- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: AF cards that are worth it?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AF cards that are worth it?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AF cards that are worth it?

@Adidas wrote:

A few general reasons I've come up with:

- People that travel for work can get travel rewards cards for airlines/hotels and get reimbursed by their work netting a lot of free points/miles for themselves.

I fall into this category .... I have over $1,100 in AF's

Amex Plat - $450 - $200 in Delta Gifts cards

The big benefit for me is Delta Sky Club access (which would be $450 if purchased from Delta). I travel almost weekly, so this is invaluable, plus it is reimbursable, so no true cost to me. This year I will be Diamond on Delta, so next year I'll have no need for it. But the following year I'll most likely drop back down to Plat on Delta, so I'll keep the card.

Chase Saphire Reserve - $450 - $300 travel credit

Heavy travel and dining spend, mostly reimbursable, so this is a no brainer for me at 3pts/$1. The primarly rental insurance and full international rental car CDW and incredibly valuable to me as well.

Marriott Rewards - $85

High Marriott spend, mostly reimbursable, at 5pts/$1 makes this worth the AF. I have found the Cat 1-5 cert to be pretty worthless to me most years.

Ritz Carlton - $395

I have this CL lowered to $1K, so I have no annual fee. If I did pay have to pay an annual fee, I would cancel the card. The travel credit is pretty useless, with airline status I don't pay for bagge fees etc., so the credit goes mostly unused. Other benefits are duplicated by the Amex Plat or CSR.

Barclay AAdvantage - $89

I rarely fly AA, I opened this up for the US Air sign up bonus. I keep this open because of the 1% BT offers I have been using

JCB Marukai - $15

AF is negible, but unsure how much I will be using the card going forward vs. my Freedom Unlimited for UR points. (3% cb vs. 1.5 UR on non category spend)

Delta Gold - $95

I should cancel this, but keep it to preserve my $25K CL, and rumor has it card holders have better access to lower tier mileage redemptions for flights. Honetly mileage redemptions are so bad, if that's true, it's just sad. No need for the baggage benefit since I have status

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AF cards that are worth it?

@longtimelurker wrote:

@Anonymous wrote:! Also, there has been no lag on my rewards since July. Not sure if it's something they fixed recently, but we've had no problem.

Pretty sure there IS a lag as that is part of the program. The rewards for spend that closes on the Sep statement will appear on the statement that closes in Nov (unlike almost every other issuer). There have been issues where rewards have been more delayed (or more common, not given for some eligible spend) but that is mainly fixed.A

IMO, counting Amex Offers as justifying AF isn't really convincing. Firstly, offers are available on the cards with no AF, and second, they are of variable value, I've gone a long time without getting an offer I want to use on any of my three cards.

How could you ever tell? LOL It takes so long to post and as far as I have found there is no detailed breakdown of rewards earned (just the table showing total spend per reward category), so I wouldn't know if they short changed me.

Yeah, I was incorrect initially. There is some small lag as longtimelurker pointed out. It appears to be a month. I get the credits for the previous month as long as I pay my bill for the previous statement. Besides the initial statement we got the card, every other statement has been updated consistently and properly.

@Anonymous You can tell by looking at the bottom of your statement lol. The main page has the total breakdown for all spending in general. Your statement has the actual breakdown for the statement.

But this grows off topic. Just wanted to clear that up though! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AF cards that are worth it?

Total CL $398600, plus car and RV loan.

Ooh. Ooh. Getting closer to that $500K mark!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AF cards that are worth it?

@fltireguy wrote:

I have no lag on my AMEX rewards - they seem to post with the statement..

Which card? The month delay applies to the Blue Cash cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AF cards that are worth it?

@longtimelurker wrote:

@fltireguy wrote:

I have no lag on my AMEX rewards - they seem to post with the statement..Which card? The month delay applies to the Blue Cash cards.

+1

My own BCP experience has been that there's a one-month lag before the cash rewards show up on the statement, then another (+/-) one month before the cash rewards are actually available to redeem. Basically, just because the rewards are on the monthly statement doesn't mean they are available. I think there is some fine-print that says rewards are pending payment, but even prompt payment (in my own case, even PIF) doens't make the rewards immediately available. ![]()

I've read in some cases people have been able to call a CSR and have rewards 'forced' into availability once they are displayed on the latest statement, but I've also read others tried this and weren't successful, so YMMV.

I've grown to accept (and expect) that from spend to rewards redemption there will be a (+/-) two-month delay.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AF cards that are worth it?

@sillykitty1 wrote:

Delta Gold - $95

I should cancel this, but keep it to preserve my $25K CL, and rumor has it card holders have better access to lower tier mileage redemptions for flights. Honetly mileage redemptions are so bad, if that's true, it's just sad. No need for the baggage benefit since I have status

Nice list of cards, and a lot of travel for you.

With the Delta Gold card you are also getting first checked bag free, though since the travel cost is employer expense, you don't really pay most of that.

Your Platinum AMEX also gives you SPG Gold, which should be translatable into Marriott Gold through status match.

Regarding the upgrades, you might consider running $25k through the Delta Gold card in a calendar year. The sooner you do this in a year, this can lead to better results for Delta upgrades. The other method to get those better upgrades is with the Delta Reserve card. And, if you run $25k through a Delta Gold, might as well have a Delta Platinum instead, to get the bonus 10,000 MQM ![]()

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AF cards that are worth it?

Just used my IHG annual night to book CP Times Square for New Year's Eve.

Try doing that with the annual night on all your darling metal Marriott cards. ![]()

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AF cards that are worth it?

@NRB525 wrote:

@sillykitty1 wrote:

Delta Gold - $95

I should cancel this, but keep it to preserve my $25K CL, and rumor has it card holders have better access to lower tier mileage redemptions for flights. Honetly mileage redemptions are so bad, if that's true, it's just sad. No need for the baggage benefit since I have status

Nice list of cards, and a lot of travel for you.

With the Delta Gold card you are also getting first checked bag free, though since the travel cost is employer expense, you don't really pay most of that.

Your Platinum AMEX also gives you SPG Gold, which should be translatable into Marriott Gold through status match.

Regarding the upgrades, you might consider running $25k through the Delta Gold card in a calendar year. The sooner you do this in a year, this can lead to better results for Delta upgrades. The other method to get those better upgrades is with the Delta Reserve card. And, if you run $25k through a Delta Gold, might as well have a Delta Platinum instead, to get the bonus 10,000 MQM

Thanks NRB525 ...

You know the funny thing about airline cards is all the perks they offer, traveling frequently already provides most of them. Baggage is free at every status level, and I'm already Paltinum at Marriott, and now SPG because of the merger. But hotel status is so much less valuable than airline status IME.

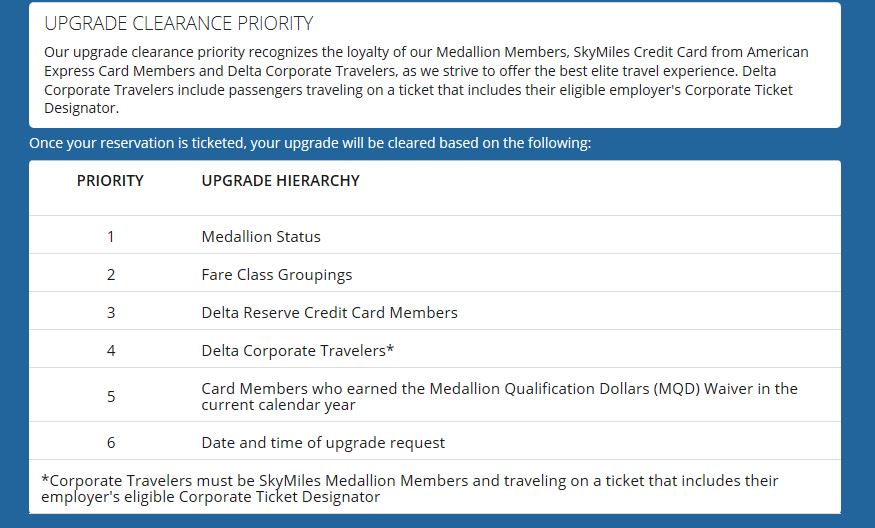

That's a very interesting chart, I knew about the status and fare class, but no idea the credit card waiver was a factor. I'll be interested to see what my upgrade % is next year as Diamond. I'm not too hopeful since I flying popular routes out of a busy airport. As a Platinum I'm often so far down the upgrade list like 23/45, I think I might need the waiver & Delta Reserve to really make a difference, but we'll see.

I just can't justify though running $25K through the Delta Amex, when Delta miles have so little value. I really struggle finding good redemptions on my Skymiles, and I already earn a lot through flying. I value UR points because it opens up United and Southwest award travel for me. I'm actually thinking of switching my flight purchases to Amex Plat for 5x MR, to further broaden my options.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AF cards that are worth it?

@wasCB14 wrote:Just used my IHG annual night to book CP Times Square for New Year's Eve.

Try doing that with the annual night on all your darling metal Marriott cards.

Agree .... I find my Marriott 1-5 Cat cert more frustrating than valuable most of the time

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AF cards that are worth it?

@Anonymous wrote:

@longtimelurker wrote:

@Anonymous wrote:! Also, there has been no lag on my rewards since July. Not sure if it's something they fixed recently, but we've had no problem.

Pretty sure there IS a lag as that is part of the program. The rewards for spend that closes on the Sep statement will appear on the statement that closes in Nov (unlike almost every other issuer). There have been issues where rewards have been more delayed (or more common, not given for some eligible spend) but that is mainly fixed.A

IMO, counting Amex Offers as justifying AF isn't really convincing. Firstly, offers are available on the cards with no AF, and second, they are of variable value, I've gone a long time without getting an offer I want to use on any of my three cards.

How could you ever tell? LOL It takes so long to post and as far as I have found there is no detailed breakdown of rewards earned (just the table showing total spend per reward category), so I wouldn't know if they short changed me.

Yeah, I was incorrect initially. There is some small lag as longtimelurker pointed out. It appears to be a month. I get the credits for the previous month as long as I pay my bill for the previous statement. Besides the initial statement we got the card, every other statement has been updated consistently and properly.

@Anonymous You can tell by looking at the bottom of your statement lol. The main page has the total breakdown for all spending in general. Your statement has the actual breakdown for the statement.

But this grows off topic. Just wanted to clear that up though!

You are correct about the statement but they don't show a breakdown of awards earned on each transaction. Chase does however.