- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: 1st USAA offer...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

1st USAA offer...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1st USAA offer...

Sheesh I havent been on here in quite a while...

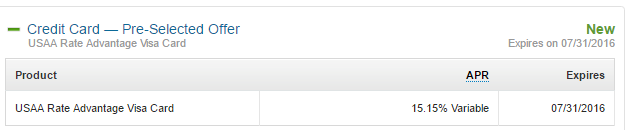

Checked my email one day and saw that USAA had sent an offer email..I didnt look into at the time. As I was making changes to my insurance policy I remember to check my offers tab and look what I see:

I'm not too excited about that APR ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1st USAA offer...

Offers will be based on your credit. If you're not too happy about the APR -- and that is a high APR for the Rate Advantage card -- then you still have some work to do on your credit. Hit the Rebuilding subforum and continue to identify and work on addressing issues on your reports. Don't just respond to offers. Get your credit in shape and then sort out your needs/wants and use that to select products that suit you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1st USAA offer...

@takeshi74 wrote:Offers will be based on your credit. If you're not too happy about the APR -- and that is a high APR for the Rate Advantage card -- then you still have some work to do on your credit. Hit the Rebuilding subforum and continue to identify and work on addressing issues on your reports. Don't just respond to offers. Get your credit in shape and then sort out your needs/wants and use that to select products that suit you.

I'm not sure about that. My credit is over 800, my available credit is over 250k, high income and I still get crappy offers from usaa. Oh and still no cli.

Current Score: 766 EX 734 EQ 780 TU 6/30/2015Starting Score/Goal Score: 580s/780s across the board

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1st USAA offer...

@unc0mm0n1 wrote:

@takeshi74 wrote:Offers will be based on your credit. If you're not too happy about the APR -- and that is a high APR for the Rate Advantage card -- then you still have some work to do on your credit. Hit the Rebuilding subforum and continue to identify and work on addressing issues on your reports. Don't just respond to offers. Get your credit in shape and then sort out your needs/wants and use that to select products that suit you.

I'm not sure about that. My credit is over 800, my available credit is over 250k, high income and I still get crappy offers from usaa. Oh and still no cli.

Exactly. Sometimes is less about your profile and more about the lender.

Please ignore the response above. That member is known for making these robotic comments and then abandoning the thread. He makes assumptions about a person's overall profile without asking questions. It doesn't help the community at all.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1st USAA offer...

Lol! Thanks for your guidance but my credit reports have been clean since last year. My scores are in the 700s and I have no debt other than student loans. I'm not applying for this card because I don't need it but I am happy to see offers finally coming back in I've applied several times for other cards with them and was denied when my credit was in great shape. Thought this was APR was pretty high compared to my other cards. I do have a few balances but my overall is under 10% and paid on time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1st USAA offer...

USAA has their own way of approving cards and loans.

I am a longtime member and have had cards with them for decades (plus insurance and other products). 10% interest on the card and always PIF prior to statement.

Applied for an AMEX travel card and was denied but offered a secured card.

Why? FICO scores were 750+ solid income, never missed a payment. App spree with a TON of new accounts. I was chasing sign-up bonuses and positioning myself to increase available credit. Scores now hovering between 780 - 810 and the only offer I currently have is for an Auto loan.

My guess is that time may be what is needed to get better offers ('my credit reports have been clean since last year')

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1st USAA offer...

I got two offers for the rate advantage card and, like yours, the APR was too high. Ignored both. Shortly after expiration of the second one I got this offer:

Jumped all over that one!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1st USAA offer...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1st USAA offer...

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k