- myFICO® Forums

- Types of Credit

- Credit Cards

- American Express Blue Cash Everyday, questions

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

American Express Blue Cash Everyday, questions

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Blue Cash Everyday, questions

@clocktick wrote:Congratulations!!

That was almost painless, right?

I was terrified. lol, seriously. Now if I can figure out which card to get for utilities...I will be all done credit card shopping for a long, long time. Of course I said that back in October when I apped for Discover and Citi too, lol. Credit is frigtening AND addicting.

Closed on home Jan 30, 2013. Yay!

Capital One (secured) $1000.00 | Capital One (former Orchard Bank) $500.00 | First Premier $500.00 | Credit One Bank $750.00 | Wal-Mart $3550.00 | Citi Thank You Preferred $6,800.00 | Discover It $4,800.00 | AMEX BCE $4,500.00

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Blue Cash Everyday, questions

I use my barclays rewards for 2x on utilities. I've never really shopped around for utility rewards cards tho so I'm sure there's better out there.

edit: also congrats on the amex approval!!! I know that's a great feeling!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Blue Cash Everyday, questions

I was just approved for this card with a score of 699 from TU (its the only on e they pulled) but my utilaztion is low with my other credit cards. I do have a lot of inquiries. 11. but i still git approved for 4.5K which to be honest I wasnt even expecting.

Target - 300 / Chase Freedom - 500 / American Express Blue Cash - 4,500 / Navy Federal Flag Ship - 12,000 / Care Credit - 5,200

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Blue Cash Everyday, questions

I have an EX score of 714 and a TU score of 744. I have CSP $9,500cli, Marriot $5,000cli, DiscoverIT $3,000cli, Barclays US Airways Premier $2,500cli, ,and wells fargo visa $2,000cli. Average age of accounts is just under one year. No baddies and income at $60k. Very cheap car loan and no mortgage (rent). 4-5 HPs on all reports.

Instant denial, no 7-10 day message, with the only reason given being age of accounts.

I am very discouraged with AMEX. I'm trying to nurse my AAOA which is why I wanted an AMEX so I would have backdating function. I love my Chase cards but I wanted to be able to backdate... so YMMV but that was my experience with them and now I won't apply for awhile.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Blue Cash Everyday, questions

NEED ADVICE WHAT CARD SHOULD I APPLY FOR: BCE OR BCP

I HAVE A CREDIT HISTORY ABOUT 8 MONTHS AND EX (CS) 706, TU (CK) 719 AND FICO (DISCOVER) 720

I DO HAVE 4 CREDIT CARDS

- Capital One Quicksilver: $2000

- BankAmericard Cash Rewards: $1000

- Discover: $650

- Chase Freedom: $2200 (recently approved and not reported to credit report yet)

I do have 20 inquiries on EX and 17 on TU. This happened because I applied for an auto loan which I didn't get approved.

WHICH CARD SHOULD I APPLY OR

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Blue Cash Everyday, questions

@Anonymous wrote:NEED ADVICE WHAT CARD SHOULD I APPLY FOR: BCE OR BCP

I HAVE A CREDIT HISTORY ABOUT 8 MONTHS AND EX (CS) 706, TU (CK) 719 AND FICO (DISCOVER) 720

I DO HAVE 4 CREDIT CARDS

- Capital One Quicksilver: $2000

- BankAmericard Cash Rewards: $1000

- Discover: $650

- Chase Freedom: $2200 (recently approved and not reported to credit report yet)

I do have 20 inquiries on EX and 17 on TU. This happened because I applied for an auto loan which I didn't get approved.

WHICH CARD SHOULD I APPLY OR

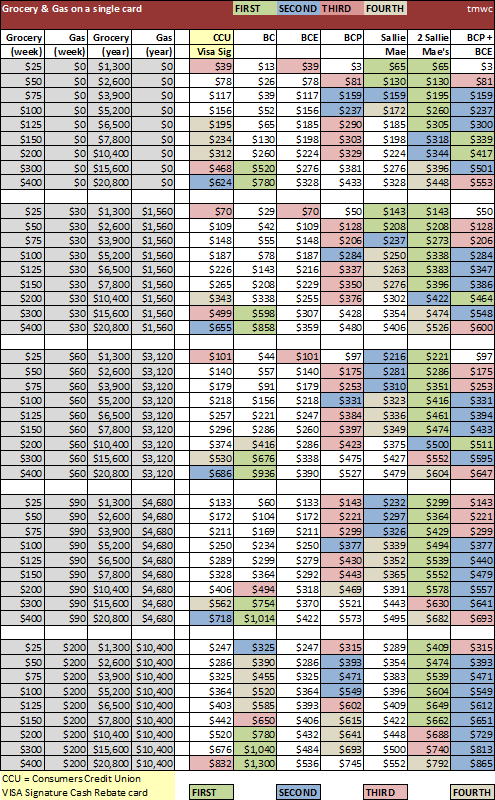

if you are trying to choose between bce and bcp. It really comes down to if you do enough spending to make BCP worth it. If you just want to get an amex card to get your foot in your door, then i guess BCE would be ok to get, but with that being said BCE as far as cash back card is trumped by non amex cards like Sallie Mae in almost every possible way.

EX Fico 804 11/16/16 Fako 800 Credit.com 11/16/16

EQ SW bank enhanced 11/16/16 839 CK fako 822 11/16/16

TU Fico discover 10/19/16 814 Fako 819 Creditkarma 11/16/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Blue Cash Everyday, questions

Thank you for quick reply!

Do you think I can get approved with the credit history and inquiries I have on my report?

I did applied for DoubleCash CitiBank card. my application was declined

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Blue Cash Everyday, questions

@Anonymous wrote:Thank you for quick reply!

Do you think I can get approved with the credit history and inquiries I have on my report?

I did applied for DoubleCash CitiBank card. my application was declined

well my honest opinion is your aaoa is an bit short, and even if those hp are all auto loan related i think that may be holding you back. I probably would wait maybe up to 9 months and reassess your situation then. I think BCP and BCE have saw UW criteria.

EX Fico 804 11/16/16 Fako 800 Credit.com 11/16/16

EQ SW bank enhanced 11/16/16 839 CK fako 822 11/16/16

TU Fico discover 10/19/16 814 Fako 819 Creditkarma 11/16/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Blue Cash Everyday, questions

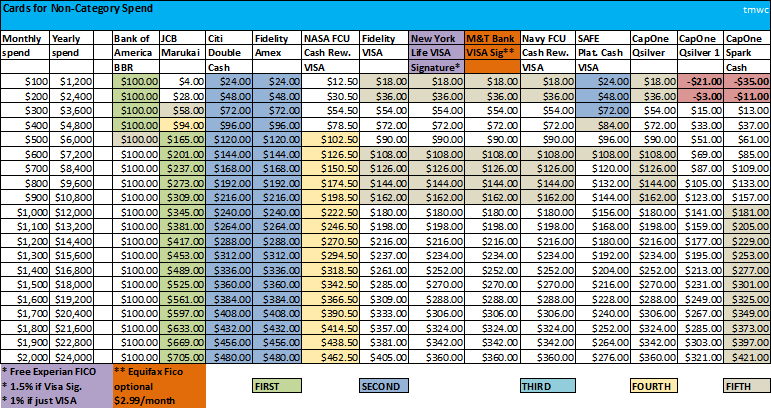

Wow, that 7 month old chart brings back the memories ![]()

Lets see some more current data

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Blue Cash Everyday, questions

@1_2 wrote:

@clocktick wrote:The other factors are basically what any of the card companies look for - income, debt, payment history, length of history, etc.

When one is immediately approved it is decided by a computer. I really don't think you have anything to worry about.

Okay....I took the leap and was immediately approved online with a limit of 4,500.00. 500.00 I can use immediately online if I chose to..but I wont. Whew! I get so nervous about these things...I'm still shaking, lol. I wouldnt have had the nerve to apply if it hadn't been for all the postive feed back I got on this forum. I also wouldnt have known about the rewards for groceries and gas if not for this great forum. I can't wait until the 61 days are up if I can get the credit limit increases so many of you have gotten it will then be my highest limit card, even if it just doubles. I'm tickled pink. Thank you EVERYONE!

I am so happy for you!

Last App 10/14. FICO's: AMEX Ex 846, BarclayTU08 815.FAKOs:CreditKarma 775,CS score 771.BofA 5400,Target $5000,Barnes $8500,Amex $22k