- myFICO® Forums

- Types of Credit

- Credit Cards

- Advice: Paying down cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Advice: Paying down cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice: Paying down cards

@Onthe27thday wrote:Hi,

I am hoping to pay down as much of my debt as possible, by June of 2016. Below are the card limits, balances and current aprs for what I have. I am hoping for advice on the best way to pay them down and not feeling like im spitting on a fire every month.

Should I try to pay the lowest balance off first while only making minimum payments on the others?

Should I try to make a little more than the minimum on all of the cards at the same time?

Thanks for any help and if I have forgotten to list something important, just let me know!

Chase Amazon.com Limit: 400 Balance: 360 Apr: 21.24%

Capital One Secured Limit: 651 Balance: 588 Apr: 22.90%

Capital One Quiksilver Limit: 1100 Balance: 1086 Apr: 19.80%

Barclays Limit: 1400 Balance: 1350 Apr: 24.99%

Care Credit Limit: 1500 Balance: 1415 Apr: 26.99%

Discover IT Limit: 2500 Balance: 2495 Apr: 17.99%

I think your biggest problem is that with all cards maxed out like that, one of the lenders might take adverse action and lower your credit limit which would squeeze you even more. Banks can be cruel that way.

So my first phase would be to try to bring each account below 80% utilization.

Then I would start tackling the ones with craziest interest rates.

And you should call Barclays and ask them if they could give you an interest rate reduction.

And I would stop using credit cards completely, until they were all at least down to 30%.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice: Paying down cards

@Onthe27thday wrote:Hi,

I am hoping to pay down as much of my debt as possible, by June of 2016. Below are the card limits, balances and current aprs for what I have. I am hoping for advice on the best way to pay them down and not feeling like im spitting on a fire every month.

Should I try to pay the lowest balance off first while only making minimum payments on the others?

Should I try to make a little more than the minimum on all of the cards at the same time?

Thanks for any help and if I have forgotten to list something important, just let me know!

Chase Amazon.com Limit: 400 Balance: 360 Apr: 21.24%

Capital One Secured Limit: 651 Balance: 588 Apr: 22.90%

Capital One Quiksilver Limit: 1100 Balance: 1086 Apr: 19.80%

Barclays Limit: 1400 Balance: 1350 Apr: 24.99%

Care Credit Limit: 1500 Balance: 1415 Apr: 26.99%

Discover IT Limit: 2500 Balance: 2495 Apr: 17.99%

The answer depends on your goals and the amount you can put forth towards paying off the cards in excess of the minimum.

If you want to have your score rise quickly, you want to drop them in buckets, bringing down the utilization of all of them more or less together. There is some anecdotal evidence that there are cutoffs at 30%, 50%, and 80-90% util per card. However, if you're not apping for something soon, the score increase is immaterial. Given your situation, I would worry about getting the debt under control before worrying about score increases. The score increase will come down the line as the debt gets more manageable, and in the long term, will rise faster for having paid off more of the debt.

The first thing you have to do is to make the minimum payment on every card. This is regardless of your goals, as the worst thing you can have happen is for there to be fees for nonpayment.

What you do next depends on how much cash you have available. The general advice to pay off the highest APR first is good, since it saves you money in the long term. However, it ignores the grace period that takes place with paid off cards. Therefore, if you only have $400 left, go for the Amazon. That would bring it's balance down to 0, which would restore the grace period and effectively have a 21% interest reduction in future charges to that card. You have to keep the card paid off, but it is a big help to have that grace period back. If you instead paid your highest APR, you would only have a 5% interest reduction on the paid off amount.

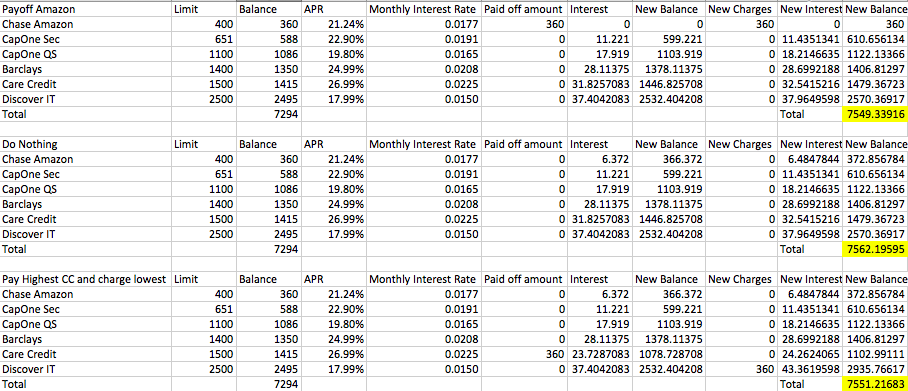

Here is a quick spreadsheet to show the difference between paying $360 to Amazon and then charging $360 in expenses to that card, doing nothing, or paying $360 to your highest APR and then charging to your lowest:

Now, this doesn't mean that you should pay Amazon first, If you can't take it to zero, put it towards the highest APR. If you instead had $600, you would be better off with the CapOne Secured card. More than that, you'll have to start playing with the numbers, but in general, you want to pay off the highest dollar amounts of cards possible. There is some variance with the exact values that are best as to whether you should pay off two high APR cards or one low APR card, but those require the exact numbers that you plan on using. and what you're going to charge in the next month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice: Paying down cards

Personal finance is just that... personal. I would pay off the two smallest cards because let's be real... they are pretty tiny and you'll feel better have those out of the way.

Then I would tackle the Care Credit because -- yikes -- almost 27% interest! And then go from there.

How much do you have to put towards the cards each month? Do you have a complete, working budget? I would get a budget in order to prevent carrying credit card balances in the future.