- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- First ever amex prequal, should I do it? - Update:...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

First ever amex prequal, should I do it? - Update: Approved

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

First ever amex prequal, should I do it? - Update: Approved

Hello to all you fair myfico denizens out there ![]() , I'm in need of a little advice here

, I'm in need of a little advice here ![]()

Some of you may already have seen some of this back story so feel free to skip ahead to the data points ![]()

I've been doing the prequal circuit for a couple months now, didn't get any hits at all till I had 6 months of history under my belt - and thus a fico score (which was only about a month ago), and once i did it was only for capital one platinum and QS1. Then a maybe week or two later i got 3 prequals from us bank for some very appealing cards that I figured were well out of my reach, all with single APRs (the highest available - which did make them seem a little more legitimate to me). I kept my composure and didn't pounce on them, and right around the same time I had a fraudulent transaction on my discover card prompting them to issue a new card and account number - which in turn caused the original account to drop off my CRs thus tanking my scores (my vantage scores, I didn't see my FICOs between then and now and my score remains the same with the same accounts and util - my discover is my AZEO balance reporting card - so I'm thinking everything is sorted out, vantage scores rebounded as well however for some odd reason they're still not showing the discover card, it reports around the 12th or so though so I'll see what happens a few days later, I think there's just some kind of weird lag going on - I highly doubt 1 inq aging past 6 months would cause a 25 point jump lol but I guess you never know with vantage, I know they can be wonky). Once the score drop/discover incident happened us bank no longer had any prequals for me, and they still don't. But something in the garden club thread (of all places lol) made me think a little, and I tried the amex prequals once again, when to my absolute shock I got 3 single APR hits, including one of my ultimate goal cards:

My EX fico is currently 651 according to discover (I haven't refreshed their TU one yet, and I'm waiting to look at my EX from their own free fico site till after discover reports this month). I'm focusing all my data points on EX because that's who I've heard they pull almost exclusively, my TU is about the same though, same info, with EQ slightly lower due to 2 extra medical collections (3 y/o) and also 1 extra inq (I also have yet to see my EQ fico 8, it's the only one I haven't found free anywhere and I haven't yet felt the need to do the CCT 3B trial).

EX data points:

3 accounts (including discover which SHOULD be back on there) -

Cap one secured - CL $500 bal $0 (6 months old, about to be 7)

Overstock - CL $750 bal $0 (6 months old, 7 around the 24th)

Discover secured - CL $200 not sure on the balance that'll report yet but I almost always have it between 1% & 9% (just turned 7 months old)

AAoA 6 months, oldest 7 months

1 inq under a year, zero under 6 months

3 unpaid medical collections, 3 years old

Currently at 1% aggregate revolving util

0 missed payments/ 100% payment history

I mainly want this card for the 3% on groceries, and I'm totally happy with a tiny SL (even one that won't grow much, I can definitely make do with a $500 or $1000 CL) - what do you guys think my odds could be on actually getting this card right now? I've been gardening this long so I can definitely continue, but if this is a fairly solid prequal I'd much prefer to grab the card now so I can use it for that 3% and then immediately hop back into the garden to gain some more history and expand the rest of my wallet later. I'd love anyone's input or data points here, particularly folks who were denied after getting a prequal - I've seen a couple but the ones I saw were for blacklist reasons or for BK, I'd be very interested to hear about any other scenarios like this that were more like my profile if there are any, and really anything anybody has to say about anything at all

Thanks for everything, you're my favorite people on the internet and I appreciate everything this community does for everyone ![]() have a great day!

have a great day!

(Haha anyone here play mass effect? 'You're my favorite people on the internet' just made me think of 'I'm commander shepard and this is my favorite store on the citadel' lol)

Mod note: I updated your subject to reflect your approval; feel free to edit/change if you would like. --UB

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First ever amex prequal, should I do it?

If the rewards are useful, snag it!

FWIW, you can get a free monthly EX at two sites so sign up for them 2 weeks apart so you have a rolling EX: creditscorecard.com (Discover's EX8) and creditscore.com (EX's monthly free EX8).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First ever amex prequal, should I do it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First ever amex prequal, should I do it?

@Anonymous wrote:If the rewards are useful, snag it!

FWIW, you can get a free monthly EX at two sites so sign up for them 2 weeks apart so you have a rolling EX: creditscorecard.com (Discover's EX8) and creditscore.com (EX's monthly free EX8).

Lol I kinda messed up on this one, when I first got my fico score I was being overzealous and checked both of those within a few days of eachother (it was right around when 2 of my cards report but I don't think I waited long enough to see the data update - although I guess maybe it did and the score just didn't change)

If I wait to check the second one for a week or 2 will it pull new data then or will it have already automatically updated on the original planned refresh date? I'm gonna try it out anyway just for kicks but interested to know if it'll work that way ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First ever amex prequal, should I do it?

If you like the rewards and you're getting a solid APR, than definitely go for it! Let us know what happens!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First ever amex prequal, should I do it?

@Anonymous wrote:

@Anonymous wrote:If the rewards are useful, snag it!

FWIW, you can get a free monthly EX at two sites so sign up for them 2 weeks apart so you have a rolling EX: creditscorecard.com (Discover's EX8) and creditscore.com (EX's monthly free EX8).

Lol I kinda messed up on this one, when I first got my fico score I was being overzealous and checked both of those within a few days of eachother (it was right around when 2 of my cards report but I don't think I waited long enough to see the data update - although I guess maybe it did and the score just didn't change)

If I wait to check the second one for a week or 2 will it pull new data then or will it have already automatically updated on the original planned refresh date? I'm gonna try it out anyway just for kicks but interested to know if it'll work that way

I think you burned your chance to have it pull 2 weeks apart unfortunately. No worries, happens to many of us! I'm not sure how you can reset it, maybe closing the free monitoring and reopening it in a few months? I have no clue!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First ever amex prequal, should I do it?

I would try for it..They are pretty good i think with screening people they would like to apply

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First ever amex prequal, should I do it?

oh my gosh! go for it! id be jumping up and down and telling everyone i got an amex prequal! LOL!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First ever amex prequal, should I do it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First ever amex prequal, should I do it?

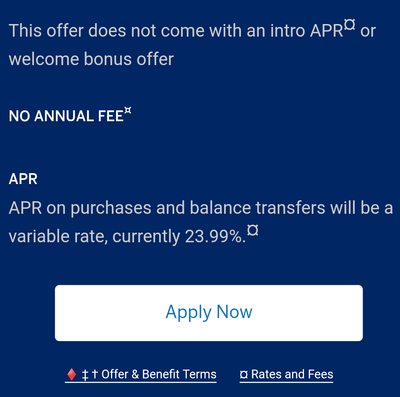

If your prequalified for the BCE card but with no offer or intro APR. go into private browsing. Get the good signup bonus and cold app.

If they are going to approve you for the card. The signup bonus or lack of isn’t going to affect that.

I had a really crappy signup bonus offer through prequalified with both of my Amex cards. The PRG I app’d over the phone to get the best bonus.

My delta gold card only wanted to give me 20k miles with 1K spend. Went to the delta site since I was buying a flight. Saw the offer for 50K mikes 1K spend and $150 statement credit if I app’d now and bought the flight. So I did and got the card and offer. Got delta at 610 EX F8 with 4 collections

My data point though.

I was recently denied for the BCE at 657 EX F8 with 3 collection accounts. For score to low. I had my delta card for a monthish at that point. I wasn’t prequalified on the site though. They told me I was over the phone when I called to pay my bill.

If the website is saying something they normally are very accurate unless something major has changed.

Total Revolving Limits $254,800