- myFICO® Forums

- Types of Credit

- Credit Cards

- Balance Transfer Advice: AMEX -> Barclay or Chase

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Balance Transfer Advice: AMEX -> Barclay or Chase

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Balance Transfer Advice: AMEX -> Barclay or Chase

Hey everyone,

Purchased some furniture today on my AMEX Plat (to help meet the $3000 spend sooner) and was wondering which lender will be the least pissy with an incoming balance transfer. I have a Sallie Mae from Barclay and an AARP from Chase both with 0% balance transfer options.

Barclay Sallie Mae:

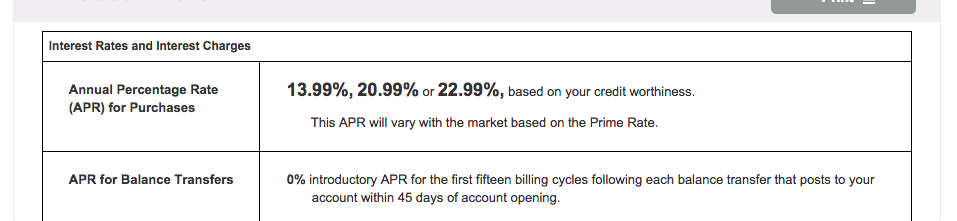

- 0% Introductory APR for 15 billing cycles following each balance transfer that posts to the account within 45 days of account opening, after that 20.99%

- 3% Balance Transfer Fee ($5.00minimum / no maximum) for each balance transfer that posts to the account within 45 days of account opening.

Chase AARP:

Balance Transfer APR: The rate listed below will apply to the transferred balance. You can also find this online by viewing a recent statement.

Balance transfer fees: The fee for this balance transfer is 3% of the amount of the transfer (minimum of $5.00, maximum of $250.00). The standard fee for Balance Transfers is either $5 or 3% of the amount of each transaction, whichever is greater. |

The terms themselves look about even, Chase only lets me type in the account number of the credit card itself. With Barclay, I can do the credit card number or an account number for a "loan", which may be possible to send it to my checking account instead? Anyone tried this or know if it's possible with Barclay?

Before I do so and possibly piss off two of these companies, here are my questions:

- Will this upset AMEX to have a balance transfer out from the Platinum card? I remember reading in some posts a while back AMEX does not like balance transfers to revolvers, but what about a balance transfer leaving them on a charge card...

- Will Chase not appreciate an incoming balance transfer to a new card? The balance transfer will be about $1400, the AARP limit is $4,000, which would be about 35% of the total limit of the card.

- Will Barclay not appreciate an incoming balance transfer to a new card? The balance transfer will be about $1400, the Sallie Mae limit is $5,000, which would be about 28% of the total limit of the card.

- Of Chase and Barclay as the receivers of the balance transfer which would you all pick?

I've done a balance transfer from Chase (actually two, one from Freedom and the other from Marriott) to NFCU and Chase didn't blink an eye. In fact, I later received an auto CLI a month or two later on the Freedom... I just don't want to mess up any progress I've made in my credit repair and now credit building journey. Oh also, before I forget I plan on paying substantially more than the minimum payment when paying down this balance transfer.

Thanks as always!

Oz

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice: AMEX -> Barclay or Chase

Checked Cap1 just to make sure I reviewed all my options, the good news is there'd be no balance transfer fee, the bad news is it'd be my full APR, at 22.9% lol...

Oz

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice: AMEX -> Barclay or Chase

These questions seem to come up a lot.

1: What leads you to think an AMEX Platinum, which requires PIF by 20 or so days after the statement, is going to care where that money comes from that pays them? They don't care.

2: If you have a new CC, and one of the headline marketing offers that they use to get your attention, to get you to actually app for the card, is, BT To This Card, what leads you to think they don't want you to BT onto the card?

I've done dozens of BT over the years. Don't overthink it. If you have available credit on the card, and a good BT offer to save money, and you want to finance a big purchase, do the BT. Then be sure to pay it, make the monthly payments on time, and schedule the payments so they fit in your budget, and you get the item paid off eventually.

The only thing that makes a CCC pissy is when you don't make the monthly payments. They get all snippy for some reason when you don't pay them ![]()

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice: AMEX -> Barclay or Chase

@NRB525 wrote:These questions seem to come up a lot.

1: What leads you to think an AMEX Platinum, which requires PIF by 20 or so days after the statement, is going to care where that money comes from that pays them? They don't care.

2: If you have a new CC, and one of the headline marketing offers that they use to get your attention, to get you to actually app for the card, is, BT To This Card, what leads you to think they don't want you to BT onto the card?

I've done dozens of BT over the years. Don't overthink it. If you have available credit on the card, and a good BT offer to save money, and you want to finance a big purchase, do the BT. Then be sure to pay it, make the monthly payments on time, and schedule the payments so they fit in your budget, and you get the item paid off eventually.

The only thing that makes a CCC pissy is when you don't make the monthly payments. They get all snippy for some reason when you don't pay them

Thanks for the reply, you make some good points. I'm just hesitant to poke and wake the bear that is Barclay's adverse action. I just acquired a bunch of new accounts (Barclay Sallie Mae, Chase AARP, Cap1 Venture, and AMEX Plat) this month. Add a bunch of other INQs, on top of the approval INQs from (Comcast, T-Mobile, a rental INQ, and a denial INQ from SSFCU) to the tune of 10 inquiries total in August.

My total actual util right now is around 2.4%, maybe around 2.6% reporting. The highest util on any one card is 12% actual, maybe 13% reporting.

I suppose I should just pull the trigger already so that way the payment posts to AMEX before they want a PIF ![]()

Oz

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice: AMEX -> Barclay or Chase

@Anonymous wrote:

@NRB525 wrote:These questions seem to come up a lot.

1: What leads you to think an AMEX Platinum, which requires PIF by 20 or so days after the statement, is going to care where that money comes from that pays them? They don't care.

2: If you have a new CC, and one of the headline marketing offers that they use to get your attention, to get you to actually app for the card, is, BT To This Card, what leads you to think they don't want you to BT onto the card?

I've done dozens of BT over the years. Don't overthink it. If you have available credit on the card, and a good BT offer to save money, and you want to finance a big purchase, do the BT. Then be sure to pay it, make the monthly payments on time, and schedule the payments so they fit in your budget, and you get the item paid off eventually.

The only thing that makes a CCC pissy is when you don't make the monthly payments. They get all snippy for some reason when you don't pay them

Thanks for the reply, you make some good points. I'm just hesitant to poke and wake the bear that is Barclay's adverse action. I just acquired a bunch of new accounts (Barclay Sallie Mae, Chase AARP, Cap1 Venture, and AMEX Plat) this month. Add a bunch of other INQs, on top of the approval INQs from (Comcast, T-Mobile, a rental INQ, and a denial INQ from SSFCU) to the tune of 10 inquiries total in August.

My total actual util right now is around 2.4%, maybe around 2.6% reporting. The highest util on any one card is 12% actual, maybe 13% reporting.

I suppose I should just pull the trigger already so that way the payment posts to AMEX before they want a PIF

Oz

You can't overthink it. Nobody works for Barclay or whoever here and can tell you if they will AA. Some people add one new account 4 months after a Barclay card and recieve AA. Others add 5 accounts a week after Barclay and nothing happens. The point is there are other factors which we are not 100% aware of since we are no Barclay employees. But there is no point in stressing about it, because it's beyond your control. If it's going to happen it will, if not it won't.

I'd just do the BT and stop stressing over it. They are there to be used.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice: AMEX -> Barclay or Chase

Yes you can deposit funds directly into your checking account with Barclays. And they actually happen to enjoy people BTing to their cards. I think most lenders enjoy BTs to their cards. They get to take a fee right off the top, and stand to gain some interest if you don't pay by the end of the promo period or happen to make new purchases.

Starting Score: 515

Starting Score: 515Current Score: EQ08 711 EX08 731 TU08 735

Goal Score: 740+

Amex BCP $25k | Discover IT $15.7k | Cap 1 QS $10k | PSECU $10k | Citi DC $9300 | Citi DP $6800 | Barclay Ring $6500 | PayPal Extras MC $5045 | DCU $5000 | Chase Slate $5000 | Barclays AA $4100 | Chase Freedom $4000 | Union Plus $1000 | Target $500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice: AMEX -> Barclay or Chase

A) not want to use until the BT is paid off

B) are willing to incur interest on new purchases from the day you make them

C) are willing to pay for each purchase the same day you make it to avoid interest (or mostly avoid it)

I'm on my phone so I can't see your sig to see what other cards you might have, but people usually get the cards in question for specific category spend. If I were you I'd put it on the AARP and use a 2% card (or your best alternative) for restaurants until its paid off. An extra 1 or 2 % on restaurants would quickly get eaten up by interest.

This assumes the new cards are not 0% on new purchases. (Which I never thought of as an argument when people are weighing a bunch of options for a BT, but it should be in the running. I know new Amex, Disco, and I think Citi are 0% on BT and purchased on new accts, but I think Chase and Barclay aren't. I could be wrong.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice: AMEX -> Barclay or Chase

@NRB525 wrote:

The only thing that makes a CCC pissy is when you don't make the monthly payments. They get all snippy for some reason when you don't pay them

+1

In the end, this is really the only thing Issuer's care about. They all just want to be paid. However, it is advisable to always pay at least 200% - 300% over the mnimum, if you're going to carry a higher promo balance transfer rate, resulting in a higher utility ratio reported over a longer period of time.

Make the best financial decision for you. To me, that means maximizing rebates or minimizing borrowing costs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice: AMEX -> Barclay or Chase

@Anonymous wrote:

Which of those two cards do you either:

A) not want to use until the BT is paid off

B) are willing to incur interest on new purchases from the day you make them

C) are willing to pay for each purchase the same day you make it to avoid interest (or mostly avoid it)

I'm on my phone so I can't see your sig to see what other cards you might have, but people usually get the cards in question for specific category spend. If I were you I'd put it on the AARP and use a 2% card (or your best alternative) for restaurants until its paid off. An extra 1 or 2 % on restaurants would quickly get eaten up by interest.

This assumes the new cards are not 0% on new purchases. (Which I never thought of as an argument when people are weighing a bunch of options for a BT, but it should be in the running. I know new Amex, Disco, and I think Citi are 0% on BT and purchased on new accts, but I think Chase and Barclay aren't. I could be wrong.)

That is a good point about the loss of rewards. Utilization isn't a huge factor as it's a 7% difference between the $4000 card and the $5000 card. I think the AARP card does have 0% interest for 9 months, but I'm wondering if that applies/stacks if I elect for a balance transfer...

Oz

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice: AMEX -> Barclay or Chase

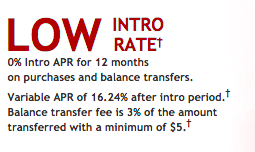

Actually, it looks like maybe AARP IS purchases and BT while SM is only BT

I don't know that what I found online is the deals you have, so be sure to check your T & C.