- myFICO® Forums

- Types of Credit

- Credit Cards

- Advice on next move for credit?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Advice on next move for credit?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice on next move for credit?

I can't honestly say i'm too worried about 2-5 pts. When it comes time for a morgage? i'll be way more concerned.

Now, since he forgot to reply to my question about both cards.. I'll skip it.

Would you guys recommend a cold apply? Or wait for a pre-q in the mail. AMEX for expample hammers me with pre-q's.. like every other day.

I haven't seen a chase on in quite some time, but I've recieved plenty of those as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice on next move for credit?

Just cold apply. No need to wait for a 'pre approval'

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice on next move for credit?

Unless there's something lurking in your reports that you don't know about, I think you would have no trouble getting an instant approval for the Amex. The one Fico you do have is about 80 points higher than my equivalent Fico, and they approved me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice on next move for credit?

@Anonymous wrote:Hey all, newly registered here.. I've been lurking around for a while, but I have a question for you guys now.

I did a light forum search, found nothing really remarkably fitting for my question.

So.. I'm kinda stuck on what my next move should be. Here's a little backstory;

Many moons ago when I was younger, my credit was damaged pretty badly by a huge fiasco with Compass bank. Now, I paid off what I could when I could, and let the rest slide from my credit repots.

Fast forward a few years to current day;

I have 3 revolving credit accounts, and a car loan.

5k CL Discover IT.

5k CL Capital One Quicksilver ONE

3.5k CL visa from my credit union

roughly 18k left on my car loan(was like 24k when I started with it a year and a half ago)

All of my cards are under 5% utilization. I have 0 missed/late payments in my history.

One of the problems with my history however, is that my oldest revolving account(capital one) is like.. 3 or 4 years old(so not very old really)

Two of my accounts were opened within the last 2 years(Discover and my car loan(loan is almost 2 years old, discover is ~1yr))

My income is ~70-80k yearly(not counting spouse) and rent is like 600$.

I have never checked my reports via myfico, but discover shows me a fico on each statement(773(FICO)) and so does cap one(737(Transunion new account model))

Now, my current puzzle.. is that neither of those scores has moved in like 4 months.

I know i'm on the decent track for credit, I just feel like there is more I should be doing. Would you guys recommend another card? I've kicked around the idea of an amex(The blue cash everyday looks promising)

I would love some advice(cards? stay with what I have? etc)

Let me know if you need/want any other info!

-Anatreth

*edit to change/reflect dates)

Do you need or have use for another credit card?

Don't go after what you can get approved for. Apply for what you can use and need.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice on next move for credit?

Apply for what ever you want. Anyone will approve you. Maybe Penfed or AMEX?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice on next move for credit?

Your FICO score is better than mine ever was, your income is better, your rent is lower... And I don't have any installment loans to boost my score (like your car loan). I've only had credit for 3 years, and the first year of that was a single secured card. Yet, by choosing cards with the best cash back rewards for my spending categories (see my signature) and no annual fees, and being smart about when and how to apply, I've done very well. Don't choose cards based on what the companies send you in the mail, those won't be the cards with the best rewards.

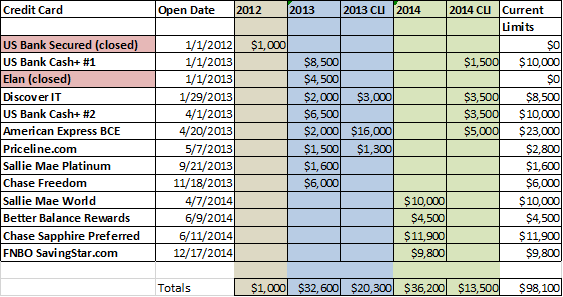

As you can see, I have 11 open credit cards, $98,100 in total credit limits. Bank cards with $10,000 limits or more are "Premium Bankcard accounts", and you want some of those to eventually improve your FICO scores. The Cash+ cards were product changes from other US Bank cards.

You should figure out how much you typicaly spend in each category. and prioritize getting the bigger categories covered with good cards first. Expect your FICO score to plummet, it will recover and your credit reports will be stronger for having more depth and breadth of credit cards reporting. Of course, this assumes you aren't late with payments.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice on next move for credit?

Ok, so i've pretty much settled on the AMEX BCE. I figure, the chase freedom is the same thing as my Discover.. so why would I need a second of the same card right now?

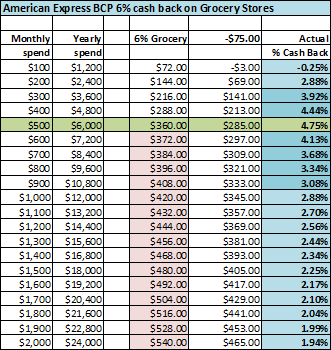

Now, the real question I can't decide on.. is; is it worth it to pay the 75$ AF for the Amex BCPreferred? It seems to have a higher benefit to Cashback (6% at grocery stores? yes please)

(ironically, I just got *another* pre-q for the amex everyday credit(told you they hounded me haha)

Also, from what i've read.. amex would be the better choice due to higher/faster CLI?

Final thoughts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice on next move for credit?

From what I've been reading, a Chase Freedom could be a nice complement to you Discover, as the rotating categories may differ each quarter. Something to think about.

AU Cards:

Store Cards:

Auto loan:

Actively rebuilding since August 2022.

Starting FICO 8 scores (8/24/2022):

Current FICO 8 scores (2/12/2024):

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice on next move for credit?

@Anonymous wrote:Ok, so i've pretty much settled on the AMEX BCE. I figure, the chase freedom is the same thing as my Discover.. so why would I need a second of the same card right now?

Now, the real question I can't decide on.. is; is it worth it to pay the 75$ AF for the Amex BCPreferred? It seems to have a higher benefit to Cashback (6% at grocery stores? yes please)

(ironically, I just got *another* pre-q for the amex everyday credit(told you they hounded me haha)

Also, from what i've read.. amex would be the better choice due to higher/faster CLI?

Final thoughts?

Are you looking for a card that will eventually give you a high credit limit, or a card that will give you the best cash back for your spending patterns? Those are separate goals.

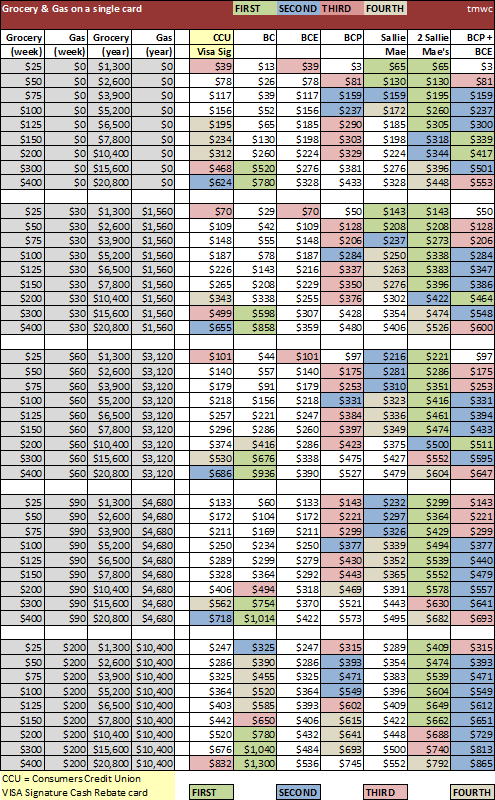

I prefer to use 2 Sallie Mae Rewards MasterCards ( I applied 6 months apart). However, you should estimate your spending in the Grocery Store and Gas Station categories, and then choose your preferred solution from this next chart.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice on next move for credit?

@Anonymous wrote:Ok, so i've pretty much settled on the AMEX BCE. I figure, the chase freedom is the same thing as my Discover.. so why would I need a second of the same card right now?

Now, the real question I can't decide on.. is; is it worth it to pay the 75$ AF for the Amex BCPreferred? It seems to have a higher benefit to Cashback (6% at grocery stores? yes please)

(ironically, I just got *another* pre-q for the amex everyday credit(told you they hounded me haha)

Also, from what i've read.. amex would be the better choice due to higher/faster CLI?

Final thoughts?

In addition to what others have said, I would suggest you look for prequalified offers on the AMEX site, and on the Cardmatch tool, which AMEX does participate in. You could get a signup bonus for the BCE that can surprise you. When I got my first AMEX, it was a regular no annual fee Blue Sky that I got an offer for $400 bonus when you spend $1000 in the first three months. I did not want the Blue Sky, i wanted the BCE, so I just applied for the Blue Sky and then changed over to the BCE in a few months. So look into what offers you have, some of these can be very lucrative. If you have an offer for a card that you already wanted to get, that's free money!

On a separate note, TheManWhoCan is correct, generally speaking Sallie Mae is a better deal than the BCE for most people.