- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Re: Discover Secured Approval

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Discover Secured Approval

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Discover Secured Approval

Hey Yall,

After filing my 2nd BK (First one comes off Nov 2018), my current BK from 2017 is already discharged back in April.

Since it was discharged I took the lead in cleaning up my reports and making sure everything was reporting at ZERO with no balances.

The only new debt / loan I have since my new BK is a car loan at ~12% with a local bank here in Houston that I got in May.

Well, Today I took the leap and wanted a credit card to help my rebuild. I wanted to start with a secured card since CAP 1 Said NO to both regular and the secured card for having too many Inq and the BK. ![]()

So, I applied for a Discover IT Card (Secured) since it seemed like the best one available. I was approved today with the $200 deposit. The rep at Discover said they pulled Equifax which I'm currently at: 547 as of today.

I am so happy about the approval. I almost cried. I'm in a place where I don't want to make the same mistakes a 3rd time and I feel like the $200 limit will help with that.

Does anybody have suggestions on how to use the card correctly? I was thinking of just putting on autpay my Netflix, and cell phone. (Both of those would be around $150 total) a month on auto pay. Is that too much to charge to the account?

Is this a good idea? Anything else I should do....

Thanks for everybody's help!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured Approval

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured Approval

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured Approval

Thank you for everyone's reply.... Sorry for my delay. Work has been super busy lately ..... but thats a good thing ![]()

AverageJoe.... I do have one question.

Should I charge my netflix and cell phone bill to the Discover card and then wait for the bill to post online before I pay? Or should I pay before the bill posts so it shows a zero balance when the bill generates. I'm a tad confused. ![]()

Thanks ! -

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured Approval

Congratulations on your new card! Enjoy ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured Approval

Major Congrat-Great Get!!! I was just approved for a

Disocver IT card after 7 tries!!! I would have started

my Credit re-build back in late-2013 with this EXACT CARD

with no Annual fee if such a card had existed at the time!!!

My SCL is only $500 too!!! Treat it right and it will GROW!!! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured Approval

IMO I'd much prefer the only usage be the Netflix charge as the utilization% in relation to the $200 CL gives a much safer move for error.

There are so many issues with folks timing their payments properly after running the balance up, then paying BEFORE the cut date but then wanting to show a low utilization rate of some sort.

So why not KISS keep it simple

Allow the Netflix charge to report vs the CL then pay it off the day after cut/report day = Never a problem, confusion or misunderstanding about how much to spend or what date to pay etc

The only purpose of the 'toy' card is to show on-time payments and beautiful utilization rates, as the profile ages...so allow it to do just that a d only that

No need to chance a hiccup, playing Russian Roulette with a $200 CL card otherwise, again IMO keep it incredibly simple.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured Approval

I agree with Gemini. Keep it simple. Let the Netflix post . Once your statement cuts you can make your payment. So long as you pay before your due date youll be fine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured Approval

@AverageJoesCredit wrote:

Hi makingitright.

I agree with Gemini. Keep it simple. Let the Netflix post . Once your statement cuts you can make your payment. So long as you pay before your due date youll be fine.

Thank you AverageJoe & Gemini, and everybody else for the congrats.... It really means a lot getting a Discover Card even being with a $200 Sec. Card.

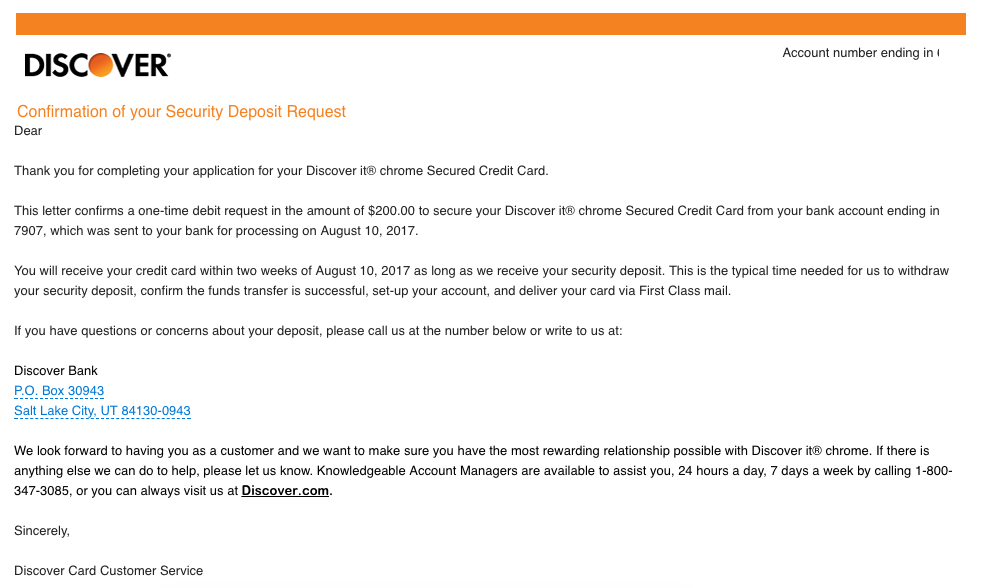

I just got the attached email from Discover today about them taking out my security deposit from my checking account. I have a question because it says in the top right corner account ending in xxxx with 4 digits. Does that mean I already have an account / card # made? Is it possible to receive the card quicker than 2 weeks?

Was also wondering when I should see the new account on myFico and receive an alert from them. I just got today the alert from FICO about the inquiry from Discover.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured Approval

Congratulations!

Yes, they have probably already assigned you an account number they are just waiting for the deposit to clear before mailing the card out.

You can always call Discover and ask them if it is possible to get the card sooner.

Discover is awesome to deal with. I had to talk to the fraud department twice this week and they were really nice. (Was because I have recently got my second discover card).