- myFICO® Forums

- Types of Credit

- Credit Cards

- Anyone else have a rewards hoarding problem like m...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Anyone else have a rewards hoarding problem like me?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@longtimelurker wrote:

@MyLoFICO wrote:I like the idea of pumpipng those rewards into an internet savings account. I have a DCU checking account that I am putting money into as savings. Would that be a good place? Also, how would I do that? Have Cap 1 send me a check and then send the check to DCU? I don't see an ACH or EFT option on Cap 1's site.

Yes, the lack of ACH is what makes Cap Ones otherwise excellent rewards a bit clunky. What rate does DCU give you? Barclays is at 1%, and I think Amex is just a little lower.

I honestly don't know. I have DCU and Resource 1 which is my local CU. Both have savings accounts but I don't know what the interest rate is. I don't use the savings accounts but I can if it will help. I usually keep it all in my checking and it eventually gets used lol. I don't want a HP so I won't be opening a new one. I will check with them and see which is higher. I have other rewards cards so I can divert them into savings as well. I have a certain amount each week going into DCU and had not even thought about it until I read this so adding my rewards to it should be fruitful for me.

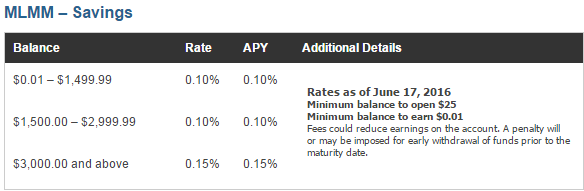

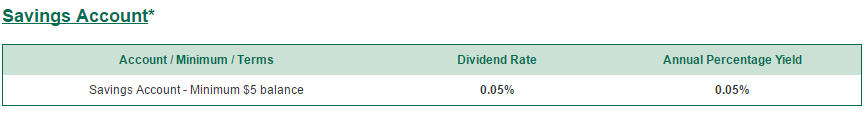

Edit: Found this on the R1CU site. Looks like I am getting the shaft.

DCU

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@MyLoFICO wrote:

Edit: Found this on the R1CU site. Looks like I am getting the shaft.

DCU

Yes, 0.05% (and 0.15%) are what you would get from big banks. You can do much better!

Amex: https://personalsavings.americanexpress.com/home.html?extlink=PS2016_Search_Branded 0.9% (18x DCU)

Barclays: https://www.banking.barclaysus.com/online-savings.html 1% (20x DCU)

and many others

ETA: there are also some 5% options, such as netspend, but they are in the process of nerfing (as of July 1, you earn 5% on the first $1000 rather than first $5000) but may still be of interest to some

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@longtimelurker wrote:

@MyLoFICO wrote:

Edit: Found this on the R1CU site. Looks like I am getting the shaft.

DCU

Yes, 0.05% (and 0.15%) are what you would get from big banks. You can do much better!

Amex: https://personalsavings.americanexpress.com/home.html?extlink=PS2016_Search_Branded 0.9% (18x DCU)

Barclays: https://www.banking.barclaysus.com/online-savings.html 1% (20x DCU)

and many others

ETA: there are also some 5% options, such as netspend, but they are in the process of nerfing (as of July 1, you earn 5% on the first $1000 rather than first $5000) but may still be of interest to some

pretty easy to find a credit union that does 1.75 or 2%. they have limits up to 10k or 25k then dont earn that much interest. must do one bill pay a month and have 10-15 debit swipes to qualify. I just use an amex serve to take 25 cents per day from my debit card. although from time to time I do get some 10-20% off coupons for using my debit card at places like Big Lots, Auto Zone, Applebbes, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

Thanks! I appreciate the info. Barclays looks like a good fit for me. I can deposit it and forget it. Might be time to pool my direct deposit to DCU and all my rewards and see how fast I can grow it.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

I opened a Barclays savings. I was putting in information and clicking continue and suddenly I was done. Then I froze. I remembered putting in my SS but I did not seeing any mention of a credit pull and I am in the garden. Thankfully I have no HP’s from it. I guess they relied on my 2 card accounts I have with them and used a SP?

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@MyLoFICO wrote:I opened a Barclays savings. I was putting in information and clicking continue and suddenly I was done. Then I froze. I remembered putting in my SS but I did not seeing any mention of a credit pull and I am in the garden. Thankfully I have no HP’s from it. I guess they relied on my 2 card accounts I have with them and used a SP?

Not all banks do HP for savings account (with no overdraft protection feature) At least in 2012, Barclays didn't, so nothing to do with your cc relationship.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@dallasareaguy wrote:

@Anonymous wrote:$47,896 is what you've ran through the card to get $718.44 in cash back, assuming QS didn't round up or down in the process.

If you were using a 2% card, and also paid the balance off if it were a Citi DC, you would've gotten $957.92 instead, a difference of $239.48

If you are waiting until you have $1,000 in cash back to redeem, you will need to put an additional $18,770.67 through your card.

You would be missing out on $93.85 if you were using a 2% card instead to make $18.77k in purchases.

Just wanted to do a quick comparison in case you or readers were wondering since none of the posts ran the numbers.

You are correct in the $47k run through the card.. I average just over $6k per month. The problem is I cannot get approved for any other cards. If you look at my FICOs below, you will see that I have mediocre at best scores. Amex gave me two $5k cards last month with only a 662 experian (I feel blessed)... but every other card company flat out denies me because I still have 50+ inquiries and a bunch of old tax leins from a failed family business in 2010. Amex was willing to look past the tax leins... but everyone else screams bloody murder when I apply... so 2% is not an option for me anytime soon sadly ;(

Discover wouldnt even give me a card.. just a secured card which I accepted to get in with them. I would use their card more but so far all 4 pay in fulls I have done on their card have resulted in 10 day holds.. meaning that 33% of the month I can't use my discover card. I spend $300-400 on it and pay if off and then have to wait 10 days.. must be because its secured. I thought they would trust me after a few payments cleared, but I guess not.

You're doing the right thing. Give your business to the creditors that were willing to take a chance on you. Continue to build relationships with your current creditors eventually others will follow. Keep up the good work!![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@UncleB wrote:

@core wrote:

@Anonymous wrote:At US Bank/Elan Financial, the executor or the estate can request in writing to have the cash value of the rewards redeemed. I think they'll issue it as a statement credit if there is a balance, otherwise they'll mail a check made payable to the estate.

Even for Cap One (the topic of the OP I think), I had no problems calling in to the automated system and requesting a redemption for my grandmother to result in a credit balance. I didn't have to talk to anyone... just did it from her phone number. (She's still alive; she just didn't know what the 20000 points meant on her statement.) My only point was: The executor may or may not be looking for a little tidbit at the bottom of the statement when going through a stack of 50 bills. If the individual is into the credit card game and knows all about it, then there's no real issues of course.

FWIW, in the event of death with rewards remaining on a Capital One card they do the right thing:

Thanks UncleB for always going the extra step.![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

The author of this thread has low to fair credit scores. I really thought consumers had to have a score of 700+ to get Amex BCE and Discover It. These prime lenders must want to steal some customers from the ever popular Capital One.

And no, I wouldn't let my money idle dormant in my credit card account. Also, there are superior cards that consumers can milk before they resort to QS 1.5% cash back rewards.