- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Citi Double Cash Credit Limit INCREASE

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Citi Double Cash Credit Limit INCREASE

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Credit Limit INCREASE

no i dont see anything like that

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Credit Limit INCREASE

Enter income and submit?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Credit Limit INCREASE

Got my card with a $2,400 Credit Line ... Scores are all in the 730's .... requested CLI after I got the card and got denied.

Makes ZERO sense ... this card has become basically pointles now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Credit Limit INCREASE

@Anonymous wrote:Got my card with a $2,400 Credit Line ... Scores are all in the 730's .... requested CLI after I got the card and got denied.

Makes ZERO sense ... this card has become basically pointles now.

denial reasons?

you have other citi cards?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Credit Limit INCREASE

‘’It’s easy to find out if you quality for a credit limit increase. A credit bureau report will not be requested and you will receive an instant decision.’’

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Credit Limit INCREASE

@DoroLucky wrote:

Hmmmm I'm so tempted to apply for a Citi card....which CR do they pull? Please say EX LOL

EX

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Credit Limit INCREASE

WOW, Congratulations!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Credit Limit INCREASE

Pay it off daily.

@Anonymous wrote:Got my card with a $2,400 Credit Line ... Scores are all in the 730's .... requested CLI after I got the card and got denied.

Makes ZERO sense ... this card has become basically pointles now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Credit Limit INCREASE

@Anonymous wrote:‘’It’s easy to find out if you quality for a credit limit increase. A credit bureau report will not be requested and you will receive an instant decision.’’

that is one HEFTY limit. Congrats! Could you please briefly describe how long you had the card and touch on what your spend was like with it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Credit Limit INCREASE

@Anonymous wrote:

@Anonymous wrote:‘’It’s easy to find out if you quality for a credit limit increase. A credit bureau report will not be requested and you will receive an instant decision.’’

that is one HEFTY limit. Congrats! Could you please briefly describe how long you had the card and touch on what your spend was like with it?

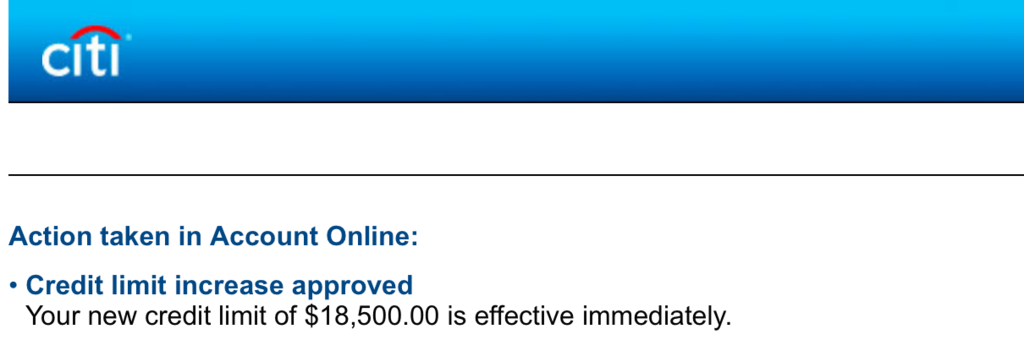

When I applied for Citi Double cash they gave me a disappointing $2,700 credit limit. I requested a credit limit increase immediately when I received my card that result me another hard inquiry on my credit report and was approved $15,000 (wished i requested more lol).

I rarely use it except for black friday so i could get the $200 bonus. Carried a balance over christmas. Still $4,000 6 months later however in 6 months you can request a credit limit increase online and 1 of the following message will pop up...

‘’It’s easy to find out if you quality for a credit limit increase. A credit bureau report will not be requested and you will receive an instant decision.’’

SOFT PULL

Or..

‘’It’s easy to find out if you qualify you a credit limit increase. By clicking ‘’continue’’ you understand that we will obtain a credit bureau report to evaluate your request. Our credit department will review your request within 24 hours.’'

HARD PULL

Citi gave me a soft pull credit limit increase from $15,000 to $18,500 after having the card for 6 months. Depending on any changes that has been made to your credit report during the last 6 months having your card... you're able to recieve a soft pull credit limit increase on all of your citi accounts every 6 months.