- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: BT or New Credit card at 0%?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

BT or New Credit card at 0%?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT or New Credit card at 0%?

I think I would personally bail on the cards and get a loan, My bank once gave me $12k over 48 months at 8.4% and the payments were $290 something a month, You need about double this amount and Im sure you could get it over 60 months or even 72 - so this could well be within your budget ![]() Then, unless any significant rewards are offered - forget about or destroy your most "useless / expensive" cards - Good Luck, you can do this

Then, unless any significant rewards are offered - forget about or destroy your most "useless / expensive" cards - Good Luck, you can do this ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT or New Credit card at 0%?

@Teasha wrote:Thanks for the response.

Ok...

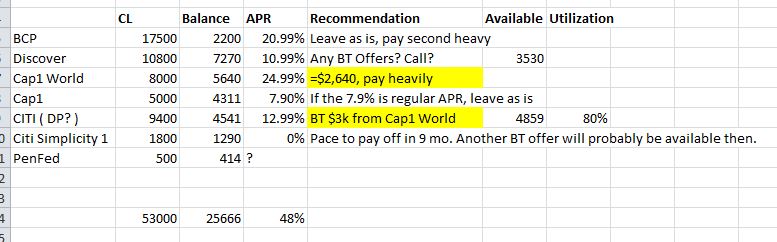

BCP $17'500 bal 2200. 20.99% but just lowered it to 18.99% starting next billing cycle

CAP1 world $ 8,000 bal 5640. 24.99% will start accruing sept 15 ALL of this balance is from a 0% cash advance

Discover. $10,800 bal 7270. 10.99%

CITI. $ 9,400 bal 4541 12.99%. I have an offer to use the difference of this card for a 0% offer

Cap1 $. 5,000 bal 4311 7.9%

citi simpl. $ 1,800 bal 1290. 9 mths 0% remaining

Penfed. $. 500 bal 414 overdraft protect credit

i have 13 credit cards total but the rest are all at 0 balance. I should also mention that I've dropped all my utilities to the lowest I can pay except one (paying for a 1k phone for my to be x-DH on my cell plan and can't change it till I pay the remaining $800.

My stick is 80/20 extremely high and my mortgage is 1400 a mth. I'd like to keep the house but I can't refi to cash out or get a new mortgage for a lesser value home with high dti, but that's for a different topic.

ok... There it all is on the table.. 😒 I've been really good with my credit and it isn't as daunting as a lot of people's credit debt, but I'm out of a bad situation now and trying to get my head back above water.

again... Help is much appreciated

Is the Cap 1 at 7.9% a permanent rate? Citi at 12.99% ?

I will suggest only doing the BT from Capital One World card, $3k, moved over to the Citi (is that the Diamond Preferred?) to take advantage of the lower APR for a time. Your utilization will go to 80%, but that's part of trying to save cash interest cost.

The Capital One World card, with about $2,640 remaining on it, should be your main payment priority to bring that down as fast as possible.

The small City Simplicity, try to pay that off in the 9 months, see if another BT offer is coming through then.

Once the Cap One with 24% is paid down to zero and presuming you get another 0% Citi offer on the $9.4k card, and the 0% has run out on the added amounts on this Citi card, you can use the CapOne 24% card as a temporary parking place to allow the Citi $9.4k card to go to zero, reset any interest rates, and then move amounts back to it at a lower APR again.

Do you have any BT offers from Discover? Even moving $1k from the Cap1 to Discover is going to help.

With only $500 per month to apply here, you are going to be working on this for a long time. Is there anything in your budget that can be reduced further? Cut off the cable TV? No Starbucks, obviously. Sack lunches every day, simple dinners, no eating out, limiting car travel.

The "Pay fast as possible" needs to be after you pay 2x the Minimum Payments on each of the other cards, to keep them happy with the payment rate. Ideally only Capital One would be going minimum payments, on the 7.9% card.

Lastly, how long have you had the Cap1 World card? Because if it's been more than 6 months, then you want to zero that card balance, and move the $8k limit over to the 7.9% APR card as fast as you can. There is a new feature of Capital One where you can combine limits of cards, from one donor card to a recipient card. Then you would have $13,000 available at 7.9% to move stuff to, with no BT fee. And with Capital One, it really would be $13,000 of available credit.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT or New Credit card at 0%?

I want to wish you the best. You have to have a detailed plan and budget. Do you have a family budget? How much is coming in? Are you working? Can your husband take a part time job to supplement the family income while he changes careers? Uber. I see the biggest problem being the income stream to service your debt. And based on your budget, where do you have room to cut spending or expenses?

Once you have the above questions answered here or at the family table, I would really consider a consolidation loan. You have good scores, but at this time you can't worry about your scores per se. What you need to make sure you do is NOT fall behind and miss a payment. Check out Lending Club, your credit union, or other lenders. You want to excercise this option while it is viable. I know this is tough, but you will make it.

Draw up your family budget, draw up your financial plan then pray and have the faith to see it through. NO more credit cards. NONE. More debt is not the answer. A consolidation loan is not more debt, if you have the discipline to pay it off and NOT charge up more cc debt. Disciplined faith.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT or New Credit card at 0%?

I am with most, I wouldn't app for a card. With your utilization on some of those cards, you probably will not get a high SL (which is what you want). App for a loan is the best for you IMO. Sorry to here about your struggle and good luck.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT or New Credit card at 0%?

To the OP:

The worse thing you can do is stress out about this. You cannot afford to allow this to affect your health, family and job. It will only make things worse. Not to trivialize what you are going through because it is very stressful; however, many of us have gone through much worse.

After my job loss, my stress caused me to get divorced (my fault) and thus this affected my ability to regain employment. I filed BK7 (I am not suggesting you do this) and the day I walked out of the Meeting of the Creditors; my life turned around. My debt was wiped cleaned, my wife came back, the dog came back and the refriderator started working again to keep my beer cold.

As mentioned before, sit down and write everything out. Use MS Excel if you have to then the "right" choice will jump off the page. I think most of us agree that a personal loan is your best option but only you can make that choice.

Good luck to you and keep us informed, and DONT STRESS OUT.