- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- I want to get CSR but.. -- Approved

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I want to get CSR but.. -- Approved

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to get CSR but.. -- Approved

when I check FICO simulations it says I will lose about 20 points or so for app. I really don't want to be back in 740s range now that I am in 750s range. So I am just curious on to know how accurate the simulator will be in case I go for 2 cards (CSR & Freedom)? I know a lot of people lose about 5 odd and I will be okay with that but not with 20 pts on TU.

What does the community think?

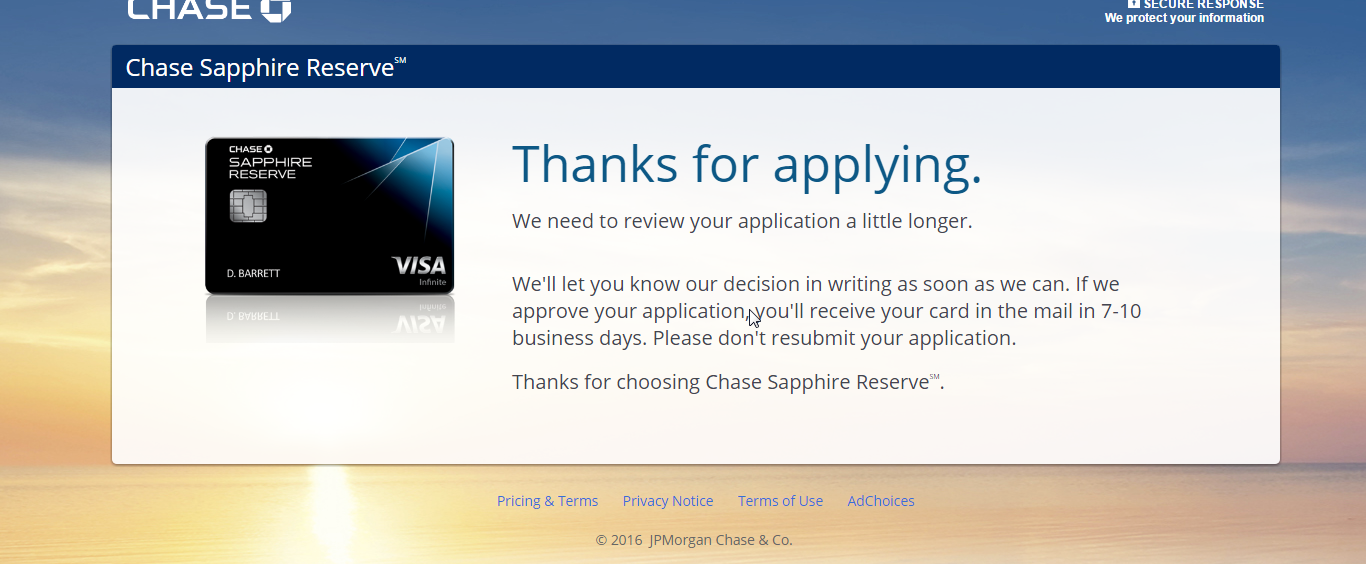

EDIT: I gave in and applied for 2 cards (CSR & Freedom). I get we will notify you in 30 days message. Should I call application status line and ask if I was approved or wait?

Doesn't seem like Freedom went through but I got an approval for 26K.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I want to get CSR but..

Not many pull TU anyway so app away.

But really if you have a need and the card fits your spending habits then by all means get it. It's worth the sign-up bonus!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I want to get CSR but..

How long does it take for the score to come back up?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I want to get CSR but..

@darwin_wins wrote:

Its not just TU, it shows TU 30 EX 20 and EQ 15. So thats my concern. I agree that the sign-up bonus itself makes it worth it.

How long does it take for the score to come back up?

If you are done apping after that then probally bounce back after 6 six months. If you aren't looking for credit after getting the CSR then it really doesn't matter if your range 720 - 750 as long as you don't run up balances.

I my case it was a 5 - 10 point point hit but I didn't even run a simulator because I went to a branch to see if I was pre-appoved and I was, I didn't want to pass that up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I want to get CSR but..

@redpat wrote:

@darwin_wins wrote:

Its not just TU, it shows TU 30 EX 20 and EQ 15. So thats my concern. I agree that the sign-up bonus itself makes it worth it.

How long does it take for the score to come back up?If you are done apping after that then probally bounce back after 6 six months. If you aren't looking for credit after getting the CSR then it really doesn't matter if your range 720 - 750 as long as you don't run up balances.

I my case it was a 5 - 10 point point hit but I didn't even run a simulator because I went to a branch to see if I was pre-appoved and I was, I didn't want to pass that up.

The plan for now is to get Chase CSR & Freedom. And then probably wait till I get offers from AmEx. I am not app-spreeing or anything, but at some point may be I will go for PRG or Plat (depends on what their offering is with changes coming in Q1 2017 and if I can manage to snag their 75K MR if not 100K MR).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I want to get CSR but..

I certainly wouldn't let what an inaccurate simulator says will happen prevent me from applying for a card with a signup bonus worth $2000+ dollars. Honestly even if it was true that you'll get a temporary score drop what big difference does that make? Are you applying for a mortgage soon? The point of having a high score is allow you the opportunity to be approved for credit products that you want/need so if your score will allow you to get one of the best credit cards out there, go for it. More importantly the last thing that I would ever use to base my credit decisions on is the MF simulator. Very inaccurate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I want to get CSR but..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I want to get CSR but..

Congrats, CSR was the one to get first.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I want to get CSR but..

Re: I want to get CSR but..

10-28-2016 10:46 AM

Thank you @Irish80, you are right I shouldn't base it on the MF simulator. I am not applying for mortgage (probably not for a while) but I may apply for auto loan and just a week ago my friend got his car and the finance guy said 780 or close to that would be the tier 1 score.

___________________________________________________________________________________________________________________________________

That finance guy isn't wrong however he should have said it varies between finance companies. I have a Mercedes AMG C63 S and while 780 is tier 1 so is 720 which was what my score was, and they pulled TransUnion financed with Mercedes-Benz Financial. So, in the end, go for the card you want as @irish80 said we spend all this time building our scores to get what we want and don't worry about auto you will be surprised.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I want to get CSR but..

@darwin_wins wrote:

@Thank you @Anonymous, you are right I shouldn't base it on the MF simulator. I am not applying for mortgage (probably not for a while) but I may apply for auto loan and just a week ago my friend got his car and the finance guy said 780 or close to that would be the tier 1 score.

Not true like the OP says above, it typically varies by lender (auto mfg lender). Anything typically over 700 is Tier 1, if anyone came into a Tier 2 the dealership has the ability to get it bumped up 1 Tier. (This is for manufacturers lenders only). I was a new car manager for awhile and was in the industry for 25 years and this is still the practice today.

I've seen people get Tier 1 with high 600 scores. Go for the card if you can use it/need it.