- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: BT while using active card?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

BT while using active card?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT while using active card?

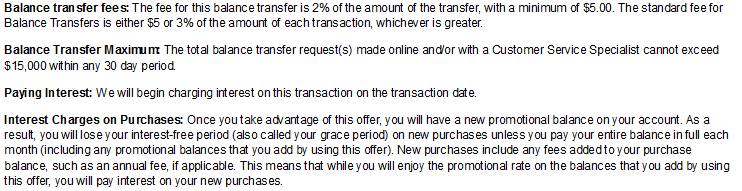

From Chase IHG Balance Transfer T&C (Step 3 of requesting a BT on my existing account)-

From back of Barclay's Sallie Mae's "Account Summary Table" sent with card-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT while using active card?

@NRB525 wrote:I am doubting this is the case. Do you have detailed T&C text you can share that says Barclay is different than all the other banks who apply the minimum payment first to the lowest APR items (which is typically the BT offer) and then amounts over the minimum to the higher APR items?

Each month's statement includes the amount you need to pay in order to maintain the grace period and avoid interest charges. This amount is equal to the balance with a non-zero APR.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT while using active card?

Ok, so it looks like Sallie Mae does a true separation of the BT amount from Purchase amounts.

It still seems strange that the Purchase amount only is necessary to pay, that nothing is required as a minimum payment on the BT amount.

However, they also have the caveat in there about Deferred Interest Purchase offers, where if you don't pay the entire amount by the end of the deferral, they will slam you with all the prior accrued interest. Probably not the situation OP asked about, but Deferred Interest is always a fun game.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT while using active card?

This is how it GENERALLY works:

Let's say that you have a 0% promotional balance AND you have new purchases. When the statement cuts, you will see (1) your 0% promotional balance, (2) your new purchases, (3) minimum payment due. What you'll need to do is to pay (2) + (3) as your payment, and you won't have any interest posted. Whatever the minimum payment due is, that entire amount will first go towards the promotional balance. Whatever you pay on top of that will get applied to the balance with the highest interest.

With Barclay, they will point out exactly how much you need to pay each month to avoid interest. At least that was my experience. When I did a BT on my Barclay AAdvantage card, the BT document's fine print indicated that I would be charged interest if I had new purchase and the ENTIRE balance was not paid off. Just to test that out, I spent <$5 on coffee, and the statement showed me exactly how much I'd needed to pay that month to avoid interest. I figured that at worst, I'd be paying interest on the $5 for the next 12 months.

FICO 08 (4/9/2018): EQ 647 EX 609 TU 620

FICO 08 (10/16/2020): EQ 676 EX 659 TU 653

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT while using active card?

So, did the statement tell you to pay $5, or $5 plus the $30 (estimating a minimum payment) $35 for example?

Because if that "suggested payment" builds in the minimum payment amount along with the "avoid interest total" then my earlier statement is still correct; Barclay would be simply factoring in both the minimum payment, applied to the BT, and the New Charges, to avoid interest cost on that.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT while using active card?

@NRB525 wrote:So, did the statement tell you to pay $5, or $5 plus the $30 (estimating a minimum payment) $35 for example?

Because if that "suggested payment" builds in the minimum payment amount along with the "avoid interest total" then my earlier statement is still correct; Barclay would be simply factoring in both the minimum payment, applied to the BT, and the New Charges, to avoid interest cost on that.

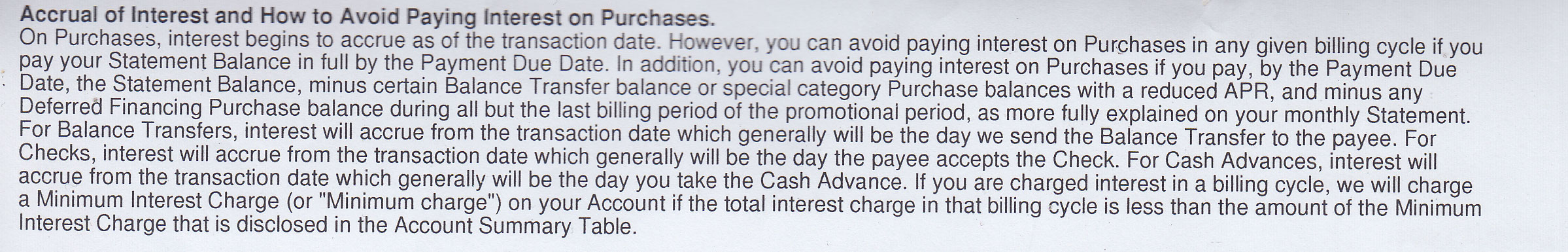

I dug up my statement.

My coffee was $4.39. I had no other charges during the statement period.

Minimum payment was $25.00.

But I had to pay $48.48 to avoid paying any interest.

Weird.

From the statement:

"If you have a 0% promotional APR on all of your Purchase balances, you can avoid paying interest on those balances during the applicable promotional period. However, pay at least your Minimum Payment Due to avoid a late fee. If you have both Purchase balances with an APR greater than 0% and you also have other promotional balances on your Account, you can avoid paying interest on your Purchases by paying $ 48.48 (this amount includes any Minimum Payment Due required to avoid a late fee). Please refer to the “Accrual of Interest and How to Avoid Paying Interest on Purchases” paragraph on the back of this Statement for further detail."

FICO 08 (4/9/2018): EQ 647 EX 609 TU 620

FICO 08 (10/16/2020): EQ 676 EX 659 TU 653