- myFICO® Forums

- Types of Credit

- Credit Cards

- Amex Platinum or Citi Prestige ??????

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex Platinum or Citi Prestige ??????

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Platinum or Citi Prestige ??????

@Anonymous wrote:

Who would have thought AAA was good for anything but roadside assistance and motel discounts.

Theme park tickets =]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Platinum or Citi Prestige ??????

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Platinum or Citi Prestige ??????

@Anonymous wrote:

Both of those. I guess I do remember AAA from back when it was still routine to carry a tool kit in your car.

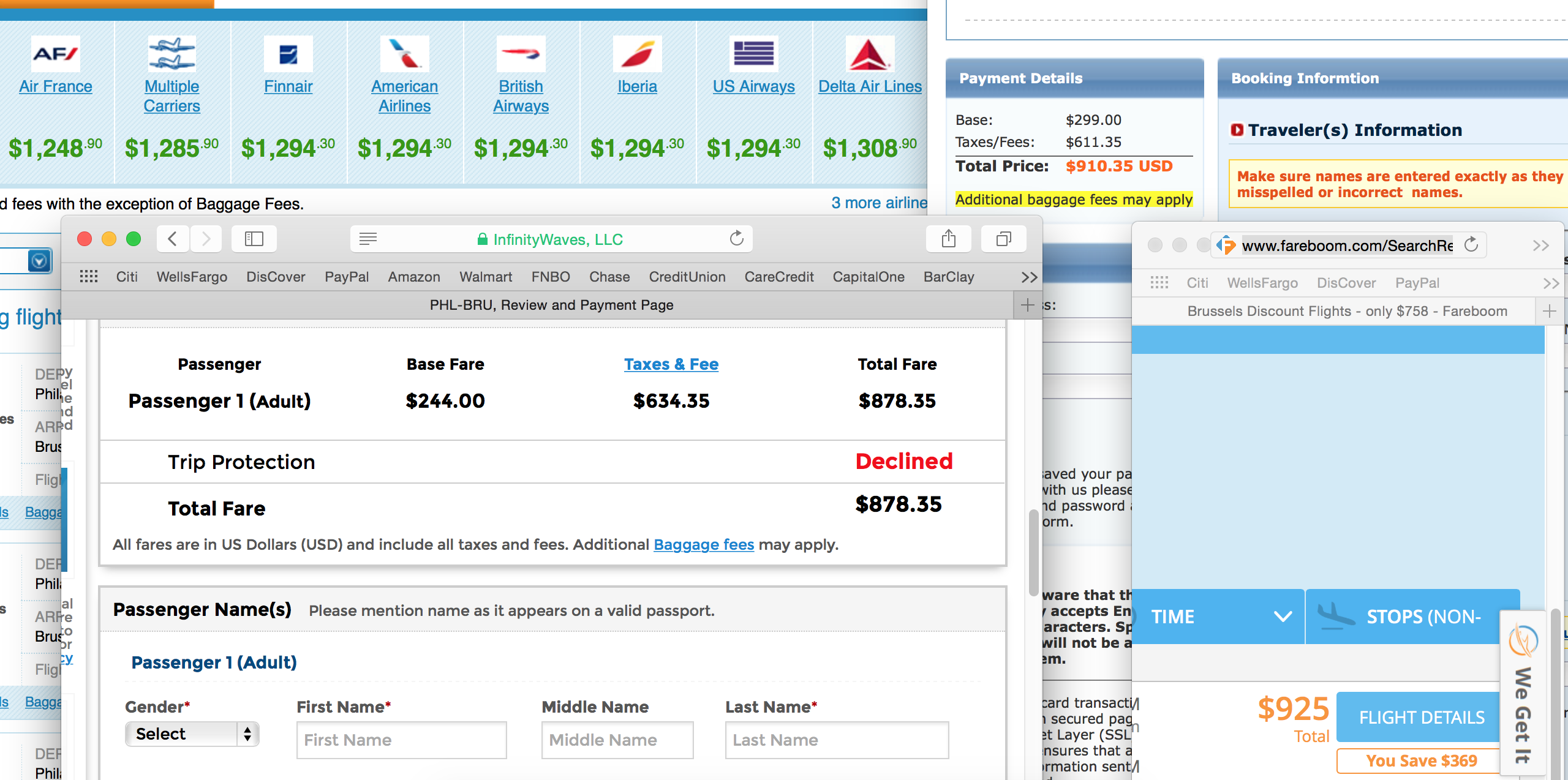

i kept getting $1,300 to brussels. until i done more shopping around i finally got a lowest $878 phl - bru. nice price. was just bored. going have to remember there in the future. i usually go on expedia but was worst. Citi and American Express credits $200 - $250 a year for airfare but you would have to book it directly which $250 - $1,300 = $1,050. i am sill better off going with Barclay and purchase my flight on discounted sites. nice to know!

in nearest 100th ...

EXPEDIA $2,000

CHASE TRAVEL $1,500

AMEX TRAVEL $1,300

ORTBITZ $1,300

BRITISH AIRWAYS $1,300

USAIRWAYS $1,300

KAYAK $900

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Platinum or Citi Prestige ??????

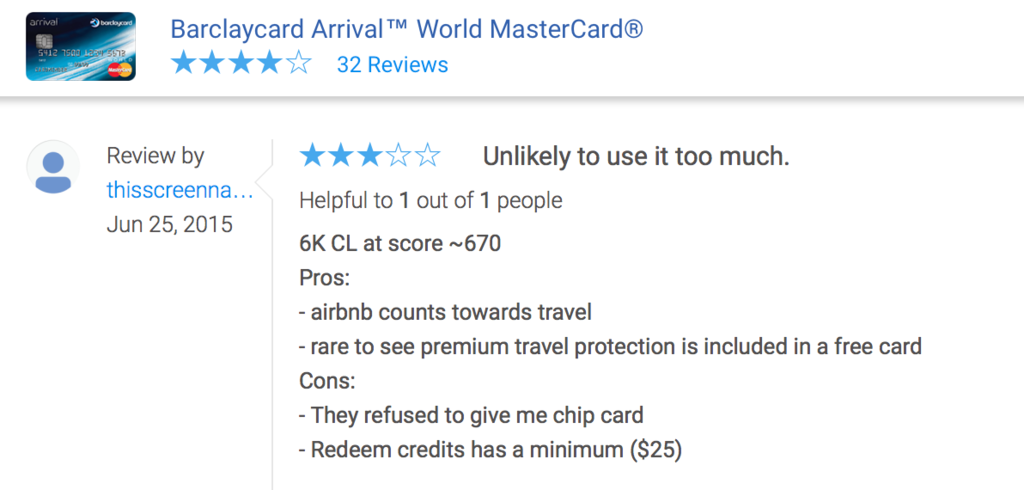

@Anonymous wrote:I'd thought pre-nerfing that airbnb was included on Arrival+, but it's definitely not now:

"Please note, some merchants that provide transportation and travel-related services are not included in this category; for example, real estate agents, websites or owners that rent properties, in-flight goods and services, merchants within airports, and merchants that rent trailers, trucks, and other vehicles for the purpose of hauling. "

Both Chase Sapphire Preferred, Cap1 Venture, Citi Prestige and Arrival from Barclay all confirmed Airbnb does indeed counts towards travel.

http://ficoforums.myfico.com/t5/Credit-Cards/Arrival-Question-Airbnb/td-p/3957647

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Platinum or Citi Prestige ??????

The Platinum is better under the following:

1. Need SPG Gold status (meaningless for those who have acquired SPG Lifetime Gold or Platinum).

2. $200 Airline GC continues to be honored.

3. Values MR transfer partners.

4. Need extremely large sporadic purchasing power. Purchase and Accidental Protection for up to $10K.

5. Centurion Lounges are located in frequently travelled or home base airports.

6. FHB occasionally offers some excellent Vegas deals, and "extra" perks with some hotels, especially for familiar and/or frequent guests.

7. Amex still much easier to deal with when issues arise, such as Merchant disagreement, warranty, accidental loss, etc...

8. Roadside service, which precludes having to pay extra for AAA, or some other service.

9. Business travelers can use Regus facilities around the world for simple tasks.

For these reasons, I still keep my bus Plat, though I've been considering changing, but not sure if I can find a static CL high enough for large quarterly charges.

Cit Premier would be better for those who don't value the above, especially if Amex stops honoring the $200 Airline GC. With status on most Airline I fly, aside from buying drinks for everyone on my flight, I'm not even sure how I'd use $200, since everything is included with Elite status. The 4th free night would be great, assuming the rates through their concierge are (1) reasonable, and (2) don't deviate too much from the lowest advertised public rates.

Citi has upped their game. Their TY program is actually respectable now, and may be mentioned along with UR, MR, and SPG in the same sentence.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Platinum or Citi Prestige ??????

@Open123 wrote:The Platinum is better under the following:

1. Need SPG Gold status (meaningless for those who have acquired SPG Lifetime Gold or Platinum).

2. $200 Airline GC continues to be honored.

3. Values MR transfer partners.

4. Need extremely large sporadic purchasing power. Purchase and Accidental Protection for up to $10K.

5. Centurion Lounges are located in frequently travelled or home base airports.

6. FHB occasionally offers some excellent Vegas deals, and "extra" perks with some hotels, especially for familiar and/or frequent guests.

7. Amex still much easier to deal with when issues arise, such as Merchant disagreement, warranty, accidental loss, etc...

8. Roadside service, which precludes having to pay extra for AAA, or some other service.

9. Business travelers can use Regus facilities around the world for simple tasks.

For these reasons, I still keep my bus Plat, though I've been considering changing, but not sure if I can find a static CL high enough for large quarterly charges.

Cit Premier would be better for those who don't value the above, especially if Amex stops honoring the $200 Airline GC. With status on most Airline I fly, aside from buying drinks for everyone on my flight, I'm not even sure how I'd use $200, since everything is included with Elite status. The 4th free night would be great, assuming the rates through their concierge are (1) reasonable, and (2) don't deviate too much from the lowest advertised public rates.

Citi has upped their game. Their TY program is actually respectable now, and may be mentioned along with UR, MR, and SPG in the same sentence.

Not that I really need to go back to vegas again, but I am curious about some of your experiences with this specific perk.

Starting Score: EQ: 714, TU 684

Current Score: EQ: 725 7/30/13, TU 684 6/2013, Exp 828 5/2018, Last App 8/5/17

Goal Score: 800 (Achieved!) In garden until Sepetember 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Platinum or Citi Prestige ??????

@Anonymous wrote:

@Anonymous wrote:

Both of those. I guess I do remember AAA from back when it was still routine to carry a tool kit in your car.i kept getting $1,300 to brussels. until i done more shopping around i finally got a lowest $878 phl - bru. nice price. was just bored. going have to remember there in the future. i usually go on expedia but was worst. Citi and American Express credits $200 - $250 a year for airfare but you would have to book it directly which $250 - $1,300 = $1,050. i am sill better off going with Barclay and purchase my flight on discounted sites. nice to know!

in nearest 100th ...

EXPEDIA $2,000

CHASE TRAVEL $1,500

AMEX TRAVEL $1,300

ORTBITZ $1,300

BRITISH AIRWAYS $1,300

USAIRWAYS $1,300

KAYAK $900

See bold above, with Citi Prestige you do not need to book directly. You'll get the $250 credit booking with Kayak. It is the best airline credit for CC out there (AFAIK).

EQ - 870 (CITI FICO), 848 (ATFCU FICO), 831 (CK FAKO)

EX - 841 (AMEX FICO)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Platinum or Citi Prestige ??????

@red259 wrote:Not that I really need to go back to vegas agaijn, but I am curious about some of your experiences with this specific perk.

Before achieving status on MLife (losing way more money than anyone ever should), I used to get late checkout, room upgrades, and some resort credits when using FHR. A few times at the Bellagio, I was upgraded to a Fountain room suite, $100 or $200 resort credit, and late checkout. A couple of years ago, I got a great deal at the Wynn for a 4th night free, upgrade, and some credits. Or, since I've always been fond of gambling, they may have tracked my gaming since before I signed up for MLife. However, I always assumed it was the booking through FHR that triggered the benefits.

Also, in some boutique hotels and even some Ritz's, you receive some perks when booking with the Plat card through FHR. However, it really depends on the specific hotel and may even be dependent on their experience with the guest in question.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Platinum or Citi Prestige ??????

I would confirm with Barclay direct because as I said before, I was pretty sure Airbnb counted before the recent nerfing, but I'm not so sure after. Might, but I'd get it from them rather than from a year old forum post.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Platinum or Citi Prestige ??????

@Anonymous wrote:I would confirm with Barclay direct because as I said before, I was pretty sure Airbnb counted before the recent nerfing, but I'm not so sure after. Might, but I'd get it from them rather than from a year old forum post.

Citi Prestige offers $250 airline credit annually and American Express Platinum offers $200 airfare credit annually but can only be used for flights booked directly or extras such as checked bags and upgrades which requires you to spend more of course. Citi Prestige $250 annual airline credit can be used to credit any purchases you made in air travel including discounted sites like Expedia and Kayak. To give an example of my experience booking a non-stop fight from USA to EUROPE last week here were the prices i had shopping around. You can see where you be able to save more doing your own research but here were my results. Keep in mind Citi Prestiage offers

EXPEDIA $2,000 - $250 Citi Prestige annual airline credit = $1,750 + 3x TYP (+$450 annual fee) - $200

CHASE TRAVEL $1,500 + x2 UR (+$95 annual fee Chase Sapphire Preferred) - $65

AMEX TRAVEL $1,300 - Platinum Ameican Express annual airfare credit - $200 = $1,100. + 2x MR ($1,300 - $100 = $1,200 + 3x MR if you use GOLD Premier Rewards)

ORTBITZ $1,300 - $250 Citi Prestige annual airline credit = $1,050 + 3x TYP (+$450 annual fee) (+$450 annual fee) - $200

BRITISH AIRWAYS $1,300 (BOOK DIRECTLY - required by AMEX) Platinum Ameican Express annual airfare credit - $200 = $1,100. (+$450 annual fee) - $250

USAIRWAYS $1,300 (BOOK DIRECTLY - required by AMEX) Platinum Ameican Express annual airfare credit - $200 = $1,100 (+$450 annual fee) - $250

KAYAK $900 - $250 Citi Prestige annual airline credit = $650 + 3x TYP (+$450 annual fee) - $200

$900 (- $18) x2 miles with Barclay Arrival no annual fee + $18 or ($89 annual fee Barclay Arrival+ Elite Mastercard.) - $71

If you see i made more using the Barclay no annual fee Arrival Mastercard but depending how many times you use your cards and fly will determine your best fit. I probably go with the 1 year waived annual fee Amerian Express Platinum card via Ameriprise Financial and see how it goes for the first year and go for the Barclay Arrival+ and Chase Sapphire Preferred which is also waived for the first year... also looking at the Gold Premier Rewards spend $1,000 get $500. (thats 50% cash back in my mind or -50% off on a $1,000 ticket item). Also waived annaul fee for the first year so i have nothing to lose if i decide to take all 4 cards now and decide which one i like best after 1 year playing with them. ![]()

i have to say there is a lot of competition out there make us harder to pick and choose! Perhaps thats why they had to go for the 1 year no annual fee for us to try out their cards RISK FREE!