- myFICO® Forums

- Types of Credit

- Credit Cards

- Balance Transfer Advice: AMEX -> Barclay or Chase

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Balance Transfer Advice: AMEX -> Barclay or Chase

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice: AMEX -> Barclay or Chase

Barclays lets you avoid interest on new purchases as long as you PIF them and pay your minimum balance. Your statement will tell you how much you need to pay to avoid paying interest. You don't have to give up your rewards on the Sallie Mae,

Starting Score: 515

Starting Score: 515Current Score: EQ08 711 EX08 731 TU08 735

Goal Score: 740+

Amex BCP $25k | Discover IT $15.7k | Cap 1 QS $10k | PSECU $10k | Citi DC $9300 | Citi DP $6800 | Barclay Ring $6500 | PayPal Extras MC $5045 | DCU $5000 | Chase Slate $5000 | Barclays AA $4100 | Chase Freedom $4000 | Union Plus $1000 | Target $500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice: AMEX -> Barclay or Chase

Interesting. I didn't know that any CC in the US allowed a grace period without paying in full other than new account 0% structures. Good to know! Thanks.

B. If you have Purchase balances with an APR that is greater than 0%, and you also have other types of promotional balances on your account, you still may be able to avoid paying interest on those balances without paying your Statement Balance in full. If this applies to your Account, you will see a Paragraph titled “Avoiding Interest on Purchases (Grace Period)” appearing directly below the Interest Charge Calculation section on the front of this Statement. This will show the amount you can pay by the Payment Due Date and still avoid interest charges on your Purchase balances. This amount may differ from your Statement Balance. It may differ because you currently have certain promotional APR balances, and the nonpayment of these balances will not affect your grace period on Purchases, provided you pay all other balances on your account. (However, to avoid a late fee, pay at least your Minimum Payment Due.)

ETA: This also made me look at my actual statement (that was quoted from there) which I don't usually do. And I see this wording:

YOUR BALANCE TRANSFER OPPORTUNITY You have a promotional APR balance transfer offer waiting for you - log on to BarclaycardUS.com or call 1-866-585-2951 by November 2, 2015 to learn more.

I'll have to check it out.

ETA2: 0% until 6/16 with 1% fee. I may take them up on that knowing that I can avoid interest on new purchases! Thanks a bunch OP for causing me to look into this and Simply827 for calling it to my attention.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice: AMEX -> Barclay or Chase

@Anonymous wrote:Hey everyone,

Purchased some furniture today on my AMEX Plat (to help meet the $3000 spend sooner) and was wondering which lender will be the least pissy with an incoming balance transfer. I have a Sallie Mae from Barclay and an AARP from Chase both with 0% balance transfer options.

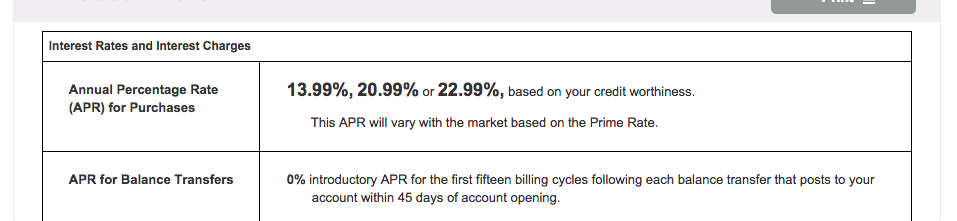

Barclay Sallie Mae:

- 0% Introductory APR for 15 billing cycles following each balance transfer that posts to the account within 45 days of account opening, after that 20.99%

- 3% Balance Transfer Fee ($5.00minimum / no maximum) for each balance transfer that posts to the account within 45 days of account opening.

Chase AARP:

Balance Transfer APR: The rate listed below will apply to the transferred balance. You can also find this online by viewing a recent statement.

0% APR through your billing cycle that ends in 08/2016; thereafter

16.24% variable APR based on the Prime RateBalance transfer fees: The fee for this balance transfer is 3% of the amount of the transfer (minimum of $5.00, maximum of $250.00). The standard fee for Balance Transfers is either $5 or 3% of the amount of each transaction, whichever is greater.

The terms themselves look about even, Chase only lets me type in the account number of the credit card itself. With Barclay, I can do the credit card number or an account number for a "loan", which may be possible to send it to my checking account instead? Anyone tried this or know if it's possible with Barclay?

Before I do so and possibly piss off two of these companies, here are my questions:

- Will this upset AMEX to have a balance transfer out from the Platinum card? I remember reading in some posts a while back AMEX does not like balance transfers to revolvers, but what about a balance transfer leaving them on a charge card...

- Will Chase not appreciate an incoming balance transfer to a new card? The balance transfer will be about $1400, the AARP limit is $4,000, which would be about 35% of the total limit of the card.

- Will Barclay not appreciate an incoming balance transfer to a new card? The balance transfer will be about $1400, the Sallie Mae limit is $5,000, which would be about 28% of the total limit of the card.

- Of Chase and Barclay as the receivers of the balance transfer which would you all pick?

I've done a balance transfer from Chase (actually two, one from Freedom and the other from Marriott) to NFCU and Chase didn't blink an eye. In fact, I later received an auto CLI a month or two later on the Freedom... I just don't want to mess up any progress I've made in my credit repair and now credit building journey. Oh also, before I forget I plan on paying substantially more than the minimum payment when paying down this balance transfer.

Thanks as always!

Oz

1. No Amex won't care. A check is a check.

2. Chase would appreciate it very much! Why do you think they offered you zero interest?

3. Barclays would appreciate it very much! Why do you think they offered you zero interest?

4. Chase and Barclay are the same for your purposes, but in order to keep your utilization down, split the balance transfer between them, keeping each below 30%.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice: AMEX -> Barclay or Chase

@NRB525 wrote:The only thing that makes a CCC pissy is when you don't make the monthly payments. They get all snippy for some reason when you don't pay them

They have such nerve ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice: AMEX -> Barclay or Chase

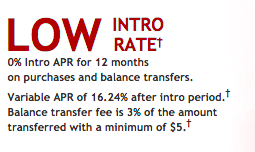

@Anonymous wrote:Actually, it looks like maybe AARP IS purchases and BT while SM is only BT

I don't know that what I found online is the deals you have, so be sure to check your T & C.

Yup, those look like the same deals I was offered.

Oz

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice: AMEX -> Barclay or Chase

@SouthJamaica wrote:

@Anonymous wrote:Hey everyone,

Purchased some furniture today on my AMEX Plat (to help meet the $3000 spend sooner) and was wondering which lender will be the least pissy with an incoming balance transfer. I have a Sallie Mae from Barclay and an AARP from Chase both with 0% balance transfer options.

Barclay Sallie Mae:

- 0% Introductory APR for 15 billing cycles following each balance transfer that posts to the account within 45 days of account opening, after that 20.99%

- 3% Balance Transfer Fee ($5.00minimum / no maximum) for each balance transfer that posts to the account within 45 days of account opening.

Chase AARP:

Balance Transfer APR: The rate listed below will apply to the transferred balance. You can also find this online by viewing a recent statement.

0% APR through your billing cycle that ends in 08/2016; thereafter

16.24% variable APR based on the Prime RateBalance transfer fees: The fee for this balance transfer is 3% of the amount of the transfer (minimum of $5.00, maximum of $250.00). The standard fee for Balance Transfers is either $5 or 3% of the amount of each transaction, whichever is greater.

The terms themselves look about even, Chase only lets me type in the account number of the credit card itself. With Barclay, I can do the credit card number or an account number for a "loan", which may be possible to send it to my checking account instead? Anyone tried this or know if it's possible with Barclay?

Before I do so and possibly piss off two of these companies, here are my questions:

- Will this upset AMEX to have a balance transfer out from the Platinum card? I remember reading in some posts a while back AMEX does not like balance transfers to revolvers, but what about a balance transfer leaving them on a charge card...

- Will Chase not appreciate an incoming balance transfer to a new card? The balance transfer will be about $1400, the AARP limit is $4,000, which would be about 35% of the total limit of the card.

- Will Barclay not appreciate an incoming balance transfer to a new card? The balance transfer will be about $1400, the Sallie Mae limit is $5,000, which would be about 28% of the total limit of the card.

- Of Chase and Barclay as the receivers of the balance transfer which would you all pick?

I've done a balance transfer from Chase (actually two, one from Freedom and the other from Marriott) to NFCU and Chase didn't blink an eye. In fact, I later received an auto CLI a month or two later on the Freedom... I just don't want to mess up any progress I've made in my credit repair and now credit building journey. Oh also, before I forget I plan on paying substantially more than the minimum payment when paying down this balance transfer.

Thanks as always!

Oz

1. No Amex won't care. A check is a check.

2. Chase would appreciate it very much! Why do you think they offered you zero interest?

3. Barclays would appreciate it very much! Why do you think they offered you zero interest?

4. Chase and Barclay are the same for your purposes, but in order to keep your utilization down, split the balance transfer between them, keeping each below 30%.

That would have made the most sense, give them both some BT. I submitted the balance transfer to Chase sometime yesterday, I'll keep an eye on my Plat and AARP to see when it posts to both. Good to know in the future about Barclay still offering a grace period even if you have a BT.

I specifically remember with NFCU reading that if you performed a balance transfer, you lose any and all grace periods, unless you pay the entire statement balance.

Oz

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice: AMEX -> Barclay or Chase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice: AMEX -> Barclay or Chase

@Anonymous wrote:

@SouthJamaica wrote:

@Anonymous wrote:Hey everyone,

Purchased some furniture today on my AMEX Plat (to help meet the $3000 spend sooner) and was wondering which lender will be the least pissy with an incoming balance transfer. I have a Sallie Mae from Barclay and an AARP from Chase both with 0% balance transfer options.

Barclay Sallie Mae:

- 0% Introductory APR for 15 billing cycles following each balance transfer that posts to the account within 45 days of account opening, after that 20.99%

- 3% Balance Transfer Fee ($5.00minimum / no maximum) for each balance transfer that posts to the account within 45 days of account opening.

Chase AARP:

Balance Transfer APR: The rate listed below will apply to the transferred balance. You can also find this online by viewing a recent statement.

0% APR through your billing cycle that ends in 08/2016; thereafter

16.24% variable APR based on the Prime RateBalance transfer fees: The fee for this balance transfer is 3% of the amount of the transfer (minimum of $5.00, maximum of $250.00). The standard fee for Balance Transfers is either $5 or 3% of the amount of each transaction, whichever is greater.

The terms themselves look about even, Chase only lets me type in the account number of the credit card itself. With Barclay, I can do the credit card number or an account number for a "loan", which may be possible to send it to my checking account instead? Anyone tried this or know if it's possible with Barclay?

Before I do so and possibly piss off two of these companies, here are my questions:

- Will this upset AMEX to have a balance transfer out from the Platinum card? I remember reading in some posts a while back AMEX does not like balance transfers to revolvers, but what about a balance transfer leaving them on a charge card...

- Will Chase not appreciate an incoming balance transfer to a new card? The balance transfer will be about $1400, the AARP limit is $4,000, which would be about 35% of the total limit of the card.

- Will Barclay not appreciate an incoming balance transfer to a new card? The balance transfer will be about $1400, the Sallie Mae limit is $5,000, which would be about 28% of the total limit of the card.

- Of Chase and Barclay as the receivers of the balance transfer which would you all pick?

I've done a balance transfer from Chase (actually two, one from Freedom and the other from Marriott) to NFCU and Chase didn't blink an eye. In fact, I later received an auto CLI a month or two later on the Freedom... I just don't want to mess up any progress I've made in my credit repair and now credit building journey. Oh also, before I forget I plan on paying substantially more than the minimum payment when paying down this balance transfer.

Thanks as always!

Oz

1. No Amex won't care. A check is a check.

2. Chase would appreciate it very much! Why do you think they offered you zero interest?

3. Barclays would appreciate it very much! Why do you think they offered you zero interest?

4. Chase and Barclay are the same for your purposes, but in order to keep your utilization down, split the balance transfer between them, keeping each below 30%.

That would have made the most sense, give them both some BT. I submitted the balance transfer to Chase sometime yesterday,.....

Oz

See.... you should wait to talk to me ![]()

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691