- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: AMEX Platinum 100K MR Points for 3K spend, ava...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AMEX Platinum 100K MR Points for 3K spend, available to all

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Platinum 100K MR Points for 3K spend, available to all

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Platinum 100K MR Points for 3K spend, available to all

Hey all,

I was just appoved for the PRG 2 weeks ago. Do you think AMEX would approve of a platinum card so quickly after the approal of a PRG?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Platinum 100K MR Points for 3K spend, available to all

@Anonymous wrote:

@Anonymous United club as in the Chase card? I hope @sebastian or someone can share the 25k MR POID. Do you guys think I'm still in the window for double app one HP? My initial app was around midnight last night.

good luck everyone i'm going to be famous ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Platinum 100K MR Points for 3K spend, available to all

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Platinum 100K MR Points for 3K spend, available to all

@jsucool76 wrote:

@signaturecardmember wrote:Sorted throught he the thread but didnt see too much.

I was not planning on leaving the garden but I dont think 1 new account would do much to me, I have been in garden since January spree.

The $495 fee is billed up front?

What other benefits like the airline fee waivers are there and how soon can they be used?

Airline gift cards can be bought etc?

I am interested in how much of the fee can be mitigated and how soon.

Thanks in advance guys!

It's $450, not $495, billed on the first statement.

Airline fee waiver is $200/calendar year, so $200 by dec 31, and then another $200 starting Jan 1. Can be used for gift cards (check FT for more info)

Card comes with SPG gold status, Avis Preferred Status, Hertz Gold Plus, and National Emerald Executive status.

Card also comes with a TSA PreCheck, or Global entry fee waiver (up to $100 value)

Card also comes with the FHR program (can be very valuable perk)

You'll also get access to Delta Sky Clubs (while flying on delta), Priority Pass lounges (For you (and AUs only), each guest will cost $27 unless they have their own PP card), and airspace lounges.

Those are the only benefits with immediate value.

thanks for the quick responses cool, and others

hmmmm the $400 makes it tempting however I have such little time to travel right now and have most of the other statuses it comes with

how far do the 100k miles get compared to other miles? i would use them towards international business or first class tickets

the 100k miles makes it most tempting but shelling out $500 for something I cant use for a while makes it hmmm, esp since no more back dating and AMEX seems over rated lately anyways...decisions, decisions

Currently: 6/18 Bank of America Signature $99.9k, Chase Slate $0, Chase Freedom Signature $2.5k, American Express Gold NSL, American Express Everyday $6k, Lowes GE $0 (From $35k), Discover IT $38.5k, Capital One Quicksilver $5k, Barclays US Airways $24k, DCU Platinum $30k, PenFed Promise $47k, Chase Freedom Unlimited Signature (From CSP) $50k, Chase AARP Signature $7.5k, American Express Blue Cash $7.5k, Citi American Airlines Platinum $10.5k, Capital One Venture Signature $30k, Chase Sapphire Preferred (From Reserve) $12k, Chase Ink Business Preferred $10k, Barclays Aviator Business $14k. Total Available Credit: Over $350k, Utilization 4%, AAoA 7 Years, TU Fico 799, EX Fico 727

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Platinum 100K MR Points for 3K spend, available to all

@medo wrote:Hey all,

I was just appoved for the PRG 2 weeks ago. Do you think AMEX would approve of a platinum card so quickly after the approal of a PRG?

I would say go for it. It will only be a soft pull if you are denied.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Platinum 100K MR Points for 3K spend, available to all

@signaturecardmember wrote:

@jsucool76 wrote:

@signaturecardmember wrote:Sorted throught he the thread but didnt see too much.

I was not planning on leaving the garden but I dont think 1 new account would do much to me, I have been in garden since January spree.

The $495 fee is billed up front?

What other benefits like the airline fee waivers are there and how soon can they be used?

Airline gift cards can be bought etc?

I am interested in how much of the fee can be mitigated and how soon.

Thanks in advance guys!

It's $450, not $495, billed on the first statement.

Airline fee waiver is $200/calendar year, so $200 by dec 31, and then another $200 starting Jan 1. Can be used for gift cards (check FT for more info)

Card comes with SPG gold status, Avis Preferred Status, Hertz Gold Plus, and National Emerald Executive status.

Card also comes with a TSA PreCheck, or Global entry fee waiver (up to $100 value)

Card also comes with the FHR program (can be very valuable perk)

You'll also get access to Delta Sky Clubs (while flying on delta), Priority Pass lounges (For you (and AUs only), each guest will cost $27 unless they have their own PP card), and airspace lounges.

Those are the only benefits with immediate value.

thanks for the quick responses cool, and others

hmmmm the $400 makes it tempting however I have such little time to travel right now and have most of the other statuses it comes with

how far do the 100k miles get compared to other miles? i would use them towards international business or first class tickets

the 100k miles makes it most tempting but shelling out $500 for something I cant use for a while makes it hmmm, esp since no more back dating and AMEX seems over rated lately anyways...decisions, decisions

It's not 100k miles its 100k member rewards points which can be used for hotels, air fare, car rentals, gift cards, cash back, and all sorts of other things.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Platinum 100K MR Points for 3K spend, available to all

@Anonymous wrote:

Wait! Just got an email! I was approved. Their application status web portal is unreliable.

Wooohooo!

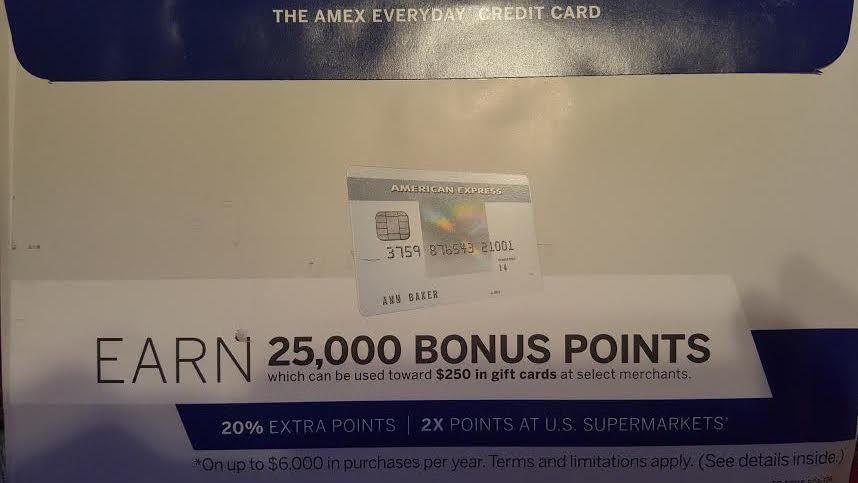

Now…ED 15k MR offer or Delta 50k? I honestly don't plan on accumulating Delta miles, unless there are some good international business/first class opportunities I'm unaware of?

Congrats on both of your approvals.. two great cards the freedom for obvious reasons to go along with the csp. The Platinum for the bonus! Glad it worked out!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Platinum 100K MR Points for 3K spend, available to all

@signaturecardmember wrote:

@jsucool76 wrote:

@signaturecardmember wrote:Sorted throught he the thread but didnt see too much.

I was not planning on leaving the garden but I dont think 1 new account would do much to me, I have been in garden since January spree.

The $495 fee is billed up front?

What other benefits like the airline fee waivers are there and how soon can they be used?

Airline gift cards can be bought etc?

I am interested in how much of the fee can be mitigated and how soon.

Thanks in advance guys!

It's $450, not $495, billed on the first statement.

Airline fee waiver is $200/calendar year, so $200 by dec 31, and then another $200 starting Jan 1. Can be used for gift cards (check FT for more info)

Card comes with SPG gold status, Avis Preferred Status, Hertz Gold Plus, and National Emerald Executive status.

Card also comes with a TSA PreCheck, or Global entry fee waiver (up to $100 value)

Card also comes with the FHR program (can be very valuable perk)

You'll also get access to Delta Sky Clubs (while flying on delta), Priority Pass lounges (For you (and AUs only), each guest will cost $27 unless they have their own PP card), and airspace lounges.

Those are the only benefits with immediate value.

thanks for the quick responses cool, and others

hmmmm the $400 makes it tempting however I have such little time to travel right now and have most of the other statuses it comes with

how far do the 100k miles get compared to other miles? i would use them towards international business or first class tickets

the 100k miles makes it most tempting but shelling out $500 for something I cant use for a while makes it hmmm, esp since no more back dating and AMEX seems over rated lately anyways...decisions, decisions

Honestly, I wouldn't jump on the card unless you have a specific redemption in mind. I was in the process of looking at redemptions for MRs anyway and this offer popped so for me it was worth it. 100k points is a lot though, although not enough on its own for roundtrip first class. However, if you have some other MRs saved up or points in another program that overlaps with MRs then this will go a long way to giving you a shot at some good redemptions.

Starting Score: EQ: 714, TU 684

Current Score: EQ: 725 7/30/13, TU 684 6/2013, Exp 828 5/2018, Last App 8/5/17

Goal Score: 800 (Achieved!) In garden until Sepetember 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Platinum 100K MR Points for 3K spend, available to all

@Anonymous wrote:

@Anonymous @jfriend! I could definitely fly Delta in the next two years. I'm just focused on accumulating the same currency of points to use towards an international trip next year. Instead of getting incidental Delta points. If that makes any sense. Then again I think Delta has some decent international partners. Maybe it is the way to go. And wait on the 25k ED.

delta got a bad rap with their miles changes. It was mostly affecting people that fly a ton. If you dont fly every week then you should be just fine.

You could also consider diversification of your points for future flexibility. I know I would be very tempted to transfer all 100k of my mr points to avios before the rate changes. Even though I rarely fly that way.

there have been many international delta flights for 42k points round trip. You can also do a points and cash ticket and use the gift cards if you had to. Now you could also research throwaway travel/hidden city pricing/ skip gating as well but if you do it often it can get you kicked out of your frequent flier program.

I have seen a lot of flights international lately on the cheap. Ireland for $399, or paris for $599 by going non stop from chicago to paris, and skipping the last leg of paris to helsinki. Hence, hidden city pricing.

Your habits are probably different than mine so you should do what works best for you. If you stay at ton at hilton properties then maybe go for the surpass. My goal is to have a wide array of choices with points banked up in different areas for flexibility. I want to one day have MR, UR, and TY. And maybe also have the expedia voyager because I do find myself using expedia often as they have extra coupons.

You really dont have a ton of cards right now, I would let it boil down to what bonus spending you can afford. Unless you are buying a house in the next 12 months, use the inquiry in the most profitable way. Now 50k delta miles could also be used with sky team and they have 20 partners. Do you have delta near you? you dont have to fret about what to do with the MR points on the platinum. You can transfer them before you nix the card. Or ya know, you could always PC the delta to the ED down the road if you wanted to, and they would probably refund the annual fee when it posts (60 day window, do this the 13th month)

Maybe you need the ED with 2.4 mr points per dollar for groceries, thats essentially 4.8% back or 2.4% on everything else.. How much do you spend on groceries, maybe the EDP is the better option, as it becomes a 4.5 MR / dollar on groceries, 3 MR on gas, and 1.5 on everything else.... which translates to on avg a 9% return on groceries, 6% on gas, and 3% on everything else....... would need to spend more than 500 a month on groceries to offset the AF though.

You really dont need another no interest card as you are getting that on the freedom. You will have quite a few rotating categories on it to deal with and transfer those to the CSP. I would say, go for Delta, easiest amex credit card to get approved for, get the 50k miles and $50 gift card (i think?) and if you dont fly in the 12 months, PC to ED on month 13. Hopefully you will only see 1 HP tonight or tomorrow.