- myFICO® Forums

- Types of Credit

- Credit Cards

- 2% vs 2 points

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

2% vs 2 points

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2% vs 2 points

What is the difference if any?

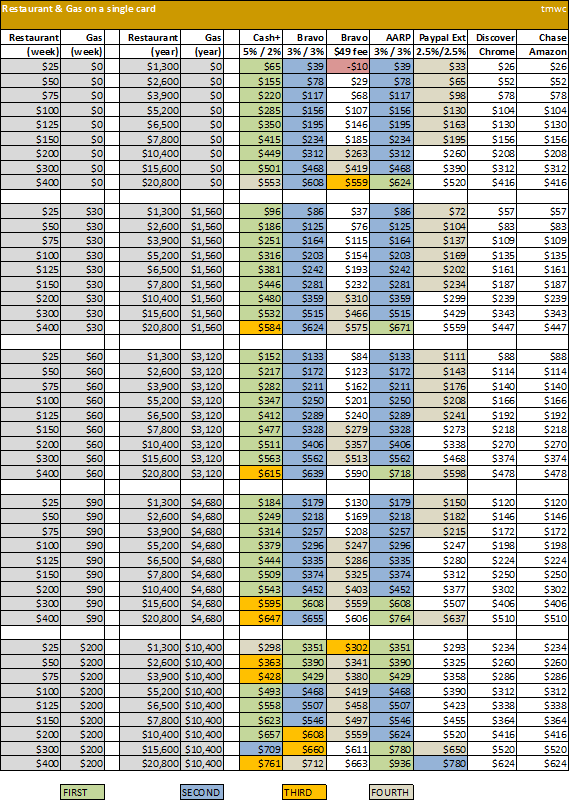

If it helps...I am referring specifically to the Discover IT Chrome (2% back on resturants) and the Chase Sapphire (2pts back on every dollar spent at restaurants).

Say you spend $20 at Pizza Hut (randomly coming up with a scenario here...)

You would get $.40 from Discover IT Chrome, or 40pts back with CS. Which is the better scenario?

Also, I am aware that there are a few better restaurant rewards cards out there (Us Bank Cash+ for 5% and Huntingon Voice for 3% both come to mind)...I'm just trying to understand the different between the 2. Is one better than the other? Are they the same in cash/gift card type value?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% vs 2 points

@Anonymous wrote:What is the difference if any?

If it helps...I am referring specifically to the Discover IT Chrome (2% back on resturants) and the Chase Sapphire (2pts back on every dollar spent at restaurants).

Say you spend $20 at Pizza Hut (randomly coming up with a scenario here...)

You would get $.40 from Discover IT Chrome, or 40pts back with CS. Which is the better scenario?

Also, I am aware that there are a few better restaurant rewards cards out there (Us Bank Cash+ for 5% and Huntingon Voice for 3% both come to mind)...I'm just trying to understand the different between the 2. Is one better than the other? Are they the same in cash/gift card type value?

If you are doing for pure cash back they are the same. Most people use Chase UR points for transfer to an airline or hotel where you are getting more than 2 points per cent, so if you are transferring to an airline partner you are getting nearly 4 per cent. If you just want cash back then it would be normal 2 per cent similar to discover which is only cash back they don't do transfers to airline partners.

EX Fico 804 11/16/16 Fako 800 Credit.com 11/16/16

EQ SW bank enhanced 11/16/16 839 CK fako 822 11/16/16

TU Fico discover 10/19/16 814 Fako 819 Creditkarma 11/16/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% vs 2 points

@mongstradamus wrote:

@Anonymous wrote:What is the difference if any?

If it helps...I am referring specifically to the Discover IT Chrome (2% back on resturants) and the Chase Sapphire (2pts back on every dollar spent at restaurants).

Say you spend $20 at Pizza Hut (randomly coming up with a scenario here...)

You would get $.40 from Discover IT Chrome, or 40pts back with CS. Which is the better scenario?

Also, I am aware that there are a few better restaurant rewards cards out there (Us Bank Cash+ for 5% and Huntingon Voice for 3% both come to mind)...I'm just trying to understand the different between the 2. Is one better than the other? Are they the same in cash/gift card type value?

If you are doing for pure cash back they are the same. Most people use Chase UR points for transfer to an airline or hotel where you are getting more than 2 points per cent, so if you are transferring to an airline partner you are getting nearly 4 per cent. If you just want cash back then it would be normal 2 per cent similar to discover which is only cash back they don't do transfers to airline partners.

Pretty much, this. It's all in what/how you want your rewards redeemed. Cash back is just that ... cash back. The percent you get is the same all the time (other than bonus cash back). So if your card offers 3% cash back on gas, you'll always get that 3% cash back.

With points, as was pointed out, they can change in value depending on what you redeem them for.

Basically, it's the value at redemption time that matters.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% vs 2 points

Points are worth more if you transfer them to airline partners for miles

Chase Freedom: $12,500 | Citi Double Cash: $10,000 | Bank of America Cash Rewards: $8,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% vs 2 points

Thanks for the information. I wasn't completely sure! Now I know.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% vs 2 points

@Anonymous wrote:What is the difference if any?

If it helps...I am referring specifically to the Discover IT Chrome (2% back on resturants) and the Chase Sapphire (2pts back on every dollar spent at restaurants).

Say you spend $20 at Pizza Hut (randomly coming up with a scenario here...)

You would get $.40 from Discover IT Chrome, or 40pts back with CS. Which is the better scenario?

Also, I am aware that there are a few better restaurant rewards cards out there (Us Bank Cash+ for 5% and Huntingon Voice for 3% both come to mind)...I'm just trying to understand the different between the 2. Is one better than the other? Are they the same in cash/gift card type value?

Also the Chase AARP VISA Signature card is 3% Restaurants & Gas. Santander Bravo is 3% restaurants & Gas but has a $49 fee unless you can qualify to have that waived (you won't qualify). And Paypal Extras or Ebay card is 2.5% in those categories.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800