- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Amex BCE and Fred Meyer

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex BCE and Fred Meyer

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex BCE and Fred Meyer

@UncleB wrote:

@Anonymous wrote:

@CribDuchess wrote:

@Anonymous wrote:Not familiar with Fred Meyer, but not every grocery store will code as a super markets. The card does not give 3% (or 6% for the BCP) in grocery stores. It only does so for super markets. Even the Sallie Mae card does not code all grocery stores as super markets. When shopping at smaller grocery stores, I don't always get 5% on my Sallie Mae, nor did I get 6% on my BCP when I had it. I sometimes shop in smaller asian stores for variety in my food and they almost never give me the 5% on my Sallie Mae.

TLDR: Grocery stores are not 3% on BCE. Only super markets will give you 3%. Not sure about Fred Meyer, but if it codes as grocery store, you probably are stuck with the 1%.

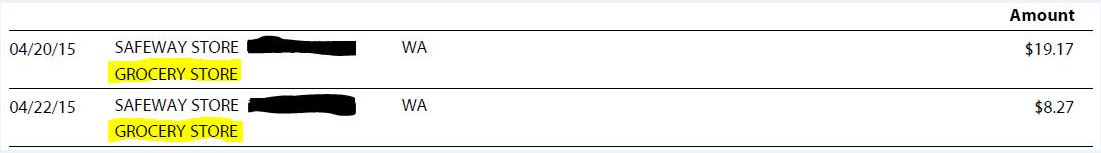

Grocery store, supermarket, what's the difference? I think they are splitting hairs. And, actually, I just checked my DH's statements for his BCE card that he opened in April, and he received 3% cash back on purchases categorized as "grocery store." My Fred Meyer purchase showed up as "grocery stores" rather than "grocery store".....so that "s" at the end is somehow the deal breaker? Doesn't make sense. But yes, I am aware that store coding can definitely have an impact on rewards. As always, YMMV.

Safeway reports as both Grocery Store and Supermarket so, even though it isn't showing the word Supermarket it is is reporting as such.

How does a business report as 'both'?

My understanding of MCCs is that a merchant's category is 'drilled down' to a single code. I'm aware that some stores might use different MCCs depending on which register is used (ex. Kroger gas island registers use 'gas' MCC, inside registers use 'grocery' MCC) but I was unaware a single transaction could simultaneously be two MCCs.

This is what appears in my Sallie Mae account:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex BCE and Fred Meyer

@Anonymous wrote:

@UncleB wrote:

@Anonymous wrote:

@CribDuchess wrote:

@Anonymous wrote:Not familiar with Fred Meyer, but not every grocery store will code as a super markets. The card does not give 3% (or 6% for the BCP) in grocery stores. It only does so for super markets. Even the Sallie Mae card does not code all grocery stores as super markets. When shopping at smaller grocery stores, I don't always get 5% on my Sallie Mae, nor did I get 6% on my BCP when I had it. I sometimes shop in smaller asian stores for variety in my food and they almost never give me the 5% on my Sallie Mae.

TLDR: Grocery stores are not 3% on BCE. Only super markets will give you 3%. Not sure about Fred Meyer, but if it codes as grocery store, you probably are stuck with the 1%.

Grocery store, supermarket, what's the difference? I think they are splitting hairs. And, actually, I just checked my DH's statements for his BCE card that he opened in April, and he received 3% cash back on purchases categorized as "grocery store." My Fred Meyer purchase showed up as "grocery stores" rather than "grocery store".....so that "s" at the end is somehow the deal breaker? Doesn't make sense. But yes, I am aware that store coding can definitely have an impact on rewards. As always, YMMV.

Safeway reports as both Grocery Store and Supermarket so, even though it isn't showing the word Supermarket it is is reporting as such.

How does a business report as 'both'?

My understanding of MCCs is that a merchant's category is 'drilled down' to a single code. I'm aware that some stores might use different MCCs depending on which register is used (ex. Kroger gas island registers use 'gas' MCC, inside registers use 'grocery' MCC) but I was unaware a single transaction could simultaneously be two MCCs.

This is what appears in my Sallie Mae account:

That's totally weird... if they do indeed differentiate between "Grocery Stores" and "Supermarkets" for reward purposes it makes no sense that a merchant can be both at the same time.

I'll add this to my list of Amex peculiarities... ![]()

Edit: I looked back and realized this is from your Sallie Mae account, so I guess it's not just Amex that is behaving weirdly with the classifications.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex BCE and Fred Meyer

@UncleB wrote:

@Anonymous wrote:

@UncleB wrote:

@Anonymous wrote:

Safeway reports as both Grocery Store and Supermarket so, even though it isn't showing the word Supermarket it is is reporting as such.

How does a business report as 'both'?

My understanding of MCCs is that a merchant's category is 'drilled down' to a single code. I'm aware that some stores might use different MCCs depending on which register is used (ex. Kroger gas island registers use 'gas' MCC, inside registers use 'grocery' MCC) but I was unaware a single transaction could simultaneously be two MCCs.

This is what appears in my Sallie Mae account:

That's totally weird... if they do indeed differentiate between "Grocery Stores" and "Supermarkets" for reward purposes it makes no sense that a merchant can be both at the same time.

I'll add this to my list of Amex peculiarities...

Edit: I looked back and realized this is from your Sallie Mae account, so I guess it's not just Amex that is behaving weirdly with the classifications.

The Sallie Mae isn't wierd, there's nothing I find really interesting about the words used.

If you used an AMEX that has some Grocery reward at Safeway, it's going to code just fine.

The real comparison is using the Sallie Mae and a rewards AMEX at Fred Meyer. The Sallie Mae will give the rewards. The AMEX will not.

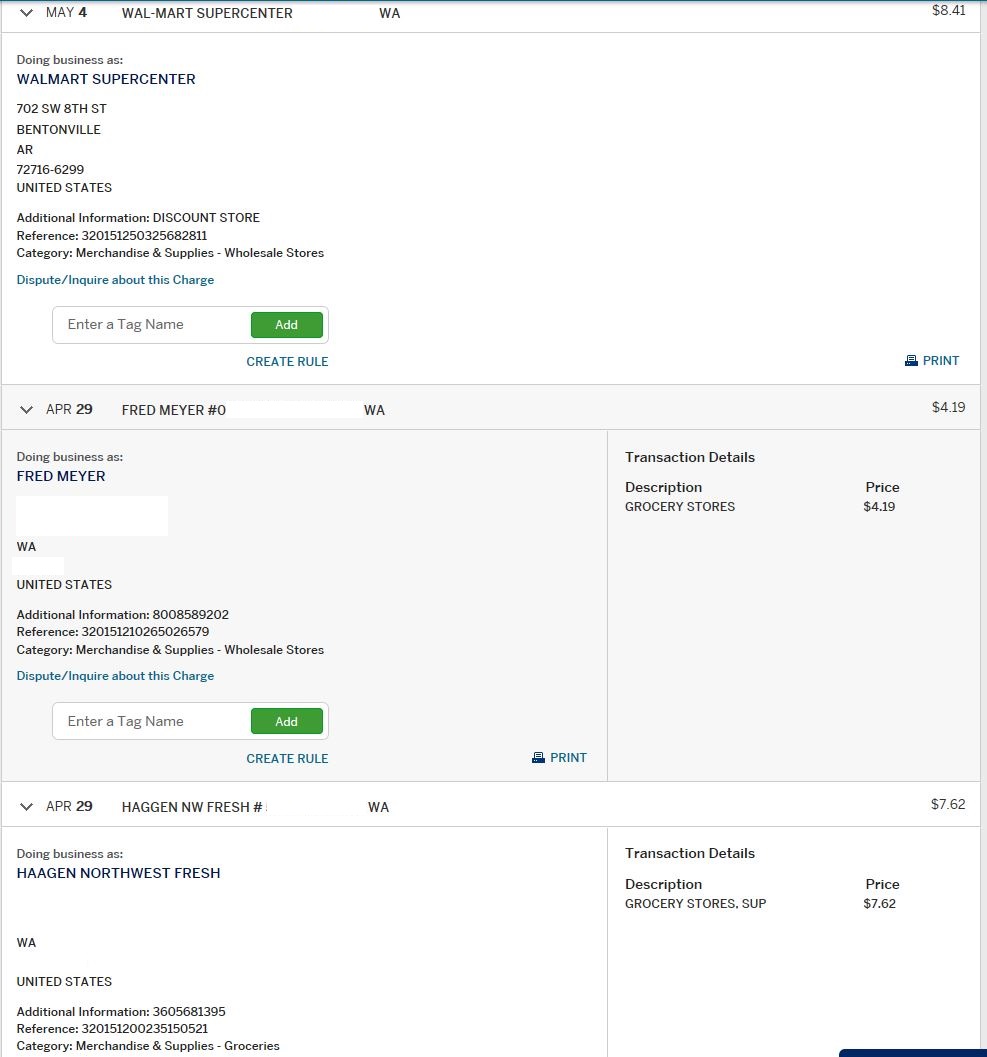

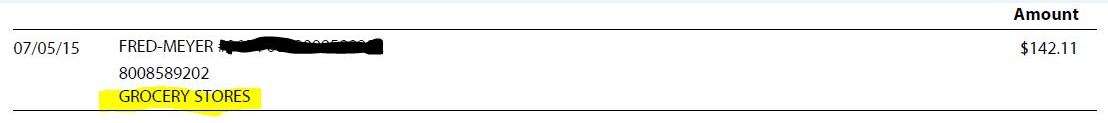

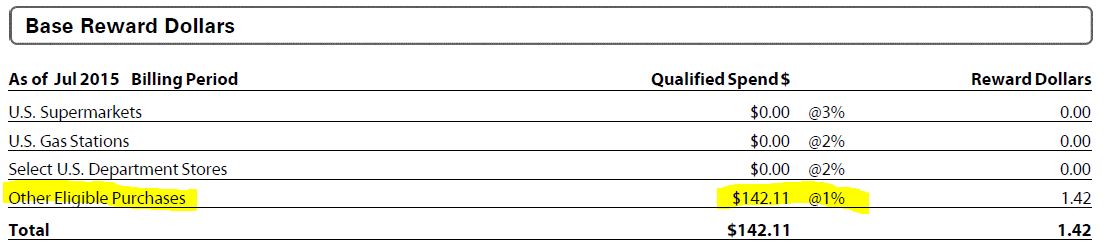

Here's the detail comparison from AMEX for WalMart, Fred Meyer, and Haggen, Haggen is the only one that scores as Grocery. The key is in the Category, not the Description on the right, which is the higher level, summary description on the short transaction list. Haggen, even here, is Grocery Stores and Supermarkets in the Description.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex BCE and Fred Meyer

@CribDuchess wrote:I was looking over my BCE statements and noticed that my grocery purchase at Fred Meyer only qualified for 1% cash back rather than 3%. Anyone else experience this with their BCE and Fred Meyer? The Amex statement categorizes the Fred Meyer purchase as "Grocery Stores." I'm a little bit annoyed that the purchase didn't earn the 3%, but I realize it's only a couple of bucks, so probably not worth calling Amex about it. I don't use my BCE much, as I prefer my Penfed and Sallie Mae for grocery purchases.

How weird, must be an Amex thing because I get 2% back with Barclays rewards and 5% back with sallie Mae at Fred Meyer. I too run about 1000.00 a month through Fred meyer. You may want to get a different card.

Starting Score: 460

Current Score: EQ 764, TU 764, EX 740,

BOA AK AIR 30,000, Discover IT 6300, Freedom 25,300, Barclays RMC 15,660, Ring 15,000, BCE 15,000, QS17,000,AARP 15,000, ChaseFU 8,000,AND A LOT MORE!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex BCE and Fred Meyer

yes the EDP MR point show the same breakdown on my e-statments

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex BCE and Fred Meyer

@UncleB wrote:

@petarap wrote:Even though your statement shows 'GROCERY STORES', when you go to your online account and go to that particular transaction and click on it (basically show details) it will have the category as

Category: Merchandise & Supplies - Wholesale StoresAh, I see what you mean there.

In your example, "Grocery Stores" is used as a descriptor, but the actual MCC is 'M&S - Wholesale', which is what drives the rewards rate. At a glance it seems deceptive, but like you point out, it's legit.

I've been fortunate that so far the grocery stores I've used have been coded as 'Grocery'. These credit card companies definitely keep us on our toes!

Not necessarily. Amex is famous for changing the code around to suit their needs. I was going to use at 7 eleven, because has conoco gas. I never swipe at the pump. They changed the coding to grocery for inside purchases. All my other cards that offer gas station bonus has code for gas station at same store. I called to complain, thought it was their oversight. I had researched prior to getting card, and that store counted. They tried to tell me the register inside sends a different code. It does not, I found out, if you pay inside, they don't know if you purchased gas. Hence, they only cover gas at the pump.

Only card I know that does that (better for them, I guess). However, I am feeling a little disenchanted with the whole Amex experience (still no fico score). If it wasn't for SimplyCash......

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex BCE and Fred Meyer

@Anonymous wrote:

@UncleB wrote:

@Anonymous wrote:

@CribDuchess wrote:

@Anonymous wrote:Not familiar with Fred Meyer, but not every grocery store will code as a super markets. The card does not give 3% (or 6% for the BCP) in grocery stores. It only does so for super markets. Even the Sallie Mae card does not code all grocery stores as super markets. When shopping at smaller grocery stores, I don't always get 5% on my Sallie Mae, nor did I get 6% on my BCP when I had it. I sometimes shop in smaller asian stores for variety in my food and they almost never give me the 5% on my Sallie Mae.

TLDR: Grocery stores are not 3% on BCE. Only super markets will give you 3%. Not sure about Fred Meyer, but if it codes as grocery store, you probably are stuck with the 1%.

Grocery store, supermarket, what's the difference? I think they are splitting hairs. And, actually, I just checked my DH's statements for his BCE card that he opened in April, and he received 3% cash back on purchases categorized as "grocery store." My Fred Meyer purchase showed up as "grocery stores" rather than "grocery store".....so that "s" at the end is somehow the deal breaker? Doesn't make sense. But yes, I am aware that store coding can definitely have an impact on rewards. As always, YMMV.

Safeway reports as both Grocery Store and Supermarket so, even though it isn't showing the word Supermarket it is is reporting as such.

How does a business report as 'both'?

My understanding of MCCs is that a merchant's category is 'drilled down' to a single code. I'm aware that some stores might use different MCCs depending on which register is used (ex. Kroger gas island registers use 'gas' MCC, inside registers use 'grocery' MCC) but I was unaware a single transaction could simultaneously be two MCCs.

This is what appears in my Sallie Mae account:

Shopped at that store for ten years (lived across the street). ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex BCE and Fred Meyer

@Imperfectfuture wrote:

@Anonymous wrote:

@UncleB wrote:

@Anonymous wrote:

@CribDuchess wrote:

@Anonymous wrote:Not familiar with Fred Meyer, but not every grocery store will code as a super markets. The card does not give 3% (or 6% for the BCP) in grocery stores. It only does so for super markets. Even the Sallie Mae card does not code all grocery stores as super markets. When shopping at smaller grocery stores, I don't always get 5% on my Sallie Mae, nor did I get 6% on my BCP when I had it. I sometimes shop in smaller asian stores for variety in my food and they almost never give me the 5% on my Sallie Mae.

TLDR: Grocery stores are not 3% on BCE. Only super markets will give you 3%. Not sure about Fred Meyer, but if it codes as grocery store, you probably are stuck with the 1%.

Grocery store, supermarket, what's the difference? I think they are splitting hairs. And, actually, I just checked my DH's statements for his BCE card that he opened in April, and he received 3% cash back on purchases categorized as "grocery store." My Fred Meyer purchase showed up as "grocery stores" rather than "grocery store".....so that "s" at the end is somehow the deal breaker? Doesn't make sense. But yes, I am aware that store coding can definitely have an impact on rewards. As always, YMMV.

Safeway reports as both Grocery Store and Supermarket so, even though it isn't showing the word Supermarket it is is reporting as such.

How does a business report as 'both'?

My understanding of MCCs is that a merchant's category is 'drilled down' to a single code. I'm aware that some stores might use different MCCs depending on which register is used (ex. Kroger gas island registers use 'gas' MCC, inside registers use 'grocery' MCC) but I was unaware a single transaction could simultaneously be two MCCs.

This is what appears in my Sallie Mae account:

Shopped at that store for ten years (lived across the street).

HOMIE!!! It's four blocks from my shop, and five blocks from home.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex BCE and Fred Meyer

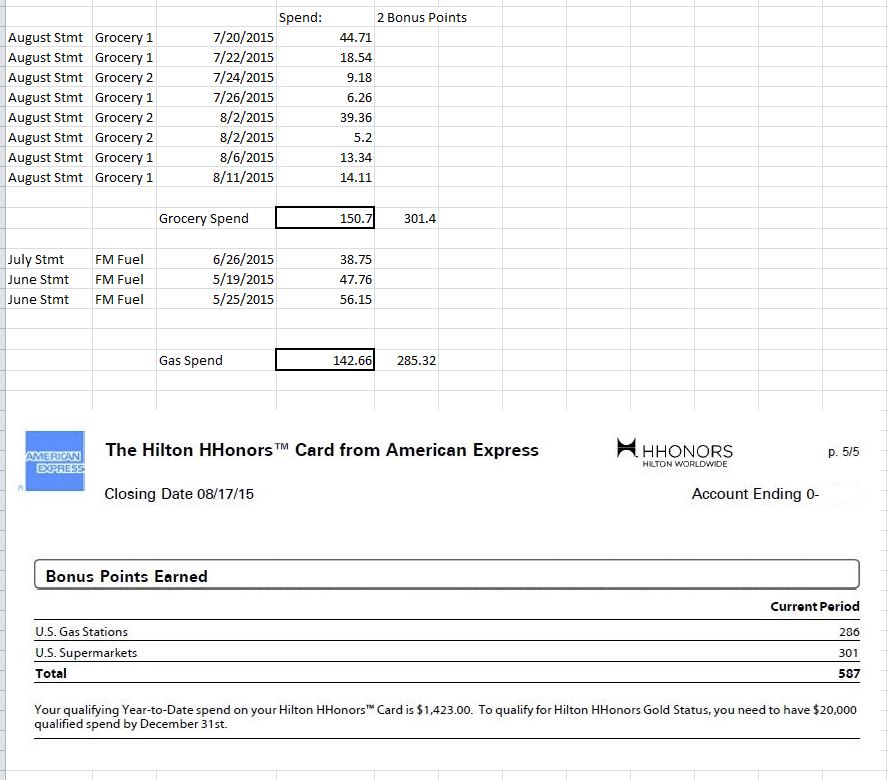

So, my AMEX Hilton HHonors card statement printed today. Because I had figured out that Fred Meyer Gas does not code as Gasoline on this card, I had not used it except strictly at grocery stores this statement cycle. No gas, no dining.

There is an extra section now, different from the first several months, where they call out the Bonus points categories for this period. I went back and checked, and AMEX has recoded my FM Fuel charges from prior months to add the 2 points for 5 points total.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex BCE and Fred Meyer

So the Walmart picture posted might help to understand a bit what they do. Some stores such as Walmart, Sams Club, Costco, Meijer, and Meyer are different than say Safeway, Publix, or Kroger in regards to being Supermarkets. Since they sell other things than just food, they could be classified as not being a Supermarket, but instead a grocery store. Furthermore, I think some banks, including maybe Amex, can seperate out purchases made by certain retailers for rewards purposes. Fred Meyer stores might even have different classifications too, since there are some which are Hypermarkets and others which are simply grocery stores. (From what I remember about them anyway from living in Seattle.)

Although I will admit that I find it weird that they don't consider Meyer and Meijer in the same categories! Meijer, according to them is a different category I guess than Meyer. I find the stores to be basically identical to each other! I was amazed how similar they are when I lived near Meyer, having also lived near Meijer for many years. The similarity of the pronunciation of the names also was interesting. (Oh I do realize they are in no way related! Meyer is part of Kroger and Meijer is owned by a family from Grand Rapids, MI.

Always follow these rules: Only take a HP for a new account. Always use the best rewards card for that reward category. Don't close a card unless you know you really should. Never use more than 35% of a credit limit. Recon as much and as best you can. Use the introductory period to the best advantage. Get the signup bonus. Whenever possible PIF or balance transfer so you pay less in interest. Never give an excellent rating when it is actually the norm. Always look for a discount as more is always better.

Always accept candy from strangers because they have the best candy or from people you know have good candy.