- myFICO® Forums

- Types of Credit

- Credit Cards

- Anyone else have a rewards hoarding problem like m...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Anyone else have a rewards hoarding problem like me?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@Anonymous wrote:

@longtimelurker wrote:

@core wrote:

@Anonymous wrote:Note that they only apply it as account credit, not as cash back. So if there is a $1,200 balance on the card with $718 in rewards, guess who gets to keep the account credit?

Capital One.

Ummmm.... LOL yes, that's exactly how it should be. What were you going to do, pocket the cash and then stiff Cap One for the balance by telling them the estate has no money to pay off the $1200 balance??? I'm no fan of credit card companies, but that seems pretty low-down and rotten.

Right. The more interesting case is if the balance is say $0, and you have $718 in rewards. They would then apply that as statement credit. If you are alive, after a while you get sent a check for the credit, hopefully they do the same here (can't imagine that they wouldn't)

I'd be willing to bet that they don't send the estate a check for any negative balance.

OK, need a guinea pig! Someone here wiling to get a postive reward balance and a 0 account balance, and then die? Come on, for the team!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

Interesting topic. I hadn't given it much thought until now. My behavior seems to vary. The rewards for my Venture and Quicksilver are close to zero as I've credited them right back to the account at least monthly. It's been good to just use them towards any balances. My Discover, on the other hand, has over $570 in cash back sitting there. I'm waiting until the end of the 1st year when it doubles. I'm planning a Maui trip early next year for my b-day and I'm planning to use the Discover funds for something really nice. I have no idea what it is, but it will be something I wouldn't normally spend that much money on. I hadn't considered taking the funds and putting them in a savings account.

Now, outside of credit cards, I have 394,000 frequent flyer miles sitting in an account. It was over 400K until last month when I had to use some for an emergency trip. So now I feel the need to get it back up over 400K. I don't quite know what I'll do with them yet... but that's a totally different topic.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@longtimelurker wrote:Unless there are potential bonuses for waiting (such as getting enough to get a discounted gift card for example) it doesn't make financial sense to leave the rewards with the issuer, because a) risk of closure and b) no interest being earned. If you want to see it all add up, set up an internet savings account that earns decent interest, and regularly transfer the credit card rewards to there. And when you have enough to satisfy you, spend it!

ETA: this is just for cash rewards. For transferable point systems (such as MR/UR/TYP) it can make sense to keep them with the issuer for flexibility. Just don't give any excuse for them to close the account!

+1 LTL

That's what I do with mine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@core wrote:

@Anonymous wrote:Note that they only apply it as account credit, not as cash back. So if there is a $1,200 balance on the card with $718 in rewards, guess who gets to keep the account credit?

Capital One.

Ummmm.... LOL yes, that's exactly how it should be. What were you going to do, pocket the cash and then stiff Cap One for the balance by telling them the estate has no money to pay off the $1200 balance??? I'm no fan of credit card companies, but that seems pretty low-down and rotten.

Who said anything about stiffing the bank? You are reading in something that wasn't said. I'm only stating that cash back after someone has passed away is not an option, so it may be best to take the cash back when you can.

Perhaps it may be a good idea to read more carefully. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@Anonymous wrote:The sooner you claim those rewards and either drop them into a high yield savings or invest them the more those rewards can work for you. Think of every dollar as an employee. By leaving your rewards sit like that you're letting your employees slack off. Kick those dollars into high gear and get them working for you!

Absolutely agree 100%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@Anonymous wrote:

@longtimelurker wrote:

@core wrote:

@Anonymous wrote:Note that they only apply it as account credit, not as cash back. So if there is a $1,200 balance on the card with $718 in rewards, guess who gets to keep the account credit?

Capital One.

Ummmm.... LOL yes, that's exactly how it should be. What were you going to do, pocket the cash and then stiff Cap One for the balance by telling them the estate has no money to pay off the $1200 balance??? I'm no fan of credit card companies, but that seems pretty low-down and rotten.

Right. The more interesting case is if the balance is say $0, and you have $718 in rewards. They would then apply that as statement credit. If you are alive, after a while you get sent a check for the credit, hopefully they do the same here (can't imagine that they wouldn't)

I'd be willing to bet that they don't send the estate a check for any negative balance.

I'd be willing you to bet you are correct, my Gaelic friend ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

The UK division of Cap One didn't exactly shine with glory here:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@dallasareaguy wrote:It's become a game in our house.

ME: "Hey wife, remember... Amex Blue for Groceries and gas!... everything else put on the QuickSilver"... she got frustrated with me this weekend when I said.. "Why did you use the Blue at Sam's?..."...she said... "because you said to use it on groceries!".... I said: "yes, but remember it's not valid at wholesale stores or walmart or target, etc.".... her final response " uggh, I'm trying to follow your requests..I give up."

We only got 1% using Blue in the case instead of 1.5% with QS... it all amounted to about $1.11 difference in rewards but hey!

When our household first switched over to using reward cards for all of our expenses, this conversation happened a lot.![]() My hubby has started calling me a Don.

My hubby has started calling me a Don.![]() It's hilarious!

It's hilarious!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@Anonymous wrote:

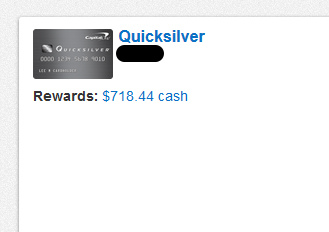

@dallasareaguy wrote:I can't bring myself to cash in rewards. I have accumulated $718 since November 1st and can't get myself to accept the credit. As if I'm saving them for a rainy day or something. I do the same with my other accounts too. Am I the only one? Took me 7 1/2 months to accumulate.... just don't want to see the number stop growing. I guess my only risk is that if CapOne closed my account for some reason I would miss out on all that reward.

What about creating a separate savings account to just put your rewards in so they can accumulate without being tied to Cap1? I was thinking about doing that with my rewards.

Excellent suggestion.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@longtimelurker wrote:

@northface28 wrote:I would not be able to sleep knowing I had over $700 tied up in rewards with an issuer. I have an online savings account with Capital One and ALL my rewards are funneled to that account which is aptly named "credit card rewards" so all rewards, sign up bonuses, and saved money via points go here. By saved money I use the Sallie Mae card and if I redeem for 2500 points which is $25, i add that $25 to the credit cards reward account. At the end of every month, I then transfer the money to my Schwab brokerage account and then invest it into SWPPX (S&P index fund). I do not see the point in the letting the money just there idly, i like my money to work for me.

That would be a problem! I'm sure people have more than that tied up in unproductive assets. Even if you could earn 10% investing it, we are talking $70 a year (with a low risk of closure), so not really worth losing too much sleep over.

Compounding interest makes this much more significant long term though. If someone opened an investment account with a $700 balance, added $200 more per year (sounds like OP earns more than that in yearly rewards, but just a low rough estimate), and earned a 10% return, then over 30 years (a long time sure, but not that long for investments/long-term financial strategies) that figure would turn into $51,874.93. More realistically let's assume a more conservative 6% averaged return that's in line with historical data. That would turn into $21,041.43

And if the person is adding this money to a Roth IRA then those figures are tax free.

By contrast if someone starts with $700, adds $200 per year, and doesn't take advantage of investing or even deposit interest, then at the end of 30 years they have...$6,700

Anyway, personally I cash out all of my cash back rewards at literally the first opportunity, usually the very next time I log into my account after the rewards have been credited, unless I'm under a redemption threshold, then the first opportunity I get once reaching the threshold.