- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- DCU Visa approval

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

DCU Visa approval

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

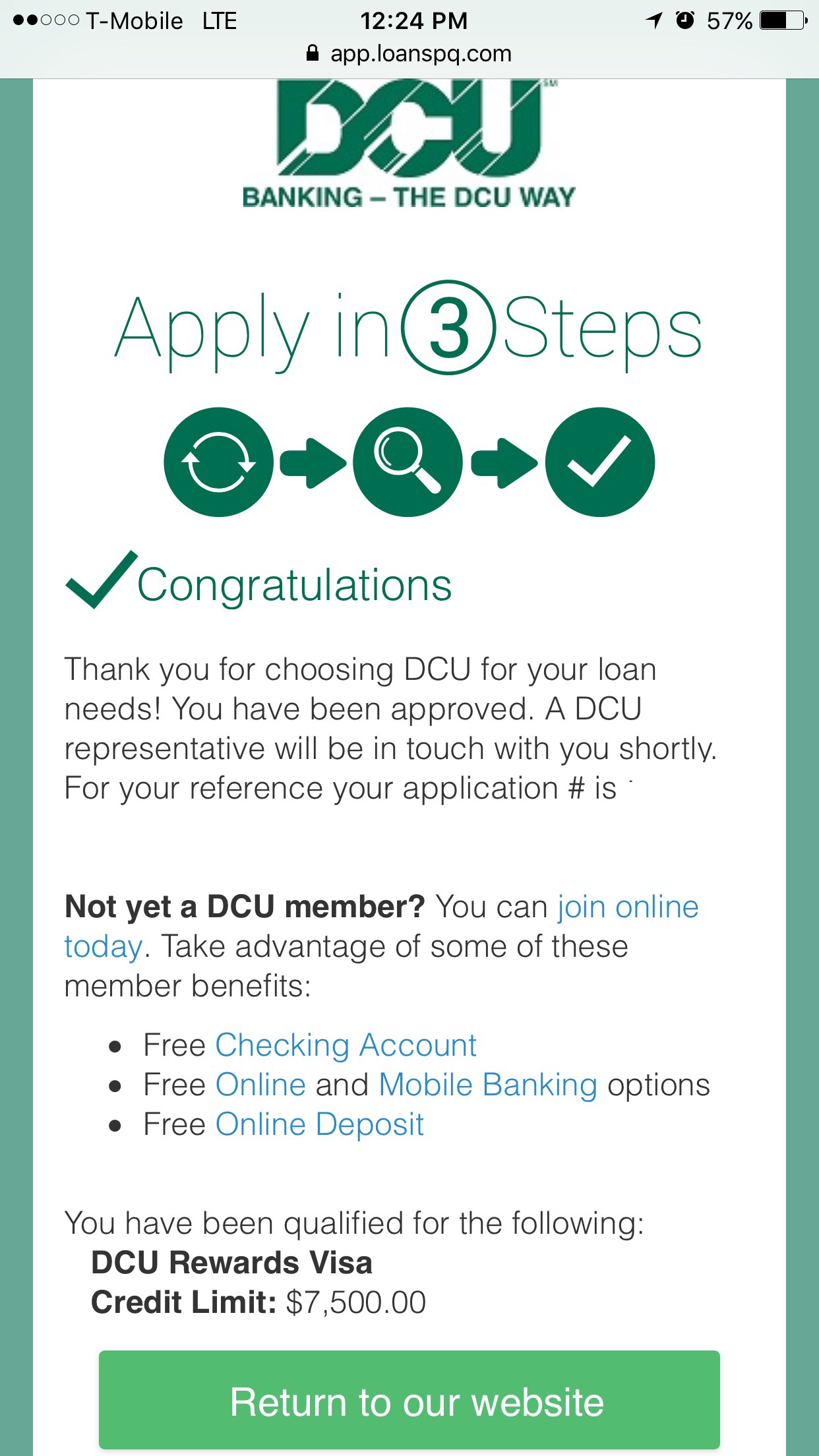

DCU Visa approval

I was feeling bored at work today.. decided to app for a DCU card, since I don't have anything from them... Pulled Eq, my lowest score @663 - approved! Is this a decent SL from them ? With this approval, I am going to send a few of my lower limit cards to the shredder - my CapOne QS1 ($2k), Merrick ($1200 that would double next month), and a few others... Just trying to get into some higher CL cards, and get rid of the crap!

Total CL $398600, plus car and RV loan.

Ooh. Ooh. Getting closer to that $500K mark!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Visa approval

Congrats! Looks good to me. They show my FICO EQF at 645 and I got declined so you got the magic touch. And please, chant my name as you shred Crapital One.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Visa approval

Congrats OP, it's a great CU IMO, my scores are higher than yours and I was approved with a $5k SL which has yearly gone to $10k, then $15k. I also have two car loans with DCU at 1.49% and 1.74% .

Best thing with that card is the ability to give yourself a short term "payday" loan with no up front fee or extra APR - I use it all the time on the road when I need cash.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Visa approval

I would say DCU can be conservative and this is a great SL and a great limit in general for them..

Only thing id do different is let the Merrick double in the sock drawer.... then cancel it...

Have you tried for a CLI on the Cap One? ... Just like the idea of both the merrick and Capone leaving with a CLI reporting on the report...(soft pulls only, of course)... Ditch them after the increases if there are any... (as long as theres no fee/af due)

Think a congrats is in order....

DCU is big around where I live... Then again. they originally were the DEC Credit Union.... Yes their history is with the computer company.... (Digital Equipment Corp) which is no longer...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Visa approval

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Visa approval

Congratulations on the nice approval!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Visa approval

@pipeguy wrote:Congrats OP, it's a great CU IMO, my scores are higher than yours and I was approved with a $5k SL which has yearly gone to $10k, then $15k. I also have two car loans with DCU at 1.49% and 1.74% .

Best thing with that card is the ability to give yourself a short term "payday" loan with no up front fee or extra APR - I use it all the time on the road when I need cash.

Pipe: iv heard of doing this.. is this because the DCU has no fee CAs, or is it someway else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Visa approval

@joltdude wrote:

@pipeguy wrote:Congrats OP, it's a great CU IMO, my scores are higher than yours and I was approved with a $5k SL which has yearly gone to $10k, then $15k. I also have two car loans with DCU at 1.49% and 1.74% .

Best thing with that card is the ability to give yourself a short term "payday" loan with no up front fee or extra APR - I use it all the time on the road when I need cash.

Pipe: iv heard of doing this.. is this because the DCU has no fee CAs, or is it someway else?

It's one of the "features" - you just transfer from your card to your checking account OR take a cash advance from an ATM (be careful on ATM fees, but they'll refund I think its up to $5 a month on ATM fees too). There is no limit transferring from the card to checking online, but ATM cash advances are limited to a daily limit - not sure exactly what it is, but I've taken $900 in cash on the road a couple of times with no problem.

There is no grace period for paying interest, which is your regular card APR, but for a 5-7-10 day loan to yourself it's a great benefit IMO. Of course if you abuse this you can run your card up real fast if you don't think of it as a short term loan say less than 2 weeks tops, but as an option for quick cash - think antique shopping, flea markets, collectible auctions like coins, stamps, pens, etc where cash is king you can't beat it unless you want to carry $2-3 thousand in cash you may not need or use.

To be fair my CFCU card also offers this option, but the APR is higher than my DCU card - I've been known to spend a couple of grand on antiques/collectibles when I know I'm getting a great deal (a lot of times I resold quickly for a profit).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Visa approval

Congrats on your approval!!

They do use Fico4 scores, so may be a little different. That is a good SL from DCU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content