- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Anyone who carries a balance on a credit card ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Anyone who carries a balance on a credit card is financially illiterate

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone who carries a balance on a credit card is financially illiterate

@longtimelurker wrote:

@elim wrote:Preaching to the wrong crowd here i think. Most people i read here are to busy beating up the CCC's with huge sign-up bonuses, waived annual fees, rotating cards for normal spend to get the best cash back and of course, pay in full.

I think the crowd here is more diverse. While there are a set of people going for rewards, there are also questions every week about "How do I pay down this debt", so at least some are carrying quite a lot of debt. Of course, those asking how to pay it down know there is a problem!

This is true. There certainly are people that come look to get out credit card debt but the OP suggested that this board encourages people to carry balances. That's the furthest thing from the truth.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone who carries a balance on a credit card is financially illiterate

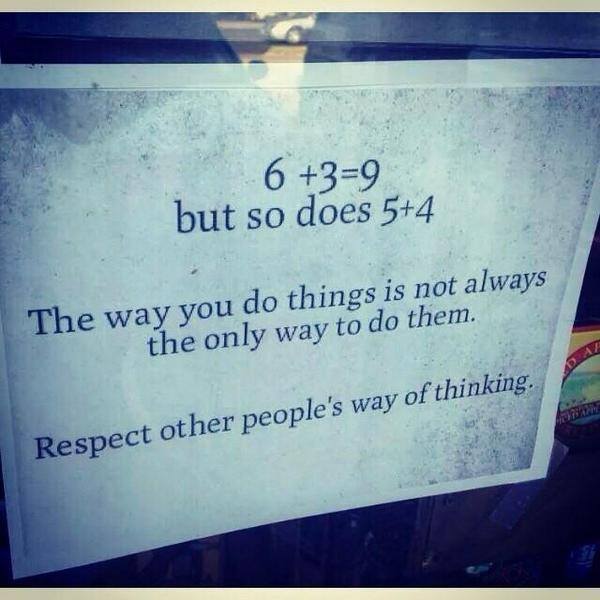

Wow this is some thread! While I agree that a person should never carry a balance on their cc's, my scale is tipping more on what are other people's circumstances in life.

I guess I am financially illiterate because I currently have a 0% balance on my Citi Diamond card until this summer. That balance came from my CSP early last year when I used it to pay for my wife and I's continuing education tution during the 2013 fall and 2014 spring term. This didn't mean that we did not have the money to pay cash for all $10K. The tuition money has always been in one of our savings account earning me dividends and I take out what's needed to pay the Diamond card each month. A month before the 0% ends, the card would be paid in full.

I got the additional points for the transaction of using my CSP for tuition, used the points to help pay for our vacation last year, and all without having to pay interest! Add to that the tuition money that I should've used outright so I could be financially literate made money just recently from the annual dividends my CU pays. The dividends doesn't take me to the top 1% of income earners, but I still came out ahead with carrying a balance on my card. So if this "system" did not work to my advantage, then I would be proud on being, as the OP called me, financially illiterate!

Don't get me wrong, I do not see my credit cards as means for me to get something I want while not having the money or budget for it. I don't spend money that I do not have. I use my cards to pay for everything we have to pay for each month, then turn around and use the cash to pif the cards. But when opportunities like 0% offers come along, I will not hesitate to jump on the deal...again not because I want to indiscriminately buy things, but because I have the cash to pay for it and still come out ahead after all said and done. OP can call people financially illiterate all he/she wants...but I think that is over the top when he/she does not know everyone's situation.

Oh and btw, putting the money in retirement? Check! I have 3 retirement accounts I am paying into each month. So yeah, contrary to OP's, and some people on this thread's belief, most of us do have a financial plan or "system" that works perfectly for us! But we do not look down on others for having credit card debt...because again, it all comes back to we do not know what the other person is going through in life.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone who carries a balance on a credit card is financially illiterate

Glad I have plenty of popcorn!

FICO 5 ,4, 2 - 10/2023 FICO 8 - 10/2023 FICO 9 - 10/2023 FICO 10 - 10/2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone who carries a balance on a credit card is financially illiterate

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone who carries a balance on a credit card is financially illiterate

CC's: AMEX (4), Alliant Visa, PenFed AMEX, Pen Fed Promise, Citi (3), Chase (5), US Bank Cash+, Huntington Voice, Nasa Plat Cash Visa, Barclay's Visa, Discover IT, Cap One QS, BOA (2), BMW Visa, 5/3 Real Life Rewards MC; FNBO Amex; Comenity Visa/MC (3), Ebates Visa Siggy, Nordstrom Visa, Walmart MC, Sam's Club MC; A few assorted store cards.

Current Scores (09/2017): EQ My Fico: 786; TU MyFico: 799; EX (My Fico): 797

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone who carries a balance on a credit card is financially illiterate

I only carry a credit card balance so I can live like a centi-millionare for a month or two then I plan on filing Chapter 7. So with my plans, interest isn't an important factor anyway. Interest only concerns those whom plan to pay their bills.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone who carries a balance on a credit card is financially illiterate

It's been a long time, but I've been in a position where I needed to carry a credit card balance (and a significant one given my income at the time) due to my circumstances at the time. Would it have been better not to? Certainly, had that been an option. But it wasn't, and I went into it eyes wide open, knowing that I was going to be paying an exhorbitant amount of interest fees but believing that it was what I needed to do given my situation. In the long run it definitely turned out to be the right thing to do - for me.

My circumstances have now changed, and it's been nearly a decade since I paid a penny in interest to a credit card company (and that was a one-month blip...well, two if you count the residual interest the second month...on a couple decades of not paying interest on a credit card). My improved circumstances and ability to PIF every month do NOT give me the right to judge someone who carries credit card debt as "financially illiterate."

OP, I don't know if you are just a troll looking for reactions, or if you are really so condescending as to think that anyone carrying credit card debt has chosen to do so for fun-sies. If choice A, I'm feeding the troll. If choice B, then I hope you'll think before you post next time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone who carries a balance on a credit card is financially illiterate

@CreditCuriousity wrote:Guessing the OP is a french canadian by how he started out his post.. Just speculation.

Got two or three pages in to post and need some caffeine, but ya better ways to approach the forum then calliing people essentially idiots.. Most people on this forum know not to carry a balance and have been in trouble before from it.. Anyways, that is the only comment I have on this thread.

Yeah ... can you catch me a cup of Java too ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone who carries a balance on a credit card is financially illiterate

@Anonymous wrote:

@Anonymous wrote:I'm about to start a gofundme "project" to help me not carry this balance. Any takers?

I could donate $0.02.

Get it, $0.02!

Nice limit btw.

No that's just my two cents.

Current FICOS: Mid 640s-50s on all reports, Ch 7 BK D/C Aug 2019

Starting scores: EX - 534, EQ - 574, TU - 516 | Total TLs: $91k approx | Total Utilization: 17%, getting this back down