- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Amer MR vs Chase UR for royalty travel rewards...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amer MR vs Chase UR for loyalty travel rewards/points

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amer MR vs Chase UR for royalty travel rewards/points

The Hyatt Card does not have a FTF. Also the fact that you can get two free nights at ANY Hyatt is hella worth it. I know interational Hyatt's can get really pricey at around $800+ a night for the very luxurious ones. Next, Hyatt points have a great value at around 1.5c per point and typically can go up to 3c per point. Also you do get a free night every anniversary year at any category 1-4 Hyatt for only a $75 Annual Fee. There are are several category 3 and 4 Hyatt where this could come at a great value. For example, Grand Hyatt San Antonio (Category 3) is typically around $200 a night except for Sundays, and you really only paid $75. There are probably better examples out there but I'm more familiar with Grand Hyatt San Antonio. Lastly, you do get automatically Platinum status.

Edit: Also if you do decide to apply for the Hyatt card, If you pretend to make a reservation through hyatt, there should be an ad on the page that will also give a $50 statement on top of the free nights after meeting the spend requirement. (You do not need to make a reservation).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amer MR vs Chase UR for royalty travel rewards/points

@Jerryf08 wrote:The Hyatt Card does not have a FTF. Also the fact that you can get two free nights at ANY Hyatt is hella worth it. I know interational Hyatt's can get really pricey at around $800+ a night for the very luxurious ones. Next, Hyatt points have a great value at around 1.5c per point and typically can go up to 3c per point. Also you do get a free night every anniversary year at any category 1-4 Hyatt for only a $75 Annual Fee. There are are several category 3 and 4 Hyatt where this could come at a great value. For example, Grand Hyatt San Antonio (Category 3) is typically around $200 a night except for Sundays, and you really only paid $75. There are probably better examples out there but I'm more familiar with Grand Hyatt San Antonio. Lastly, you do get automatically Platinum status.

Edit: Also if you do decide to apply for the Hyatt card, If you pretend to make a reservation through hyatt, there should be an ad on the page that will also give a $50 statement on top of the free nights after meeting the spend requirement. (You do not need to make a reservation).

That's some pretty sweet perks, and definitely worth it if you travel often to places where Hyatt has locations. I definitely agree that Hyatt points can be extremely valuable, and that card definitely brings awesome perks to the table!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amer MR vs Chase UR for royalty travel rewards/points

@enxinas wrote:1.) I actually have the Double Cash as well, but I used it for the 0% 15 month apr.. I'll check the Fidelity Amex.

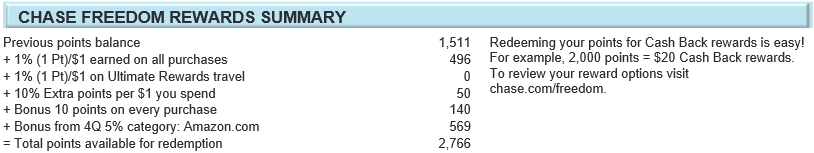

and here's a screenie of my recent statement. I feel like it's the same.

So you are still on the "old" program which was meant to end by the end of 2013. Good stuff!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amer MR vs Chase UR for royalty travel rewards/points

@longtimelurker wrote:

@enxinas wrote:1.) I actually have the Double Cash as well, but I used it for the 0% 15 month apr.. I'll check the Fidelity Amex.

and here's a screenie of my recent statement. I feel like it's the same.

So you are still on the "old" program which was meant to end by the end of 2013. Good stuff!

Wait...LTL, if I don't see the "+10% Extra points per $1 you spend" line on my statements (have had Chase checking since 9/13), will I not get my 10% dividend for 2014? ....Chase is about to get a nastygram...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amer MR vs Chase UR for royalty travel rewards/points

@Jerryf08 wrote:The Hyatt Card does not have a FTF. Also the fact that you can get two free nights at ANY Hyatt is hella worth it. I know interational Hyatt's can get really pricey at around $800+ a night for the very luxurious ones. Next, Hyatt points have a great value at around 1.5c per point and typically can go up to 3c per point. Also you do get a free night every anniversary year at any category 1-4 Hyatt for only a $75 Annual Fee. There are are several category 3 and 4 Hyatt where this could come at a great value. For example, Grand Hyatt San Antonio (Category 3) is typically around $200 a night except for Sundays, and you really only paid $75. There are probably better examples out there but I'm more familiar with Grand Hyatt San Antonio. Lastly, you do get automatically Platinum status.

Edit: Also if you do decide to apply for the Hyatt card, If you pretend to make a reservation through hyatt, there should be an ad on the page that will also give a $50 statement on top of the free nights after meeting the spend requirement. (You do not need to make a reservation).

Wish I knew this trick when apping.

Starting Score: EQ: 714, TU 684

Current Score: EQ: 725 7/30/13, TU 684 6/2013, Exp 828 5/2018, Last App 8/5/17

Goal Score: 800 (Achieved!) In garden until Sepetember 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amer MR vs Chase UR for royalty travel rewards/points

@red259 wrote:

@Jerryf08 wrote:The Hyatt Card does not have a FTF. Also the fact that you can get two free nights at ANY Hyatt is hella worth it. I know interational Hyatt's can get really pricey at around $800+ a night for the very luxurious ones. Next, Hyatt points have a great value at around 1.5c per point and typically can go up to 3c per point. Also you do get a free night every anniversary year at any category 1-4 Hyatt for only a $75 Annual Fee. There are are several category 3 and 4 Hyatt where this could come at a great value. For example, Grand Hyatt San Antonio (Category 3) is typically around $200 a night except for Sundays, and you really only paid $75. There are probably better examples out there but I'm more familiar with Grand Hyatt San Antonio. Lastly, you do get automatically Platinum status.

Edit: Also if you do decide to apply for the Hyatt card, If you pretend to make a reservation through hyatt, there should be an ad on the page that will also give a $50 statement on top of the free nights after meeting the spend requirement. (You do not need to make a reservation).

Wish I knew this trick when apping.

Last time i checked wasn't any hyatt i thought it was only category 1-5 that you were eligible to get free stay with, so that doesn't include most park hyatt and andaz hotels.

Edit: Looks like you are eligible for 2 free night at any hyatt, when did they change that, the additional free night was for category 1-4 hotel, interesting.

EX Fico 804 11/16/16 Fako 800 Credit.com 11/16/16

EQ SW bank enhanced 11/16/16 839 CK fako 822 11/16/16

TU Fico discover 10/19/16 814 Fako 819 Creditkarma 11/16/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amer MR vs Chase UR for royalty travel rewards/points

@mongstradamus wrote:

@red259 wrote:

@Jerryf08 wrote:The Hyatt Card does not have a FTF. Also the fact that you can get two free nights at ANY Hyatt is hella worth it. I know interational Hyatt's can get really pricey at around $800+ a night for the very luxurious ones. Next, Hyatt points have a great value at around 1.5c per point and typically can go up to 3c per point. Also you do get a free night every anniversary year at any category 1-4 Hyatt for only a $75 Annual Fee. There are are several category 3 and 4 Hyatt where this could come at a great value. For example, Grand Hyatt San Antonio (Category 3) is typically around $200 a night except for Sundays, and you really only paid $75. There are probably better examples out there but I'm more familiar with Grand Hyatt San Antonio. Lastly, you do get automatically Platinum status.

Edit: Also if you do decide to apply for the Hyatt card, If you pretend to make a reservation through hyatt, there should be an ad on the page that will also give a $50 statement on top of the free nights after meeting the spend requirement. (You do not need to make a reservation).

Wish I knew this trick when apping.

Last time i checked wasn't any hyatt i thought it was only category 1-5 that you were eligible to get free stay with, so that doesn't include most park hyatt and andaz hotels.

Edit: Looks like you are eligible for 2 free night at any hyatt, when did they change that, the additional free night was for category 1-4 hotel, interesting.

When I apped a year ago it was still 2 free nights, I'm about to hit my anniversary. I'm not sure if maybe it was different prior to that. I know the sign on bonus for Marriot includes a free category 1-5 after sign up, and free category 1-4 at anniversary.

I also wish I knew about the $50 statement prior to applying, I didn't find out till afterwards as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amer MR vs Chase UR for royalty travel rewards/points

@Jerryf08 wrote:

@mongstradamus wrote:

@red259 wrote:

@Jerryf08 wrote:The Hyatt Card does not have a FTF. Also the fact that you can get two free nights at ANY Hyatt is hella worth it. I know interational Hyatt's can get really pricey at around $800+ a night for the very luxurious ones. Next, Hyatt points have a great value at around 1.5c per point and typically can go up to 3c per point. Also you do get a free night every anniversary year at any category 1-4 Hyatt for only a $75 Annual Fee. There are are several category 3 and 4 Hyatt where this could come at a great value. For example, Grand Hyatt San Antonio (Category 3) is typically around $200 a night except for Sundays, and you really only paid $75. There are probably better examples out there but I'm more familiar with Grand Hyatt San Antonio. Lastly, you do get automatically Platinum status.

Edit: Also if you do decide to apply for the Hyatt card, If you pretend to make a reservation through hyatt, there should be an ad on the page that will also give a $50 statement on top of the free nights after meeting the spend requirement. (You do not need to make a reservation).

Wish I knew this trick when apping.

Last time i checked wasn't any hyatt i thought it was only category 1-5 that you were eligible to get free stay with, so that doesn't include most park hyatt and andaz hotels.

Edit: Looks like you are eligible for 2 free night at any hyatt, when did they change that, the additional free night was for category 1-4 hotel, interesting.

When I apped a year ago it was still 2 free nights, I'm about to hit my anniversary. I'm not sure if maybe it was different prior to that. I know the sign on bonus for Marriot includes a free category 1-5 after sign up, and free category 1-4 at anniversary.

I also wish I knew about the $50 statement prior to applying, I didn't find out till afterwards as well.

Marriott is 1-4 first year, 1-5 thereafter.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amer MR vs Chase UR for royalty travel rewards/points

@longtime_lurker wrote:

@longtimelurker wrote:

@enxinas wrote:1.) I actually have the Double Cash as well, but I used it for the 0% 15 month apr.. I'll check the Fidelity Amex.

and here's a screenie of my recent statement. I feel like it's the same.

So you are still on the "old" program which was meant to end by the end of 2013. Good stuff!

Wait...LTL, if I don't see the "+10% Extra points per $1 you spend" line on my statements (have had Chase checking since 9/13), will I not get my 10% dividend for 2014? ....Chase is about to get a nastygram...

LT_L: there is/are two programs: the old one, which gives a 10% bonus on each purchase (i.e. 1.1 points per $, PLUS 10 points per purchase, regardless of amount). This encouraged people to make lots of small purchases, and in extremem cases lots and lots of microtransactions (so 100 1c purchases would gain you 1000 points for the 100 purchases plus 1.1 points for the purchase, so over $10 for a $1 total).

The new program is 10% bonus all all points. For some, this is better because you get the bonus on the extra 5x points as well. And stops abuse/clever manipulation.

So if you don't have those 10% Extra points per $1 and 10 points for every purchase, that means you are on the new program and will get the 10% bonus for 2014.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amer MR vs Chase UR for royalty travel rewards/points

@longtimelurker wrote:

@longtime_lurker wrote:

@longtimelurker wrote:

@enxinas wrote:1.) I actually have the Double Cash as well, but I used it for the 0% 15 month apr.. I'll check the Fidelity Amex.

and here's a screenie of my recent statement. I feel like it's the same.

So you are still on the "old" program which was meant to end by the end of 2013. Good stuff!

Wait...LTL, if I don't see the "+10% Extra points per $1 you spend" line on my statements (have had Chase checking since 9/13), will I not get my 10% dividend for 2014? ....Chase is about to get a nastygram...

LT_L: there is/are two programs: the old one, which gives a 10% bonus on each purchase (i.e. 1.1 points per $, PLUS 10 points per purchase, regardless of amount). This encouraged people to make lots of small purchases, and in extremem cases lots and lots of microtransactions (so 100 1c purchases would gain you 1000 points for the 100 purchases plus 1.1 points for the purchase, so over $10 for a $1 total).

The new program is 10% bonus all all points. For some, this is better because you get the bonus on the extra 5x points as well. And stops abuse/clever manipulation.

So if you don't have those 10% Extra points per $1 and 10 points for every purchase, that means you are on the new program and will get the 10% bonus for 2014.

I don't understand. How do you get that 10% extra pts? Old program?