- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: American Express targeted 6.99% APR for 12 bil...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

American Express targeted 6.99% APR for 12 billing cycles

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

American Express targeted 6.99% APR for 12 billing cycles

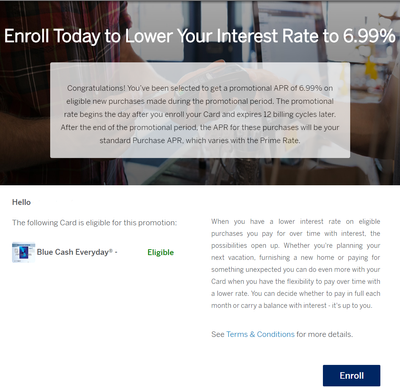

One of my American Express cards showed a pop-up when I signed in to check my account. My Blue Cash Everyday displayed this:

Here are the nitty gritty details

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express targeted 6.99% APR for 12 billing cycles

@Themanwhocan wrote:One of my American Express cards showed a pop-up when I signed in to check my account. My Blue Cash Everyday displayed this:

Here are the nitty gritty details

You can wait until jan to take the offer I believe. Only downside would be for a year you would be unable to take any permanent APR reductions. Have seen quite a few 0% for 6 month offers on charge and revolvers. But this is not too shabby. However, and no offense, since I do look up to you so much, I am sure you are well aware that many folks were able to get 6.74% or less as permanent apr via chat. That seems to have slowed down and been replaced with offers like these. Citi too.

I would say if you have had no success in perm reductions in the last 6 months, ask again, then wait a few days before this offer expires and ask for a permanent reduction if you are anywhere close to this offer or not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express targeted 6.99% APR for 12 billing cycles

Yes, I only take permanent reductions myself, since I don't carry a balance. But for anyone that was planning to carry holiday spending on a credit card, they might find an offer like this interesting.

I don't use my Amex cards enough, so I could only get my APR down to 10.49% so far, though they did increase my credit limit to $40k.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express targeted 6.99% APR for 12 billing cycles

Sweet! I've been off the grid for a week in Hawaii, getting ready to check out with my SPG card, and it's the one which got this offer. So it may be that the charges that go on today get the 6.99% rate instead of the 10.49% regular rate.

I got got this rate two years ago on my Delta card, but thought it was only given if the card was on the standard high APR rates. It may also be influenced by AMEX trying to promote card usage in the face of competition.

For or what it is worth, the rate should be good until the items are paid off, not just expiring at the end of 12 months. I got a credit on my account this year after AMEX went back to recalculate that promo APR and extended the low interest result.

Thanks for posting!

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express targeted 6.99% APR for 12 billing cycles

Thanks for this. I have been meaning to start calling card issuers for decreased interest rates. I'm currently in my 12 month 0% period for my AMEX BCP. After the period ends, I'll ask for a rate reduction.I'd be happy with a sub 10% rate. My Citi Prestige is currently 8.74%. I was approved for a Chase Sapphire Reserve card for 23%. That's just insane. While I don't carry a balance, that's still insane. I will ask for a rate reduction on that pretty soon.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express targeted 6.99% APR for 12 billing cycles

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express targeted 6.99% APR for 12 billing cycles

@NRB525 wrote:Sweet! I've been off the grid for a week in Hawaii, getting ready to check out with my SPG card, and it's the one which got this offer. So it may be that the charges that go on today get the 6.99% rate instead of the 10.49% regular rate.

I got got this rate two years ago on my Delta card, but thought it was only given if the card was on the standard high APR rates. It may also be influenced by AMEX trying to promote card usage in the face of competition.

For or what it is worth, the rate should be good until the items are paid off, not just expiring at the end of 12 months. I got a credit on my account this year after AMEX went back to recalculate that promo APR and extended the low interest result.

Thanks for posting!

I agree totally! It should be good until they are paid off but unfortunately the language states otherwise. Maybe the offer was different previously?

My credit union does that which is great. 2.9 pct for a year but any purchases or advances made the first year have until they are paid off before they return to a fixed rate of 7.9%.

I saw 6.99% for 12 show up on my delta but I am not taking it since its at 8.49%...I envision levaraging an APR reduction on my 16ish pct ED or taking the bait on a targeted BCE offer with 0 for 15 then 13.24%. I had previously thought I'd be rooting SPG but it looks like theres more longevity on another card. I sure wish amex would let people swap rates on cards, that would be sweet. So therein reinforces TMWC's statement of them doing it for card promotion most likely! Super happy I got multiple 2500 MRs after 100 spend on verizon, hoping that I am able to get more than one. Will be a nice follow up to my 10% off up to $30 back on verizon. Also got the same offer for cable payments.

Wonder if anyone has seen 0% for 12 months on a revolver post promo? Have seen 0 for 12 and 0 for 6 on charge cards quite a bit on charges >100.