- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Fidelity Visa Disappointment w/ Data Points

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Fidelity Visa Disappointment w/ Data Points

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fidelity Visa Disappointment w/ Data Points

I might recon and see what they say, perhaps get more insight into the low $1K limit. Also, I may just use it to get the $100 bonus and then cancel sometime after that. I would NEVER have applied for the Fidelity card had I seen the advert for the new Penfed card. Live and learn!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fidelity Visa Disappointment w/ Data Points

BoA has their 99/500 card and I guess Fidelity has a 25k/1k card

>5/2023 All 3 reports 840ish (F8) F9s = 850 but my app finger is still twitching

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fidelity Visa Disappointment w/ Data Points

I would recommend calling customer service to confirm what your actual CL is going to be. Here is the reason why I say this.....

I applied for this same card on February 7th 2017. I received an email with an offer... spend $500 and receive a $75 bonus. I also received the 7-10 day message after applying. A few days later I logged into my Fidelity account and saw the Visa Signature card in my list of accounts. It showed that my CL was $1.2k. I was a bit annoyed and was kicking myself for even applying.

A few days later I received the card in the mail and my CL was actually $4.2k. The $1.2k that I saw online was my"available credit". I totally forgot that when I applied for the card I requested a balance transfer (they were offering 0% APR on balance transfers). They reduced my available credit by the amount of the balance transfer plus the fee. All of my other credit accounts distinguish between the actual CL vs the available credit. When I log into my Fidelity account it does not which is why I thought MY CL was only $1.2k.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fidelity Visa Disappointment w/ Data Points

In another thread, you stated that you received a $3k SL on your new Power Cash and then transferred $9k from another PenFed card. That is NOT a $12k SL - that is a $3k SL. I'm not going to try to tell you what to do but the rule of thumb I have seen on this board is that if your approvals are decreasing and not increasing or remaining the same, then it may be time to slow down on the applications.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fidelity Visa Disappointment w/ Data Points

@Anonymous wrote:In another thread, you stated that you received a $3k SL on your new Power Cash and then transferred $9k from another PenFed card. That is NOT a $12k SL - that is a $3k SL. I'm not going to try to tell you what to do but the rule of thumb I have seen on this board is that if your approvals are decreasing and not increasing or remaining the same, then it may be time to slow down on the applications.

Very valid point

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fidelity Visa Disappointment w/ Data Points

Thanks for correcting that. Did not mean to mislead. FWIW, the last CC I applied for was last June. I have a total of 7 cards (including the Fidelity which i have not received yet). Total of 6 hard Pulls - 2 with each bureau. So I am not a mega apper like a lot of folks here. After this I will not be applying for anything for a long time... I really just wanted a 2% card and screwed up. Had I been aware of the penfed i would have just applied for that. But I think the outcome of 3K would have been the same.

I am also curious as to the lowering starting lines. I have great scores. Low amount of HPs. No big debt. I have a paid off mortgage, no car payment. I have a small HELOC with a modest balance kept mainly as a tax deduction. My annual income is 53k.... My credit use runs from 1to 2%... so not sure what the deal is? Again, no big deal since I will be gardening for a while.

Edited due to problems typing on my mobile. Sorry guys.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fidelity Visa Disappointment w/ Data Points

7 cards with Fidelity? If you haven't omitted anything and all the other data points are still current then I would wonder if you're reaching exposure limits with Fidelity. PenFed is normally generous but have been known to decline for "pyramid debt structure". While not declined they seemed to be very cautious with you on that app. I support the gardening idea as well. After building some history I can't see PenFed, at least, be more than generous with your credit profile.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fidelity Visa Disappointment w/ Data Points

OMG NO, NOT 7 cards with fidelity. This is what happens when you try typing on your phone. I will edit that now.

I have 7 cards in TOTAL. Period.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fidelity Visa Disappointment w/ Data Points

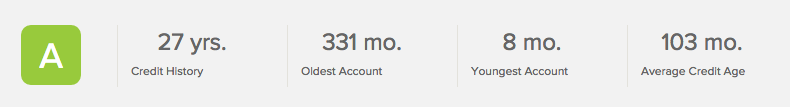

As for history. I have history.

TBH, they may not like me because I typically PIF and do not see me as profitable. Who knows.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fidelity Visa Disappointment w/ Data Points

Update, the card came in mail yesterday. 5 days after I applied. I can confirm the SL is $1000. I called to verify the spending bonus of $1k/$100 so I plan to use it for that period, perhaps hang on to it a few months and cancel. Figure $100 is worth the headache and TU pull. LOL. Also I am not all that impressed with the Fidelity Web Portal and how it opens pop up windows to the Elan site. Also cannot seem to get it to work on my Personal Capital account, I will keep trying though. I will have the spend bonus done in less than a month and I will move to break in my PenFed Power card.