- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: 2.2% fee on rent, what card to use?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

2.2% fee on rent, what card to use?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2.2% fee on rent, what card to use?

Hey guys,

My apt just switched to a new residence portal. Now they charge 2.2% if I pay rent by Mastercard, Visa, Discover and 3% by Amex, which I think is pretty low. Do you think it's a good idea to utilize a CC in this case? Which one? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2.2% fee on rent, what card to use?

save the 2.2%

Use cash or check unless your trying to meet spend for a bonus. In which case, use THAT credit card.

Current Scores 3/2016 Equifax 676 Transunion 697 Experian 648 Goal Scores: 720's accross the board. Gardening Goal: 3/2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2.2% fee on rent, what card to use?

@grillandwinemaster wrote:save the 2.2%

Use cash or check unless your trying to meet spend for a bonus. In which case, use THAT credit card.

Yes, for non-bonus spend, it just is simply a case of do you value any of the rewards as greater than 2.2%? For some people, UR/MR/TYP can be (but such people probably wouldn't have asked the question...)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2.2% fee on rent, what card to use?

The only card that can beat it is Discover Miles for one year with the double up promotion.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2.2% fee on rent, what card to use?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2.2% fee on rent, what card to use?

@Anonymous wrote:

I use PCM Credit Union's Platinum Rewards Mastercard. It gives me 5% back on up to $1000 per month on anything. I use it for rent and utilities. The only catch is that their 'Field of Membership' is rather restricted in that you must work for a small list of Wisconsin employers or be related to a current member. Discover miles is another option as mentioned.

That's a sweet deal!

I use Plastiq and locked in a 1.5% fee for my rent payments. I use my DC card so I net .5% back. Not much but something.

I agree with above posts. Use CCs for rent if needing to meet spend, otherwise doesn't make rewards sense when fee % > reward %.

ETA: If you are not concerned with rewards or cash back, I would use the card that had the closest % back to the 2.2% fee.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2.2% fee on rent, what card to use?

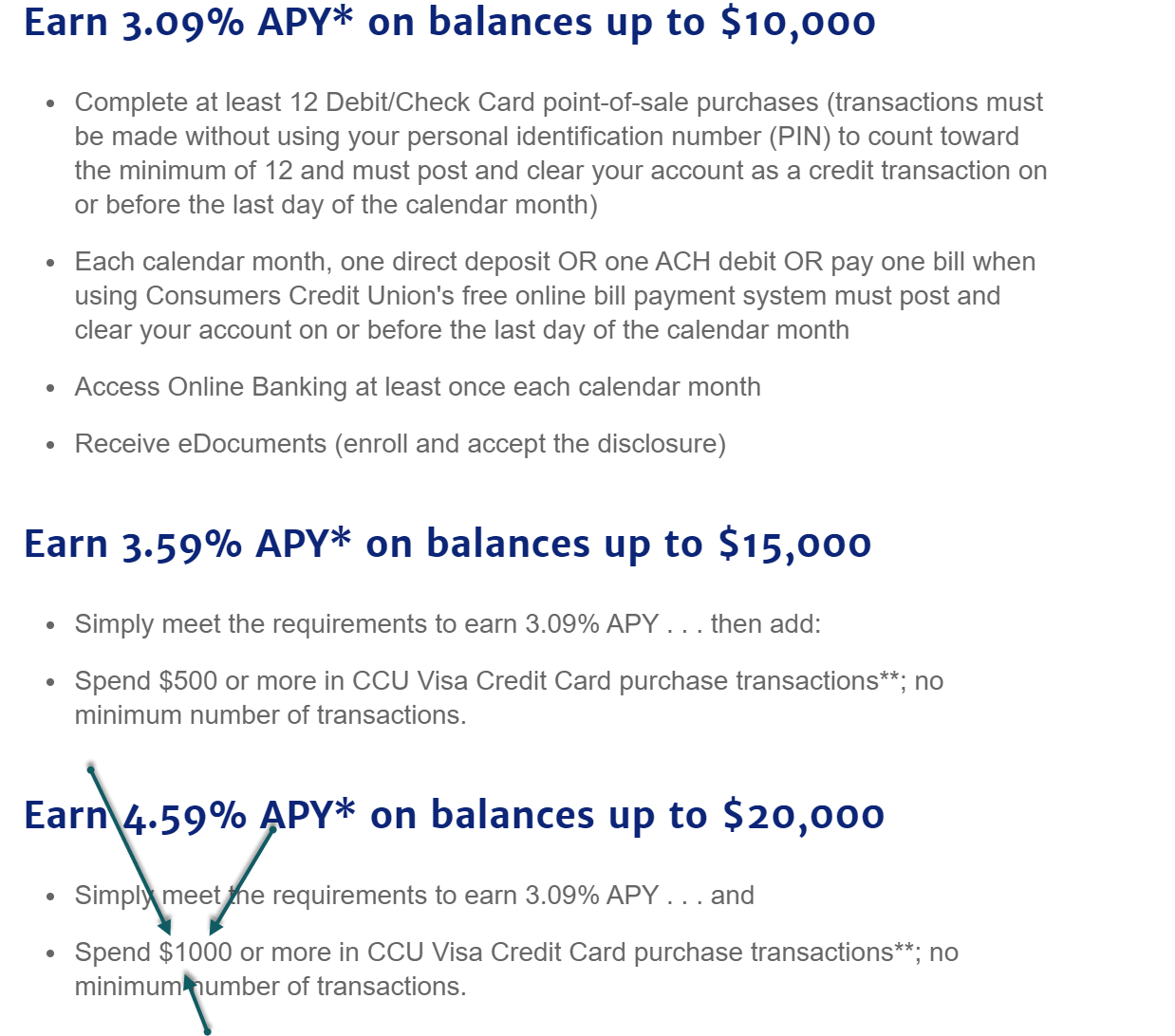

This brings up an advantage to using a CC for paying Rent! Now, if you had a requirement to spend at least $1000/mo to get 4.59% APY on your checking balance it would definitely be worthwhile!!!

https://www.myconsumers.org/personal/checking/free-rewards-checking.html

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2.2% fee on rent, what card to use?

@austinguy907 wrote:This brings up an advantage to using a CC for paying Rent! Now, if you had a requirement to spend at least $1000/mo to get 4.59% APY on your checking balance it would definitely be worthwhile!!!

https://www.myconsumers.org/personal/checking/free-rewards-checking.html

1000*.022*12=$264 in yearly fees.

264/.0459 = $5751

$14,250 remainder can be stashed at the full 4.59%. That's $654 in net interest on 20k deposit. Figure you could get 1% ($200) elsewhere so it's a net gain of $454 on $20,000 (approx 2.27%). If you already have 20k in an emergency fund this is a great answer that could yield that $20k an extra 2.27% interest.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2.2% fee on rent, what card to use?

@longtimelurker wrote:

@grillandwinemaster wrote:save the 2.2%

Use cash or check unless your trying to meet spend for a bonus. In which case, use THAT credit card.

Yes, for non-bonus spend, it just is simply a case of do you value any of the rewards as greater than 2.2%? For some people, UR/MR/TYP can be (but such people probably wouldn't have asked the question...)

I disagree personally. There are quite a few flat 2% cards out there. So (assuming you have a 2% card) is the extra 0.2% cost really NOT worth using a credit card for you? Perhaps - I mean it's obviously a personal call - but I wouldn't think twice about it. I HATE cash and checks and never feel as comfortable using debit cards as I do credit cards. It would take quite a bit more than a net 0.2% cost for me to consider using checks/debit in this situation.

Personally speaking, I used to live at a property that charged roughly about a 1% fee for accepting credit cards. So I still netted about 1% in rewards by using my Citi DC, but even if I'd been losing 1-2%, I'd have gone along with it for the convenience.

Hypothetically, using a credit card for rent can also potentially save you in interest fees in some cases. For example let's say you have about $500 in credit card debt that you can't comfortably pay off but are managing to not add to. If your rent is $1,000 and you are budgeting properly for that and have it every month, then by using the credit card with the $500 balance, and immediately paying it off in full, you're putting/keeping yourself in PIF status instead of paying interest (of definitely more than 2.2%) every month, and you can gradually chip away at your credit card debt. Granted, this is fairly specific and may not apply to you...but really almost anyone who has less credit card debt than their monthly expenses (that they can reliably pay) could use this method to avoid interest charges.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2.2% fee on rent, what card to use?

@Kevin86475391 wrote:

@longtimelurker wrote:

@grillandwinemaster wrote:save the 2.2%

Use cash or check unless your trying to meet spend for a bonus. In which case, use THAT credit card.

Yes, for non-bonus spend, it just is simply a case of do you value any of the rewards as greater than 2.2%? For some people, UR/MR/TYP can be (but such people probably wouldn't have asked the question...)

I disagree personally. There are quite a few flat 2% cards out there. So (assuming you have a 2% card) is the extra 0.2% cost really NOT worth using a credit card for you? Perhaps - I mean it's obviously a personal call - but I wouldn't think twice about it. I HATE cash and checks and never feel as comfortable using debit cards as I do credit cards. It would take quite a bit more than a net 0.2% cost for me to consider using checks/debit in this situation.

Personally speaking, I used to live at a property that charged roughly about a 1% fee for accepting credit cards. So I still netted about 1% in rewards by using my Citi DC, but even if I'd been losing 1-2%, I'd have gone along with it for the convenience.

Hypothetically, using a credit card for rent can also potentially save you in interest fees in some cases. For example let's say you have about $500 in credit card debt that you can't comfortably pay off but are managing to not add to. If your rent is $1,000 and you are budgeting properly for that and have it every month, then by using the credit card with the $500 balance, and immediately paying it off in full, you're putting/keeping yourself in PIF status instead of paying interest (of definitely more than 2.2%) every month, and you can gradually chip away at your credit card debt. Granted, this is fairly specific and may not apply to you...but really almost anyone who has less credit card debt than their monthly expenses (that they can reliably pay) could use this method to avoid interest charges.

I would just set it up using my bank's bill pay and just hit a button once a month. For me, yes, certainly better than spending 0.2% a month. Now if you have no other bills (auto PIF everywhere) then maybe