- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- DW Huntington Voice

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

DW Huntington Voice

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DW Huntington Voice

@Anonymous wrote:

@bigpoppa09 wrote:I looked at this card but i see u have to be in there foot print.

According to their twitter, it is nationwide. When I made a post here, people said the footprint was an issue. Then on Doctor of Credit, the editor got in touch with me and said it is nationwide. So I think it is YMMV. Many people have said that if the foot print is an issue, they don't HP. So it doesn't hurt.

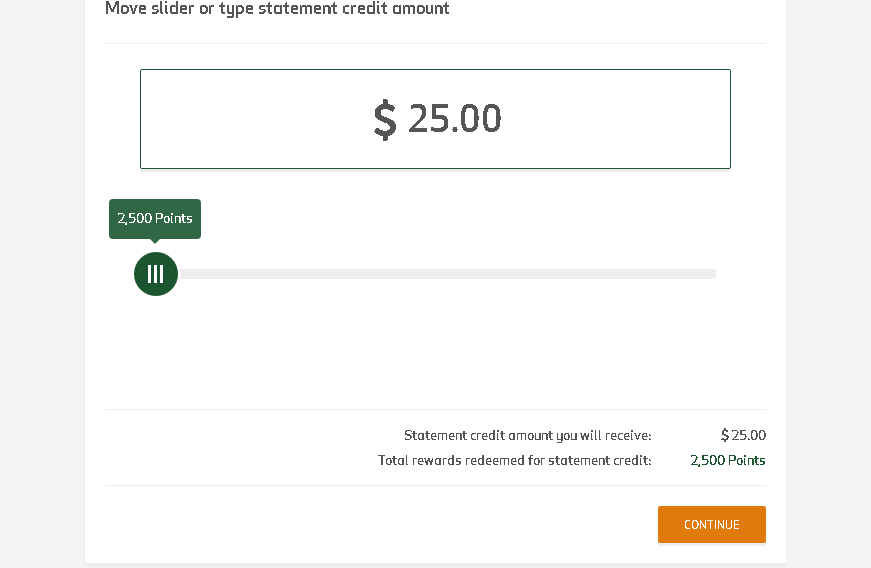

Problem for me is the 3% in one category (capped at $2000 a quarter) and 1% in the others. If this was like Capital One with no min redemption, I'd apply (of course I'd want the $100-200 signup bonus). But their T+C says it has a min redmeption of 2500 points for $25. Doctor of Credit does say it has no min redemption for statement credit, so if I'm wrong, please let me know.

Thank u for this info.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DW Huntington Voice

@bigpoppa09 wrote:

@Anonymous wrote:

@bigpoppa09 wrote:I looked at this card but i see u have to be in there foot print.

According to their twitter, it is nationwide. When I made a post here, people said the footprint was an issue. Then on Doctor of Credit, the editor got in touch with me and said it is nationwide. So I think it is YMMV. Many people have said that if the foot print is an issue, they don't HP. So it doesn't hurt.

Problem for me is the 3% in one category (capped at $2000 a quarter) and 1% in the others. If this was like Capital One with no min redemption, I'd apply (of course I'd want the $100-200 signup bonus). But their T+C says it has a min redmeption of 2500 points for $25. Doctor of Credit does say it has no min redemption for statement credit, so if I'm wrong, please let me know.

Thank u for this info.

You are welcome. If you apply and get in, make a post for the rest of us. And again, if anyone knows of statement credits having no min, please post.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DW Huntington Voice

@JamP wrote:Hit them while they are hot...

DW Received a Mailer in the mail for 18.74% Rewards and 15.75% low interest card.

$100 welcome bonus after $500 spend in 60 days and 0% Balance transfer for 12 months if made within the first 90 days.

Congratulations!

Your Voice Credit Card application has been Approved!

You will receive your credit card in 5-7 business days. It will be mailed to the address you supplied during the application process. If you have questions please call 1-800-480-2265.

Credit Line: $12000Your Annual Percentage Rate (APR) for Purchases: 18.74%

This rate may vary with the market based on the Prime Rate. See your Account Opening disclosures that enclosed with your card package for additional details, including all interest rates and fees.

Her largest CL by far. Setup Rewards for Walmart so I can take some spend off mine.

Weird thing is she cannot get approved for a BCE based on her credit score they have of 652.

Congrats OP. You have to wait 90 days in between applications (rather approved or not). I have 3 Voice cards all at 12k each.

___________ 12Njoy

FICO - EX 810; EQ 797; TU 804 I'm climbing back to 800+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DW Huntington Voice

@Anonymous wrote:

@bigpoppa09 wrote:

@Anonymous wrote:

@bigpoppa09 wrote:I looked at this card but i see u have to be in there foot print.

According to their twitter, it is nationwide. When I made a post here, people said the footprint was an issue. Then on Doctor of Credit, the editor got in touch with me and said it is nationwide. So I think it is YMMV. Many people have said that if the foot print is an issue, they don't HP. So it doesn't hurt.

Problem for me is the 3% in one category (capped at $2000 a quarter) and 1% in the others. If this was like Capital One with no min redemption, I'd apply (of course I'd want the $100-200 signup bonus). But their T+C says it has a min redmeption of 2500 points for $25. Doctor of Credit does say it has no min redemption for statement credit, so if I'm wrong, please let me know.

Thank u for this info.

You are welcome. If you apply and get in, make a post for the rest of us. And again, if anyone knows of statement credits having no min, please post.

If i app i will post here does anyone no who they pull do they use Fico 08?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DW Huntington Voice

@bigpoppa09 wrote:

@Anonymous wrote:

@bigpoppa09 wrote:

@Anonymous wrote:

@bigpoppa09 wrote:I looked at this card but i see u have to be in there foot print.

According to their twitter, it is nationwide. When I made a post here, people said the footprint was an issue. Then on Doctor of Credit, the editor got in touch with me and said it is nationwide. So I think it is YMMV. Many people have said that if the foot print is an issue, they don't HP. So it doesn't hurt.

Problem for me is the 3% in one category (capped at $2000 a quarter) and 1% in the others. If this was like Capital One with no min redemption, I'd apply (of course I'd want the $100-200 signup bonus). But their T+C says it has a min redmeption of 2500 points for $25. Doctor of Credit does say it has no min redemption for statement credit, so if I'm wrong, please let me know.

Thank u for this info.

You are welcome. If you apply and get in, make a post for the rest of us. And again, if anyone knows of statement credits having no min, please post.

If i app i will post here does anyone no who they pull do they use Fico 08?

Equifax exclusively from what I hear.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DW Huntington Voice

It definitely starts at 2500 points and goes up by 500 points so yes $25 is the min .

@Anonymous wrote:

@bigpoppa09 wrote:I looked at this card but i see u have to be in there foot print.

According to their twitter, it is nationwide. When I made a post here, people said the footprint was an issue. Then on Doctor of Credit, the editor got in touch with me and said it is nationwide. So I think it is YMMV. Many people have said that if the foot print is an issue, they don't HP. So it doesn't hurt.

Problem for me is the 3% in one category (capped at $2000 a quarter) and 1% in the others. If this was like Capital One with no min redemption, I'd apply (of course I'd want the $100-200 signup bonus). But their T+C says it has a min redmeption of 2500 points for $25. Doctor of Credit does say it has no min redemption for statement credit, so if I'm wrong, please let me know.