure my phone number was right and all that. Then I see the request credit increase. Knowing it’s a new account I thought I should probably not do this but filled out the info anyways for the Quicksilver card. I was asking what my income was and how much I would be charging a month. It was blank so I figured they did not have my income on file so I filled it all out then clicked the continue button thinking it would then ask me to confirm after having the info on file. It then said we will review your request or something like that. That was around 10am this morning. I just logged into my account just 10-20 minutes ago and this is what I see on my Quick Silver card.

It looks like it has increased the Quick Silver limit from $20,000 to $60,000?!?! I have no idea if it was automatically increased or if they did a manual review after the request. But my main question is how did this happen? I have never heard of a limit like this let alone with my others just being the secured cards I started with at 18. Could it possibly be a mistake?

Wow thats very interesting.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI Is This Normal?

@ojefferyo wrote:dam!!!! lol I'll try for the increase when I get mine. hopefully my $20k will jump to $60k also

I'm counting the days right now! ![]() Have until August. Also going to for the 2 month cli for Venture soon. I doubt I'll get anything like that since I have 2 Venture's at 20k each.

Have until August. Also going to for the 2 month cli for Venture soon. I doubt I'll get anything like that since I have 2 Venture's at 20k each.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI Is This Normal?

WOW. Congratulations... Maybe now we'll stop hearing the references to "Crap One". In my view, at this stage CapOne is on my prime list! I love that they're really genuinely covering the full spectrum now. As a consumer it's nice to now be able to stick with the company for the long haul that gives so many people a start or the opportunity to get their credit on the right track. Congratulations again and thanks for sharing!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI Is This Normal?

I have to Edit My reply .. And Just Say . A "BIG CONTRATS , GREAT JOB" .. From Crap#$ I mean Cap1. they screwd up so bad with my Accounts i dont think I'll ever get beyond the toy limit they set. everytime I apply for anythingwith Crap1 i get denied. I have to contact the Exc office everytime to find why . and come back with nothing.I tell them why dont you check into the fraud departement.and talk to your fraud rep that tpold me dont worry about the $10 balance. owed because we closed your account after 5 yrs by mistake and wrote it off as Fruadulant account and erase that account like it never exist,.and the $10 balance the Fraud Rep mention Don't worry about that.we will take care of that for you .. they did, sent it to collection .. so everytime i apply on line Instantly denial.for any product of Crap !

But someday I will hit that luv button and someday I will be saying I love you Capital one.. thank you thank . you finally notice me.. and then I woke up. LOL

Again Assume CL .. HUGE ., CONGRATS . muttiez

,10 yrs history,1.6 yr AA Cap1 Plat,VentureOne,QS ,Barckey RCI, BBVA,Amex BCE,CSP,NFCU Flag, NFCU Go,NFCU,Cloc NFCU busin,NFCU busin Cloc,Amex Delta busn,Bj's busn Perks,Hawaiian air busin, Citi dc, Discover IT,Chase Hyatt,U.S bank flex perks.,Am,ex Business Plat JCP. Commercial, citi Hilton

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI Is This Normal?

It's not unusual to see one offs where Crap One will decide to treat someone right even on QS. It doesn't change their overwhelming lean towards the sub-prime market. I hit the luv button regularly and get the standard "&^$% off" response. every. single. time.