- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Anyone over 25k on Amex w/out 4506-T

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Anyone over 25k on Amex w/out 4506-T

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone over 25k on Amex w/out 4506-T

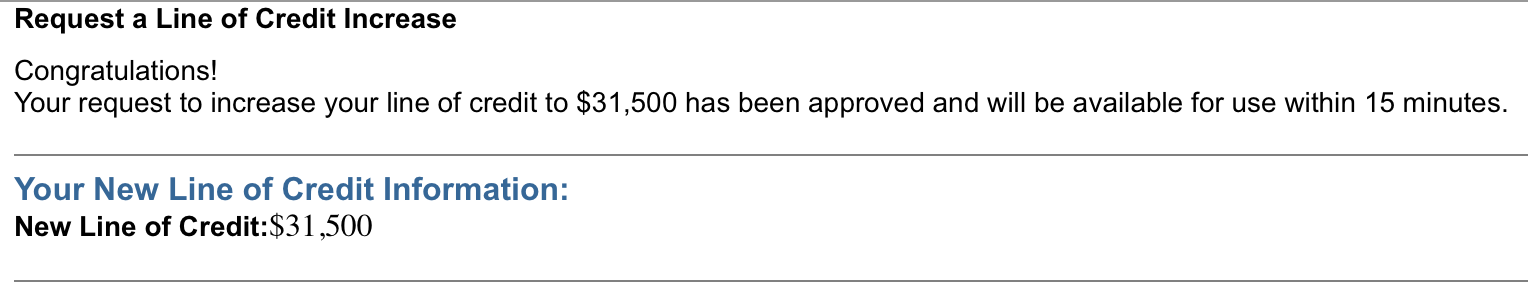

Just asked for a 3X CLI tonight...$10500>$31500. Didn't ask for any documentation.

1/19/14:

1/28/14:

2/12/14:

Current Scores:

7/10/19:

12/17/16:

9/05/17:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone over 25k on Amex w/out 4506-T

Went for CLI today - $24.8k to $34.8k on AMEX EDP w/ no request for documentation. Immediately after I put in a request for DW - $24k to $34k on AMEX BCE w/ no request for documentation. I usually run about $1,000-1,500 through my card every month, DW runs between $100-1,000 through hers, and total household income is $111k. I've had my card almost 2 years and I started at $15k, and been with AMEX for almost 3. DW started at $4k, and has been with AMEX for about a year and a half. As mentioned before, I think it may have more to do with history, overall income, and spend more than a hard CL amount.

AMEX PRG - NPSL I AMEX Everyday Preferred - $34.8k I Capital One Venture - $20k I Chase Sapphire Preferred - $25.5k I Chase Southwest Rapid Rewards Premier - $20.7k I Barclay Arrival + - $10k I Capital One Quicksilver - $10k I NFCU Flagship Rewards Visa Signature - $15k I NASA FCU - $10k I Texell FCU Visa - $5k I Chase Freedom - $9.9k I Citi Double Cash - $7.8k I Discover IT - $5k I NFCU CLOC - $15k I Total Unsecured Credit - $188,700

EQ FICO - 714 (5/24/16) I TU FICO - 772 (5/24/16) I EX FICO - 770 (5/24/16)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone over 25k on Amex w/out 4506-T

I don't think it's set in stone. I'm at 23k with them right now and have approved me for every card I've applied with them. I have a total for 5 including small business one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone over 25k on Amex w/out 4506-T

These forums just kill me. I see individuals that charge 800 - 1000 a month and have many other cards with large limits wanting a larger limit on their Amex for no reason.

This game of credit card accumulation and clis are crazy. All this utilization paranoia is another issue that I only see here.

My Amex EDP was originally approved for 12k and charge 2k - 3k a month and have not hit the button because I have other cards in the same range or higher anyway. I think it's laughable when some think just because one card is at 25k they all need to be.

Enough with my rant, everyone have a great Memorial Day weekend.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone over 25k on Amex w/out 4506-T

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone over 25k on Amex w/out 4506-T

@Mattopotamus wrote:

Currently at 46,800 without one. My last 3X CLI they did counter though.

Nice. Is that your only Amex card? I might as well try higher than 35k and if I am countered or asked to submit form, I will either lower and repeat or just submit document. Also, any other data points you could share would be appreciated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone over 25k on Amex w/out 4506-T

@redpat wrote:These forums just kill me. I see individuals that charge 800 - 1000 a month and have many other cards with large limits wanting a larger limit on their Amex for no reason.

This game of credit card accumulation and clis are crazy. All this utilization paranoia is another issue that I only see here.

My Amex EDP was originally approved for 12k and charge 2k - 3k a month and have not hit the button because I have other cards in the same range or higher anyway. I think it's laughable when some think just because one card is at 25k they all need to be.

Enough with my rant, everyone have a great Memorial Day weekend.

What kills me is when people post rants in a thread that's requesting specific information and think the rest of us actually give a f@*&*! Lol

Have a great holiday weekend. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone over 25k on Amex w/out 4506-T

@Gmood1 wrote:

@redpat wrote:These forums just kill me. I see individuals that charge 800 - 1000 a month and have many other cards with large limits wanting a larger limit on their Amex for no reason.

This game of credit card accumulation and clis are crazy. All this utilization paranoia is another issue that I only see here.

My Amex EDP was originally approved for 12k and charge 2k - 3k a month and have not hit the button because I have other cards in the same range or higher anyway. I think it's laughable when some think just because one card is at 25k they all need to be.

Enough with my rant, everyone have a great Memorial Day weekend.

What kills me is when people post rants in a thread that's requesting specific information and think the rest of us actually give a f@*&*! Lol

Have a great holiday weekend.

Aren't forums great.......You are right noboby gives a sh%*, lol!

One more point because I feel like ranting today and I already know nobody gives a......, remember when you use your cards nobody knows your CL except yourself so if it really makes you feel good to know that you have a 30K limit instead of a 15K and you only charge $1,000 a month good luck, maybe it's to put in your sig, lol!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone over 25k on Amex w/out 4506-T

Wow! Some of you are rude!

If you don't care (nice way of saying it) then why are you in here posting to this thread?

@uncleb check out the comments here please!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone over 25k on Amex w/out 4506-T

@redpat wrote:

@Gmood1 wrote:

@redpat wrote:These forums just kill me. I see individuals that charge 800 - 1000 a month and have many other cards with large limits wanting a larger limit on their Amex for no reason.

This game of credit card accumulation and clis are crazy. All this utilization paranoia is another issue that I only see here.

My Amex EDP was originally approved for 12k and charge 2k - 3k a month and have not hit the button because I have other cards in the same range or higher anyway. I think it's laughable when some think just because one card is at 25k they all need to be.

Enough with my rant, everyone have a great Memorial Day weekend.

What kills me is when people post rants in a thread that's requesting specific information and think the rest of us actually give a f@*&*! Lol

Have a great holiday weekend.

Aren't forums great.......You are right noboby gives a sh%*, lol!

One more point because I feel like ranting today and I already know nobody gives a......, remember when you use your cards nobody knows your CL except yourself so if it really makes you feel good to know that you have a 30K limit instead of a 15K and you only charge $1,000 a month good luck, maybe it's to put in your sig, lol!

Lmao...I believe you've completely overlooked the reason for having large credit lines. Monthly spend is one thing. Let's say my HVAC system goes out and I need a new one. For a really high tech one we're talking $12k to $15k. If all you have is a $15k limit.. you're going to max it out. Some companies won't let you split the bill between two CC's .

Sure you could finance it other ways. Others ways doesn't get me cash back though. I'd rather have the spending power when I need it than not have it at all. And capitalize on my miles or cash back.

Moral of this story , normal monthly spend has nothing to do with spending power. I'm not scared to bet. You have folks in this forum with less than $2000 a month in monthly spend. Their spending power is up into the hundreds of thousands if they so choose.

Why not have cards that allows you to use your spending power?