- myFICO® Forums

- Types of Credit

- Credit Cards

- AMEX Zync PC Options

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AMEX Zync PC Options

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Zync PC Options

Im still happy tough, i use my card a lot on gas and i certainly plan on running 30k+, so that will bonus me an extra 15k miles next year, effectively making up for the AF

4/14/12: EX: 680 TU:678 EQ: 670

BOFA: 0/1k / CAP1: 0/1.75k / CITI: 700/2k / AMEX Gold:NPSL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Zync PC Options

i haven't heard anything about the rewards being removed ,but they did disc the packs and issued refunds for any packs you had, i had the connect and saw the refund earlier this week. i am in no hurry to PC either since all the other charge cards AF start @95. Overall i been disappointed by AMX because they did away w/ the MR mall now its just point per dollar. i will wait till im forced to change or hike up the AF on zync but its def. going to see alot less use now. i am only keeping it with the hopes of PC to BCE and get backdating next year sometime after all but 1 of my negs will be gone

Barclay's Mastercard-13.5k

Credit Union Visa-1k

Discover-24k, Khols-2k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Zync PC Options

Are they discontinuing the Zync entirely? I noticed it is not even offered on the website anymore.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Zync PC Options

I attempted to close my Zync today, but was given a retention offer of $20 or 3,000 MR points. I took the MR points. The MR points are worth at least $0.01 per point, so I gain $5 above the annual fee. Plus, the CSR maintains that Zync spending will still get 1 MR point per dollar. I think I will just keep my recurring expenses (cable, cell phone, newspapers, etc) on my Zync card and sockdrawer it. I will bring it out during Small Business Saturday to get the credits offered there. No plans on trying to do a PC given I have a Platinum already and I don't want to pay a fee for the PRG this year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Zync PC Options

@Scene wrote:Are they discontinuing the Zync entirely? I noticed it is not even offered on the website anymore.

AFAIK you can't apply for it but I think they are slowly phasing it out....possibly by end of the year/beggining of '14 making cardholders PC.

EQ FICO 548 3/3/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Zync PC Options

Alcibiades wrotelus, the CSR maintains that Zync spending will still get 1 MR point per dollar.

So long as it keeps earning MR points, I'd keep the Zync and not upgrade until I've accrued enough MRE points where I can book a nice flight through the MR program.

In the future, the way to go is Senior Member Green for $35 + Blue.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Zync PC Options

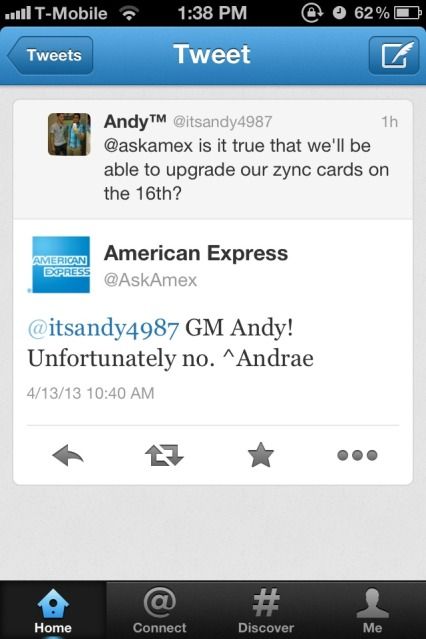

I saw this on twitter:

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Zync PC Options

Different people have gotten different responses from the AskAmex twitter account. It varies just as much as the telephone CSR answers.

Starting Score: MyFico TU: 621 EQ: 610

Starting Score: MyFico TU: 621 EQ: 610Current Score: Discover TU: 829 Discover EX: 827

Goal Score: 700's baby! (made it 4/10/2013!)

New Goal: 830!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Zync PC Options

@lazylane wrote:I saw this on twitter:

![]()

I would just say call in at the beginning of the month. These people cant seem to get a solid date set.

EQ FICO 548 3/3/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Zync PC Options

Can normal membership points be used for everyday charges like the MR Express points?

My wife is using the Unicorn card for reimburseable gas expenses right now. I am running the numbers on whether or not I should PC to something else.

I really like having a charge card that doesn't impact utilization. We make enough that a few dollars in rewards is not a big windfall for us, but at the same time I don't want to be in the red on the annual fee. Also, the NPSL is nice in case we have a month where there are significant travel expenses. She spends a minimum of 500 per month on gas. With the Zync, 6k a year in spending equates to less than 40 bucks in cashback. More than enough to cover the 25 dollar AF, but not much else. There are a few card benefits, plus the wow factor of flashing a unicorn.

If I spring for the PRG, she gets double points on gas for 12,000 minimum points per year. That's 120 bucks towards the 195 dollar fee, meaning I have to come up with 7,500 or 625 a month more in single point spending just to break even, or increase gas spending to 812. Probably not worth it.

The Gold Card is only 125, but I lose the double points on gas. So I end up with 60 bucks towards the fee, less than half of it. I have to spend a grand a month to break even.

The Green Card is 95, so I have to spend 800 a month to break even.

If I have analyzed this correctly, I should keep the Unicorn until the gas spending on the card hits 800. At that point, the return on the green and PRG are close enough.

Am I missing anything important?